Picking a financial advisor is not an easy task. An advisor’s true worth getsknown only after a few years, depending on how your investments have weathered the market volatility and whether your financial goals are achieved or not. If you wish to have a good financial advisor, it’s important you do some homework.

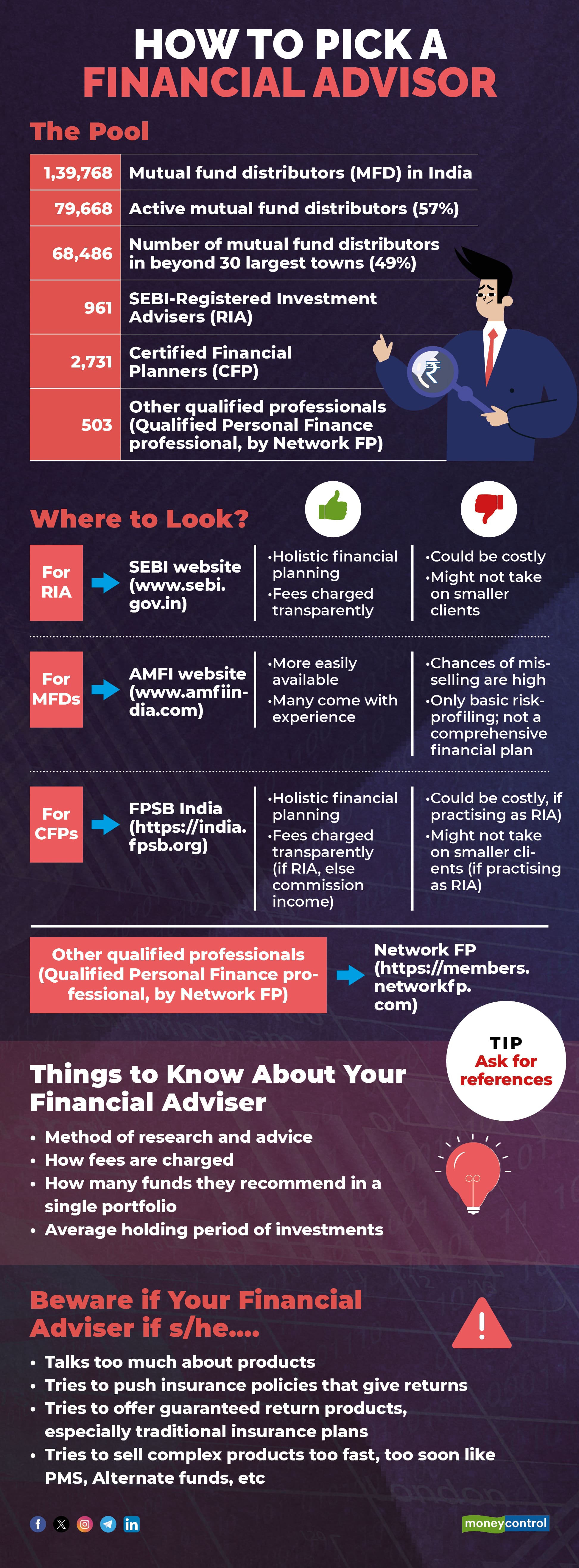

Where to start?There are 1.40 lakh people who sell mutual funds (MFs) in India. They are known as MF distributors or MFDs. The Association of Mutual Funds of India (AMFI), the MF industry’s trade body, tells us that 57 percent of them are ‘active’; meaning they do meaningful business in a year.

That leaves 80,000 MFDs at your service. AMFI tells us that nearly 68,000 distributors (49 percent of the overall pie) are in the Beyond 30 (B30) towns. B30 is a mutual fund parlance used to describe smaller towns and cities in India; those smaller than the 30 largest cities.

There are 961 Registered Investment Advisors (RIAs). They are registered with the Securities and Exchange Board of India (Sebi), India’s capital market regulator. Then, there are 2,731 Certified Financial Planners (CFPs). The CFP is a global qualification in financial planning.

Remember, you would find MFDs and RIAs who are CFPs as well. You might also find an investment firm that gives you the services of both MFDs and RIAs. It’s not that hard to find an advisor in your neighborhood. The catch is how to filter them, and how to sort out the good advisors from the average ones.

Why do you want a planner?The financial needs of someone in their 20s are vastly different from someone who is in her mid-30s or 50s. For instance, those who have just got their first paycheck and are starting out on their investment journeys, need some basic guidance on how to start their first systematic investment plan (SIP).

But those in their 30s might require nuanced financial planning because, by that age, you might be married, have children, and may want to buy a house and have loans to repay. Those in their 50s would look forward to their retirement planning and might want a rock-solid retirement plan, including how to invest their provident fund proceeds that would get.

Do your homework when choosing your financial planner

Do your homework when choosing your financial planner“The client must know what they want from the advisor. Is it a comprehensive planning that involves short-, medium- and long-term goals, or do they want advice on something specific? For example, someone may have built a sizable corpus and might want advice on how to make that last and sustain them through retirement; someone else might need help to manage an upcoming layoff... Who you choose as an advisor depends on what you want from him. For example, someone with a kidney condition will look for a nephrologist and not a dermatologist,” says Priya Sunder, Director and co-founder, PeakAlpha Investments.

For someone in their 20s, who is just starting out with a small sum to invest every month, an online investment platform, where you can set up your account and start investing in minutes, works. But as you grow older, and your family and financial responsibilities grow, you might need someone offline.

With advisors across India, Sadique Neelgund, Founder, Network FP, a platform that helps financial planners build their practice, says that you should also check if you wish to physically meet your advisor in person regularly or a virtual meet is fine. If you aren’t so hung up on your advisor being physically close to you, your options open up. But a lot of communication happens over email and the internet this way. So, if you’re not well-versed with mobile and internet communication, stick to someone local.

Is he a product pusher or a listener?This is crucial. Many times, advisors come to you and within the first few minutes, start to talk about products. That’s not the worst thing. If they talk about insurance products or a new fund offer (NFO), a newly-launched mutual fund scheme, or even a scheme that’s recently launched, that’s a red flag.

“They create a sense of urgency, pressuring you to make a quick decision before a limited-time offer expires or an opportunity disappears,” says Viral Bhatt, founder of Money Mantra, a personal finance solution firm.

Another red flag that Bhatt points out is how much the advisor is focused on product features when he or she is speaking with you, in the initial meetings. For instance, an advisor tries to sell you a life insurance policy, stressing only on the tax-deduction benefits, instead of whether you actually need the policy or not.

Guaranteed return, complex products? Stay away“Be wary of those promising guaranteed returns. The market fluctuates, and such guarantees are unrealistic,” warns Bhatt. This writer was recently approached by his stock broker’s relationship manager (RM) who tried to hard-sell traditional endowment insurance plans, in the name of guaranteed returns. The RM didn’t mention the words ‘insurance’ or ‘endowment’ until pushed, but kept focusing on the word ‘guaranteed return.’

Regular Moneycontrol readers would know better that such insurance policies (bundled products that combine insurance and investment) do not give more than around 5 percent return and pale in comparison to pure investments like MFs.

It was around the last week of March when this RM made this aggressive sales pitch. It’s the end of a financial year and the time when targets are monitored and those who are ahead in this race get rewarded with hefty bonuses.

Another type of products you should be wary of your advisor talking about are complex products. Many advisors sell Portfolio Management Schemes (PMS) these days. These are concentrated portfolios that are devised based on high-risk strategies. Many PMS have a good track record, but their strategy might just be too risky for you, and the minimum investment required is Rs 50 lakh.

If you haven’t yet invested in market-linked investments or have very little invested in MFs, a PMS is a big jump that you must avoid. And if that’s the first thing your advisor starts talking about, he might have big commissions in his mind, and not much of your interest. “If your advisor focuses heavily on product features without explaining how it benefits your specific goals, that’s also a big red flag,” adds Bhatt.

Your advisor’s conductMrin Agarwal, Founder Director of Finsafe India, says how your advisor communicates with you can give you subtle clues. “Is he or she sending too many WhatsApp messages? Like products, or research reports? Jokes, messages on religion and political ideologies are a strict no-no,” she says.

What is your advisor’s qualification?While an MFD is registered with AMFI, an RIA is registered with Sebi. While an MFD largely sells you MFs and works on a commission model, she is supposed to do basic risk-profiling to ensure that you buy the fund that fits you the best. An RIA is an investment advisor with basic qualifications required to get a licence. She charges you a fee, but invests your money in direct plans of MFs that do not have agent commission embedded in them.

While MFDs and RIAs are focused more on investments, a CFP is more holistic. A CFP focuses on your life goals, takes into account your financial needs across all your goals like retirement planning, regular holidays, loan repayments, insurance, estate planning and so on. Investment planning is just one part of your overall financial plan. The whole package is a CFP’s focus area. Some CFPs who work as investment advisors are either RIAs or MFDs; most others are part of larger teams at banks and other investment advisory firms.

Many experts say that you might not need the exhaustive services of a CFP or RIA when in your 20s and beginning your investment journey. Due to several of Sebi’s regulatory, compliance and housekeeping requirements, RIAs typically have a minimum threshold of assets a customer should have.

Those below this threshold can stick with MFDs. That said, MFDs, with a vast experience and good pedigree can also be your guiding hand throughout your lifetime. If you wish to pay fees as per your assets in a more transparent manner, go with an RIA / CFP.

Avoid chartered accountants for investment and wealth management. Their expertise lies in taxation.

Krishan Mishra, Chief Executive Officer, FPSB (Financial Planning Standards Board), a body of qualified financial planners, says having a qualified financial planner by your side is crucial. “There was a time when salaries were low and credit cards weren’t that popular. So, our spending and our loans were limited, and aspirations were low. Today, we talk in terms of CTC (Cost To Company) salaries in lakhs, our spending has gone up, lifestyles have changed and medical costs are rising. So, having an insurance policy has become extremely important. Money management is not just about investments anymore. You need to manage your overall wealth more prudently now,” says Mishra.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.