Prashant Kamani, who started his career with Microsoft and worked with the company in various capacities for 21 years, was laid off this month. “Today, I was informed that my position at Microsoft has been eliminated,” Kamani wrote in a LinkedIn post on January 19, a day after the software giant announced layoffs.

Kamani also spoke about the impact his job loss would have on his family. “I know that today’s news is hitting them equally hard, yet they are staying strong and carrying me through this,” he wrote.

He ended his LinkedIn post, saying he was looking for suitable opportunities in software management positions.

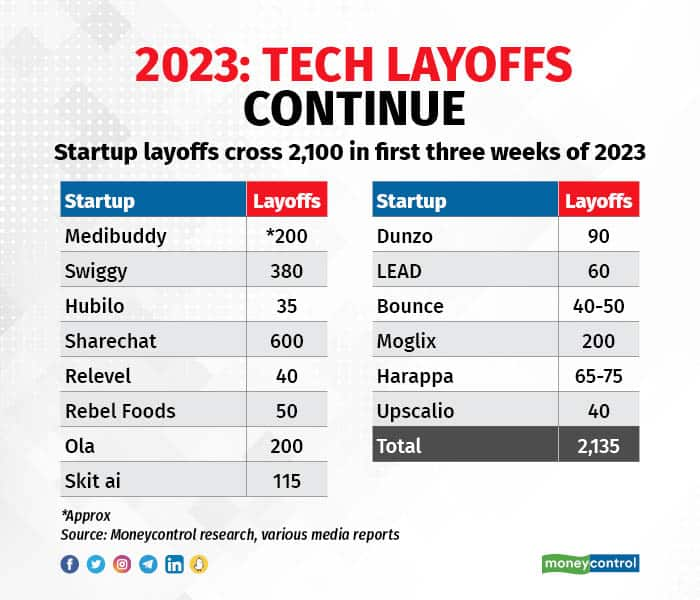

Not only in Microsoft, but many employees in many tech startups and global IT firms, like Amazon, Alphabet, Meta, etc., were handed the pink slips since the last quarter of 2022. According to data compiled by Moneycontrol, about 14 startups in India have laid off over 2,100 employees in the first three weeks of 2023.

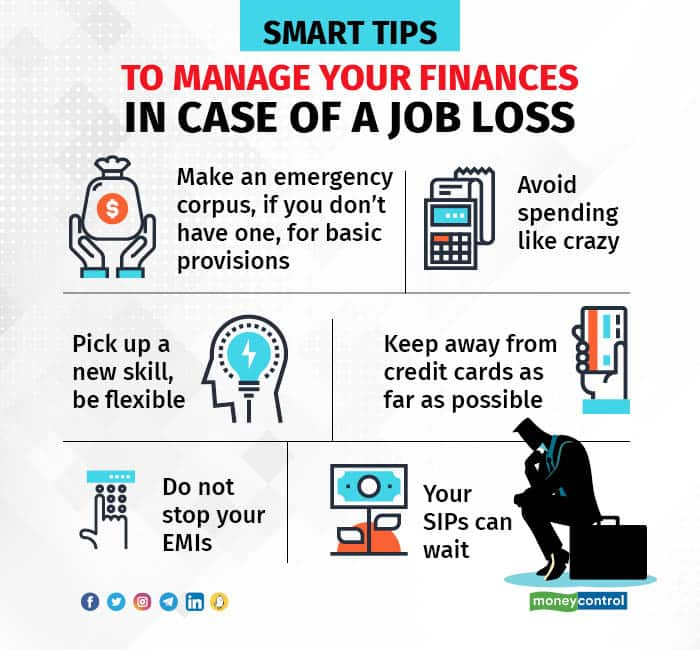

During the job loss phase and through these tough economic times, you can still sail through money matters, if planned well.

Utilising emergency corpus

An emergency corpus is one of the building blocks of sound financial planning. “We recommend anywhere between 6 and 12 months of household expenses plus equated monthly instalments (EMIs) as an emergency corpus, readily available with you,” says Amol Joshi, founder of Plan Rupee Investment Services.

“You can keep aside this corpus in your savings account or short-term fixed deposit or in a liquid fund,” he says.

If you have an emergency corpus, you can dip into it for your monthly sustenance till you find another job.

What if there is no emergency corpus?

Review your existing portfolio carefully. There may be too many traditional insurance policies that you may not need or consistently underperforming mutual funds. There could even be a portfolio with too many liquid fund investments with negligible balances in each, but when combined makes a tidy portion that can be a contingency corpus.

Even physical gold you don’t really need can be sold to build an emergency corpus, if you don’t have one.

During financial contingencies, like a job loss, the emergency corpus can save you from making hasty decisions.

If you already have an emergency corpus, “make sure to use it only for your absolute immediate necessities, i.e., survival costs, like food, medical, insurance premiums, etc.,” says Harshvardhan Roongta, CEO of Roongta Securities. For instance, you can skip paying society maintenance costs for a few months. You should prefer to repay the society dues later with the interest amount.

Track your spending and budgeting

Keep leakages in check. Limit your spending during a job loss phase, especially on non-essentials.

“Budgeting helps you get a grip on things financially as well as in helping you make the right decision on where to spend an available amount of money,” says Joshi. For instance, credit card dues, school fees, utility bill payments, and EMI payments cannot be avoided.

Avoid spending money on electronic gadgets. It is alright to put aside partying, eating out, and holidays for a few months till you get a job and start getting a regular income again.

“It’s important to have an open discussion with your family about a job loss and expenses need to be curbed in line with the revised budget,” says Vishal Dhawan, Founder and CEO, Plan Ahead Wealth Advisors.

This way, there could be a reduction in various expenses contributed by all family members in a month.

“Don’t hesitate to keep a budget for upskilling yourself after a job loss,” says Dhawan. You may need to take up a new course to get training for a slight change in your vocation. This might just help your job prospects.

Managing credit card debts and loan EMIs

Whatever you do, do not stop paying your credit card bills and loans.

There are interest rates on credit cards (up to 48 percent per annum) and personal loans (up to about 16 percent), which are massive and should be repaid first.

“Make sure to repay the credit card bill before the due date. Else, the penalty and penal interest will further dent your budget in an already cash-tight environment,” says Joshi.

The only way to avoid paying your credit card bills is by spending less. “Avoid using the credit card till the time you get another job,” says Suresh Sadagopan, MD and Principal Officer, Ladder7 Wealth Planners.

In case you are repaying EMIs, don’t stop them immediately because of a job loss. “Continue with the EMIs for at least 3-6 months from an emergency corpus. If you still struggle to get a job, look at all other options, including applying to a bank for a loan moratorium or discussing increasing a loan tenure,” he says.

“But remember, opting for a loan moratorium or increasing the loan tenure could actually end up increasing your interest costs substantially over a period. So, take a decision judiciously after consulting a professional,” adds Dhawan. After you get a job, start pre-paying the loan to reduce the debt.

Review your financial goals

The temporary loss of a job should not be significantly affecting your long-term financial goals, like children’s education, retirement savings, etc. “But if your job loss continues for at least six months, we believe that the long-term financial goals need to get reviewed,” says Dhawan.

Short-term goals should get reviewed, because those expenses are coming up right away and one has to be careful about how to finance them.

“You should stop your SIPs immediately after a job loss because there is no monthly income. In such a situation, there is no point in continuing SIPs from your emergency corpus,” says Sadagopan. This will be an unnecessary cash outflow.

To meet your basic monthly expenses and short-term goals, look for other income sources with freelancing assignments or consulting jobs on a contract basis for 3-6 months.

“Restart monthly SIPs once your cash flow is back on track with the new job,” adds Joshi.

Don’t touch EPF, PPF

Do not touch your provident fund or other investments earmarked for your retirement, because it can hurt your retirement kitty in the long term.

Withdrawing from your public provident fund (PPF) or employee provident fund (EPF) corpus should be your last option.

“Withdrawal from retirement corpus should be highly avoidable for short-term goals that might come up during the job loss phase,” says Dhawan. Money withdrawn often doesn’t get, sort of, put back in the retirement kitty. Prefer withdrawing from the retirement corpus during medical emergency situations or to repay the high interest rate debts and avoid defaults which can affect the credit score,” he says.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.