The net commission earned by Indian mutual fund distributors jumped 16 percent to Rs 12,049 crore during the financial year 2022-23 amid a consistent rise in the assets under management (AUM) of mutual funds, data available with Prime Database showed.

The data covers around 2,000 distributors as per the capital market regulator’s guidelines to shortlist distributors whose commission records need to be disclosed.

In the mutual fund industry, the fund house pays commission to the distributor based on how long investors stay invested in the scheme.

Also read | Eight financial changes that may impact you this September

Interestingly, commission paid out to mutual fund distributors (MFDs) has nearly doubled from Rs 6,138 crore in FY 2019-20 to Rs 12,049 crore, currently, data available with Prime Database showed.

Staying at the top

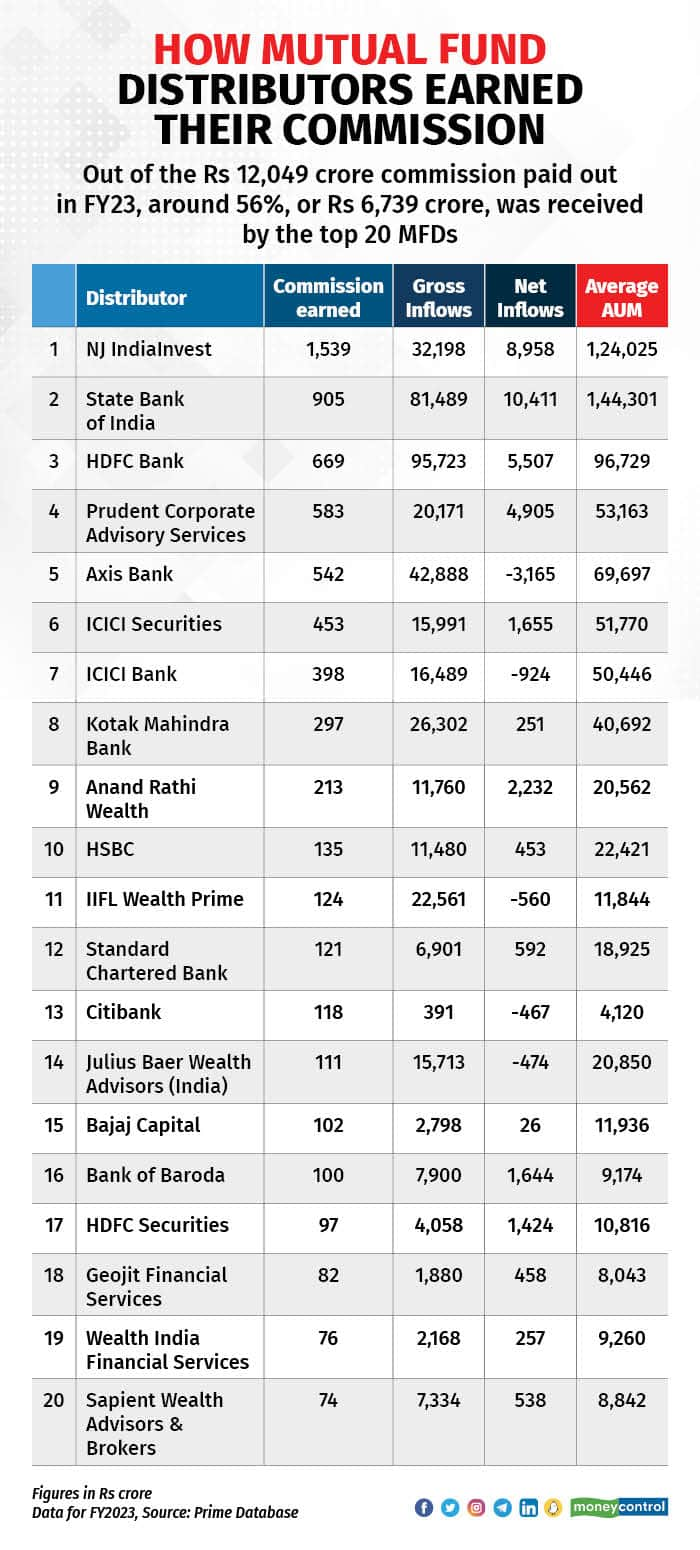

NJ India Invest continued to be the largest MFD in India (in terms of commission income) for the eighth straight financial year with a net commission earned of Rs 1,539 crore during FY23. The MFD’s commission earned jumped 19 percent from the previous financial year. The distributor had an average AUM of Rs 1.24 lakh crore at the end of March 2023, having jumped 13 percent on a year-on-year basis.

Further analysis of the data showed that Axis MF, SBI MF and Nippon India MF were the three biggest commission payers to the MFD.

Notably, NJ Mutual Fund, an associate company of the distributor didn’t feature in the top commission payers to NJ India Invest. To be sure, NJ Mutual Fund was launched in 2021 and presently has just five schemes in its bouquet.

Banks continue to dominate

Out of the top 20 biggest MFDs, nine slots were cornered by Indian banks, earning a total commission of Rs 3,286 crore.

Public sector lender, State Bank of India, was the biggest earner of commission among banks at Rs 905 crore, followed by HDFC Bank (Rs 669 crore) and Axis Bank (Rs 542 crore).

Also read | WhiteOak Capital Mutual Fund launches multi-cap scheme: A Moneycontrol review

The top 20 list included foreign banks such as HSBC, Standard Chartered Bank and Citibank.

Apart from the nine banks, sister concerns of banks such as brokerage houses ICICI Securities and HDFC Securities also featured in the list of top 20 MFDs.

Where SBI earned its commission

The biggest bank-based MFD, SBI, earned around 96 percent of its total commission (Rs 873.6 crore out of Rs 905 crore) from its group company, SBI Mutual Fund.

The fund house is the biggest AMC in India with an AUM of Rs 8.25 lakh crore at the end of July 2023.

Notably, the second-biggest contributor to SBI’s commission kitty was Axis Mutual Fund at Rs 5.4 crore. HDFC Mutual Fund, ICICI Prudential Mutual Fund and Kotak Mahindra Mutual Fund wrapped up the top five commission payers to the bank.

Additionally, UTI MF paid Rs 1.8 crore as commission to SBI during FY2023. The PSU bank along with other financial institutions such as Life Insurance Corporation of India (LIC), Punjab National bank (PNB) and Bank of Baroda (BOB) are sponsors of UTI AMC.

How top 20 list has changed

The top three slots in terms of biggest MFDs continued to be with NJ India Invest, State Bank of India and HDFC Bank, in that order.

However, Axis Bank dropped to the fifth spot as its commission inched up by a mere 1 percent to Rs 542 crore during the fiscal.

Also read | Marriott Bonvoy HDFC Bank Credit Card: A Moneycontrol Review

On the other hand, Gujarat-based Prudent Corporate Advisory Services jumped one spot with a commission of Rs 583 crore earned during FY2023. The biggest contributors to Prudent Corporate Advisory Services' commission kitty were HDFC MF, ICICI Prudential MF, and SBI MF.

Darshan Securities and JM Financial Services dropped out of the top 20 list of MFDs, while Wealth India Financial Services and Sapient Wealth Advisors & Brokers made it to the list.

Fund outflows

Among the top-20 MFDs, five distributors, Axis Bank, ICICI Bank IIFL Wealth Prime, Citibank and Julius Baer Wealth Advisors (India) saw fund outflows during FY23.

Also read | Debt funds still work, even without indexation benefits

Axis Bank saw the biggest net outflows at Rs 3,165 crore, followed by ICICI Bank (Rs 924 crore) and IIFL Wealth Prime (Rs 560 crore). Further, out of the current top 20 MFDs, only Citibank saw its commission falling by 15 percent to Rs 118 crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.