Non-banking financial company (NBFC) Indiabulls Housing Finance on March 3 launched tranche V of its secured issue of non-convertible debentures (NCDs).

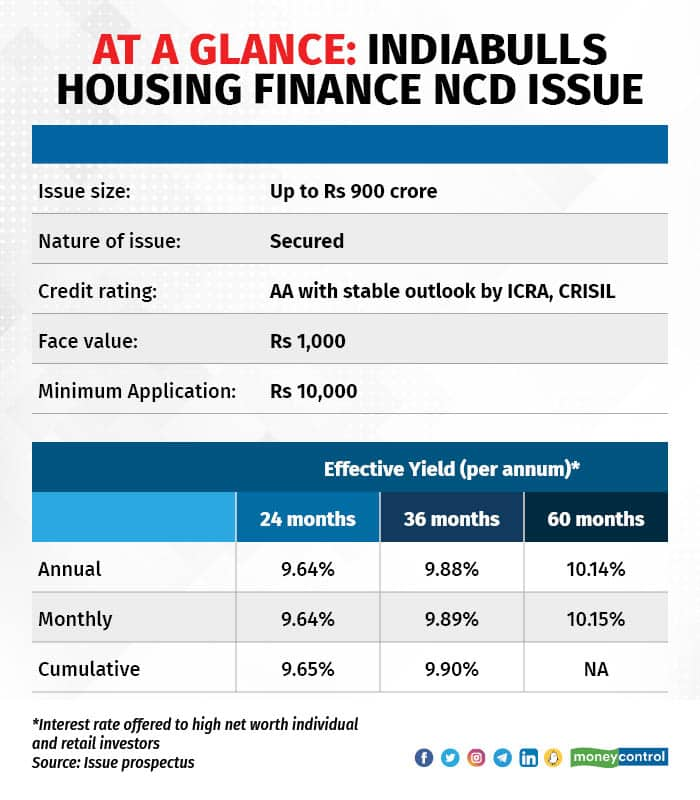

The tranche includes a base issue size of Rs 100 crore with an option to retain oversubscription of up to Rs 800 crore, aggregating up to Rs 900 crore.

The tranche V issue is within the shelf limit of Rs 1,400 crore the company is looking to raise via these NCDs.

The company intends to use 75 percent of the funds for onward lending, financing, refinancing existing debts and the rest for general corporate purposes.

About the issue

The latest tranche offers various series of NCDs for subscription, with coupon rates ranging from 8.88-10.15 percent per annum. The issue has tenures of 24 months, 36 months and 60 months.

Effective yield (per annum) for the NCD holders in Category I (institutional investors) and Category II (non-institutional investors) ranges from 9.24-9.64 percent. For Category III (high net-worth individual investors) and Category IV (retail individual investors) holders, it ranges from 9.64-10.15 percent.

Interest payment modes for the NCDs are annual, monthly or cumulative, per the series selected by the investors.

The company is also offering an additional incentive of 0.25 percent to Category III and Category IV investors in the proposed Tranche V issue.

The NCDs have been rated AA with a stable outlook by both CRISIL Ratings and ICRA.

The minimum application in the NCD issue will be Rs 10,000 with a face value of Rs 1,000 each.

What works

The AA rating of the NCDs by rating agencies indicates a high degree of safety regarding the timely servicing of financial obligations.

ALSO READ: The best asset allocation for a young, first-time investor

Indiabulls Housing reported a net profit of Rs 229.38 crore for the quarter ended December 2022, up 21 percent from Rs 190.02 crore recorded in the year-ago period.

Further, the company's net sales stood at Rs 1,985 crore, down 2 percent from Rs 2,030 crore in December 2021.

The interest rates offered under the NCDs, up to 10.15%, are also on the higher side.

According to CRISIL Ratings, Indiabulls Housing Finance displays strong capitalisation with healthy cover for asset-side risks.

ALSO READ: HDFC Mutual Fund launches MNC-themed fund. Should you invest?

“Capitalisation is marked by sizeable net worth of Rs 16,727 crore as on June 30, 2022, supported by healthy internal accruals. Accruals of Rs 1,988 crore from the sale of the bulk of its investment in OakNorth Bank in fiscal 2021 also contributed to the strengthening of capital position. Net worth coverage for net non-performing assets (NPAs) was also comfortable at around 13.4 times as on June 30, 2022,” the agency said in its rating rationale.

ALSO READ: Muthoot Finance’s Rs 500-crore NCD issue opens; Should you invest?

What doesn’t work

In terms of credit quality, the issue isn’t rated AAA, which is considered the highest degree of safety.

In February and March 2020, the credit ratings of the company’s long-term debt instruments and bank facilities were downgraded by CRISIL, ICRA and CARE from AA+ to AA (with a negative outlook).

“These downgrades were primarily on account of the continued challenges faced by us (and the HFC industry in general) in relation to diversification of our funding sources, post the IL&FS default led industry crisis,” Indiabulls Housing Finance mentioned in the issue document.

According to ICRA, the company faces continued challenges in resource mobilisation from diverse sources, while risk averseness of investors persists as well.

“The operating environment has been challenging over the past two and a half years, given the prolonged liquidity squeeze and the risk averseness of investors towards wholesale-oriented NBFCs and HFCs. This led to challenges in fund raising. Instances of litigation and allegations against the company had further heightened the risk-averse sentiments of lenders/investors in FY2020, thereby impacting its financial flexibility.

While the legal processes are ongoing, there has [sic] not been any material adverse observations by any of the inspecting/auditing agencies over the past year,” ICRA Ratings said in its rating rationale.

What should investors do?

One should note that the NCD issue comes with a fair bit of credit risk as it is not rated AAA.

Vikram Dalal, Founder and Managing Director, Synergee Capital Services, says that investors willing to take on extra risk can make a small allocation to the issue.

However, keep in mind that any kind of capital, especially in debt allocation, is best deployed in multiple instruments.

Further, NCD issues pale when compared to debt funds on liquidity grounds. Redeeming NCDs before maturity might be a challenge, as the Indian debt market is not that deep.

Also, when it comes to fixed income, certain small finance banks are offering interest rates in the range of 9 percent to 9.5 percent.

Per government rules, each depositor is insured by up to Rs 5 lakh for both the principal and interest amount on deposits held by her in that particular bank.

The Indiabulls Housing Finance NCD Tranche V Issue opened on March 3 and will close on March 17, 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.