Retail investors are facing an escalating battle against online frauds, with criminals staying a step ahead. While Rs 20,000 crore was lost to such frauds in 2024, this year, too, scammers have been employing fake apps, WhatsApp tip groups and deepfakes to target even experienced investors.

The scams get tech edgeCriminals have evolved from basic phishing to advanced tactics using artificial intelligence (AI)-generated content.

Deepfake videos of reputed market experts circulate on social media, directing users to bogus investment apps or advisory services. Lookalike websites mimicking legitimate brokers steal credentials by exploiting greed and urgency.

"The use of AI-generated content and deepfakes has transformed online fraud from crude phishing attempts to sophisticated, believable scams," Tejas Khoday, CEO and co-founder of FYERS, said.

They prey on human instincts, he said, urging the industry to match innovation with digital vigilance and investor education.

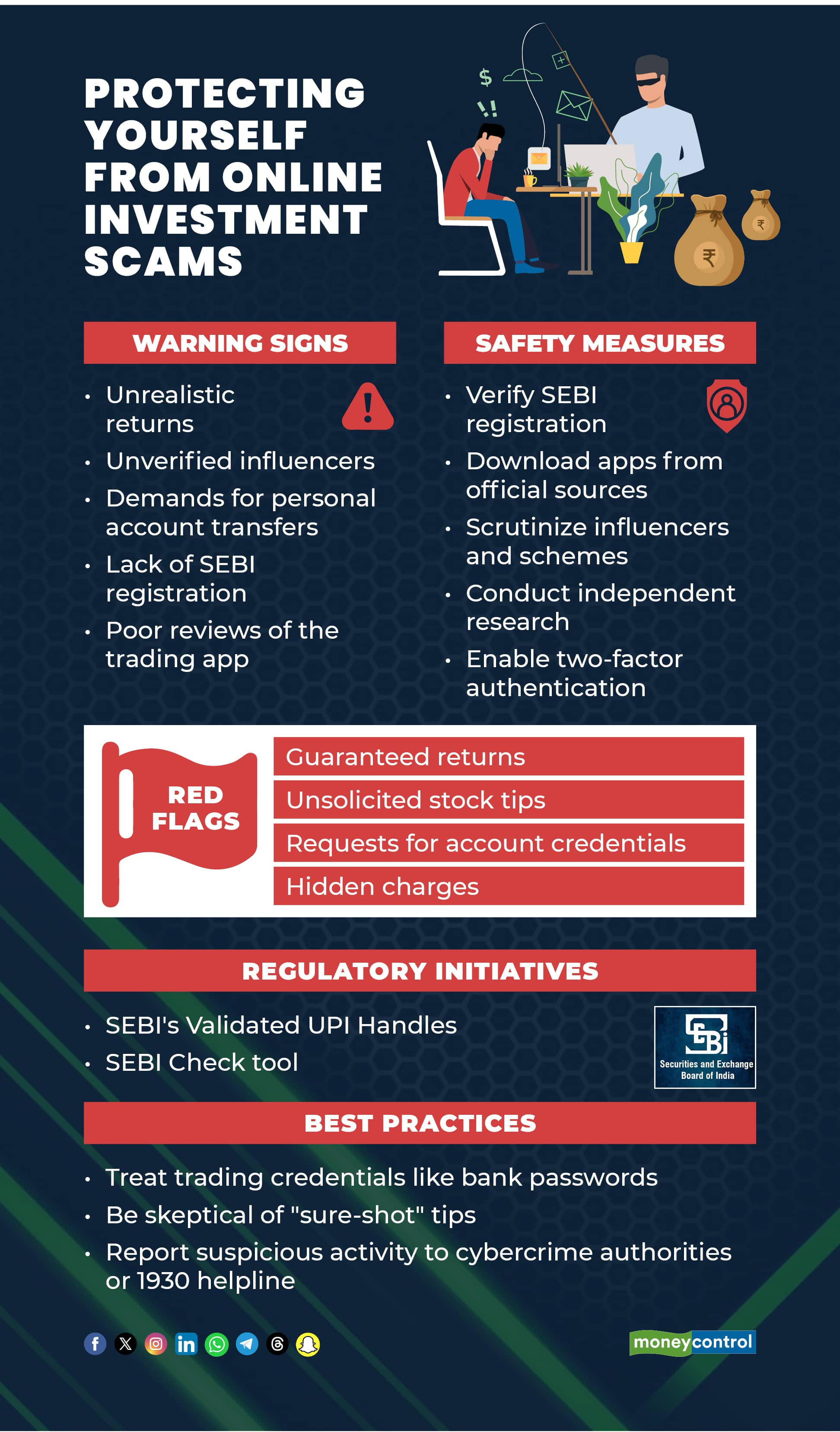

How trading scams operate?Scammers often initiate contact via social media, posing as financial experts or influencers to cultivate trust. They then promote a counterfeit trading app, promising high returns with low risk. Initial investments appear profitable, prompting users to commit more funds. Withdrawal attempts reveal hidden charges or account locks, and perpetrators vanish, inflicting heavy losses.

Fake schemes also promise guaranteed returns, which the stock exchanges and SEBI keep warning against.

Such offers, including unsolicited stock tips or requests for account credentials, violate laws and expose investors to fraud. The NSE recommends verifying brokers through its "know/locate your stockbroker" tool on the official website.

Investors should watch for apps that tout unrealistic gains, are endorsed by unverified influencers, demand transfers to personal accounts, lack SEBI registration, or accumulate poor reviews.

An unverified financial influencer lacks regulatory registration and often has no verifiable credentials, potentially offering financial commentary based on personal opinion or unreliable information.

WhatsApp scams have spiked, with fraudsters creating groups like "VIP861 HSBC GLOBAL SUMMIT" to impersonate institutions such as HSBC Asset Management.

Kotak Securities has similarly alerted users to scammers using fake IDs and international numbers on social platforms in 2024.

Paddy Raghavan, co-founder of Multipl, a goal-based investment platform, said, "The simplest solution is to always transact from within reliable apps and not by clicking links coming on SMS or WhatsApp." This advice underscores the need to avoid external prompts that lead to deceptive sites.

Also read | Paying with your MF? Here's all you need to know about UPI's ‘Pay with Mutual Fund’ feature

Safety measuresTo safeguard assets, verify that that platforms are SEBI registered. Download apps only from official sources. Stay away from third-party links.

Scrutinise influencers promoting schemes and conduct independent research. Insist on official channels for transfers, steering clear of personal accounts, and flag anomalies like odd fees or restricted withdrawals.

"Retail investors should treat their trading credentials like their bank passwords; never share, reuse, or store them insecurely," Khoday said.

He advocates scepticism towards "sure shot" tips and enabling two-factor authentication for added protection.

If suspicions arise, report to cybercrime authorities or the 1930 helpline.

Investing platforms' role in educationTrading platforms are investing in AI for anomaly detection, blocking unauthorised access, and issuing alerts on emerging scams.

Some incorporate "Report Fraud" features and educational notifications within interfaces, shifting from reactive to preventive strategies.

Impact of emerging regulationsRegulators, too, have been on their toes to guard investors against frauds. SEBI's actions include curbing unregistered advisers, enforcing disclosure for financial influencers, and bolstering KYC processes. The RBI's payment security enhancements, like multi-factor authentication, offer models for capital markets.

SEBI's validated UPI Handles and SEBI Check initiatives are steps in that directions. From October 1, registered entities have to use "@valid" UPI IDs with suffixes like ".brk" for brokers, displaying a green thumbs-up icon for verification. QR codes feature this symbol, and the SEBI “check tool” allows users to confirm details via the Saarthi app.

"The Verified UPI ID from SEBI for brokers, MFs, RIAs is an excellent initiative to establish trust and ensure people are dealing with reliable and legitimate systems," Raghavan said.

These tools aim to curb fraud, boost security, and instil confidence in digital transactions.

As innovation continues, regulation must evolve to ensure transparency, user consent and data protection, Khoday said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.