HDFC Mutual Fund has launched an open-ended equity scheme that will invest primarily in equity and equity-related instruments of multinational companies.

The core portfolio of the new fund offering called HDFC MNC Fund will consist of MNCs, including companies with foreign promoter shareholdings of more than 50 percent or companies that form part of the Nifty MNC index.

Up to 20 percent of the portfolio can consist of an Indian company with part of its turnover/revenue from overseas as well as Indian franchisees of foreign companies.

MNC thematic funds have delivered an average of 1 percent, 12.21 percent, 6.84 percent, and 14.58 percent returns, respectively, on one-, three-, five- and 10-year periods, according to data available with Value Research.

Also Read | Check out Moneycontrol’s curated list of 30 investment-worthy mutual fund schemes

What’s on offer?

The HDFC MNC Fund will invest across market capitalisation segments and will focus on a maximum of 30 stocks, as per the current investment strategy.

Also read | Why investors are into long duration debt funds despite the RBI repo rate hike

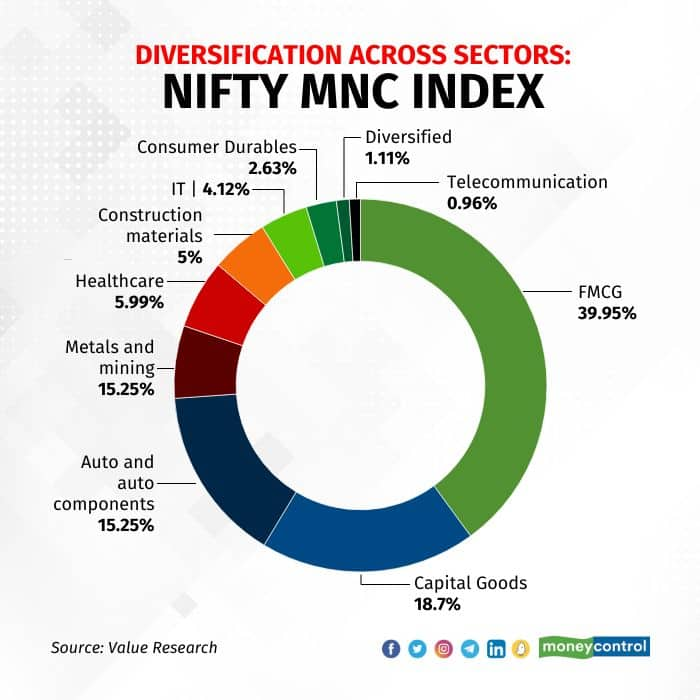

The scheme’s benchmark, the Nifty MNC index, provides exposure to seven sectors such as fast moving consumer goods (FMCG), capital goods and automobile and auto components.

The fund will be managed by Rahul Baijal, who also oversees the HDFC Top 100 Fund and the HDFC Business Cycle Fund. Baijal has over 21 years of experience in equity research and fund management.

The new fund offering (NFO) will have an exit load of 1 percent if units are redeemed/switched out within one year of allotment, and nil, thereafter.

What works?

MNCs are usually very stable companies due to their combination of good corporate governance, trusted brands, focus on innovation, and strong balance sheets. Among them, Hindustan Unilever, Nestlé India, Colgate-Palmolive and Bata India have had a presence in India for decades.

Also read | Equity funds disappointed in 2022. But there’s a way to turn them around

According to the scheme’s fund note, the Nifty MNC Index has delivered better top line growth vis-a-vis the Nifty 500 over 10 years, with higher profitability.

Also, MNCs tend to have a good track record of free cashflow generation and high dividend pay-out.

Further, the Nifty MNC index acts like a less risky large and mid-cap fund. Out of 30 companies in the index, 10 are large-cap and 19 are mid-cap firms.

“MNCs, in general, have a lot of superior products and technology as they focus more on research and development,” said Tarun Birani, founder of TBNG Capital Advisers.

“They also have much stronger brand power, which results in long-term wealth creation. These companies, due to their global ecosystem, have good corporate governance and their balance sheets are much stronger.”

Also read | Mutual funds increased exposure to these sub-sectors lately. Do you own any?

Listed MNCs in India are in a sweet spot. The parent companies of some of them may increase their investments as they look for alternatives to China.

With India’s increased focus on infrastructure, they may want to develop their local subsidiaries as production hubs for global exports. This may lead to further profit growth for the Indian subsidiaries. The China-plus-one policy of global companies can be a positive trigger for some MNC subsidiaries in India.

What doesn’t work?

Experts said that since thematic funds invest in stocks that are well-defined around an opportunity, there is the risk of concentration. The Nifty MNC index has about 70 percent allocation to the top three sectors – FMCG, capital goods and automobiles & auto components.

In India, FMCG companies have historically traded at a premium. FMCG has a 40 percent weightage in the Nifty MNC index.

Data available with the NSE indices show that the Nifty MNC Index had a price to earnings (PE) ratio of 62.49 as of January 31. Comparatively, the Nifty 50 Index had a PE ratio of 20.73.

“MNCs are majorly very mature companies. Therefore, it will be difficult to find companies which are cheap,” said Kirtan Shah, founder of Credence Wealth Advisors LLP.

“Next, if you look at the top three sectors, there is too much concentration risk. Lastly, in thematic investing, you end up taking much more concentrated bets.”

Also read | How flexi cap became the largest category in equities in 2022

Although MNCs score high on corporate governance, issues pertaining to the payment of royalty and regulatory run-ins have caused volatility in the past.

What should investors do?

Financial experts suggested that retail investors should stay away from NFOs because they should consider schemes with a proven track record.

Still, there are not many options in this category. Of the five schemes currently running, only three have a track record of 10 years.

“Is there a need to have a specific MNC fund portfolio? My answer would be no. I would rather have my diversified fund manager pick these companies in the portfolio,” said Birani.

Shah also doesn’t recommend NFOs and said a well-diversified portfolio would provide a better diversification advantage, whereas thematic is very focused.

While retail investors should stay away from NFOs, a seasoned investor with expert knowledge about exit and entry timing can look at these funds.

The NFO is open for subscription from February 17 to March 3, 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.