On 9 January, non-banking financial company (NBFC) InCred Financial Services launched the public issue of its secured non-convertible debentures (NCDs), offering an effective yield of up to 10.20 percent.

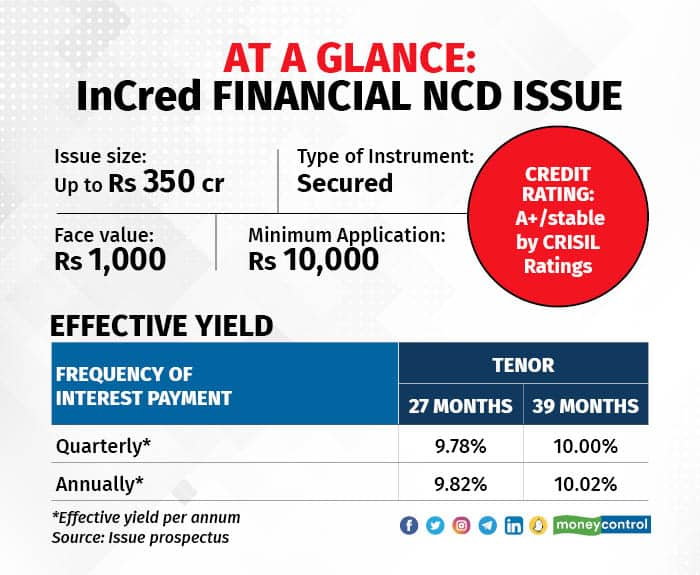

The NCDs have a face value Rs 1,000 each, amounting to Rs 175 crore (base issue), with an option to retain oversubscription of up to Rs 175 crore, aggregating to a total of Rs 350 crore.

InCred Financial Services (erstwhile known as KKR India Financial Services) caters to the personal finance needs of lower middle-class / middle-class Indian households, such as education loans and personal loans.

According to the company, at least 75 percent of the funds raised through this issue will be used for onward lending, financing, and to repay the interest and principal of existing borrowings. The balance will be utilised for other purposes.

Also read: IIFL Finance NCD issue offering up to 9% yield opens; should you invest?

Apart from private placement of NCDs or market-linked debentures that Incred has issued many times, the company has earlier done one public issue of NCDs in January 2022.

The size of the previous NCD issue was Rs 150 crore (base issue of Rs 125 crore, with an option to retain oversubscription up to Rs 25 crore). Interest rates offered in these NCDs ranged from 9.25 percent to 9.65 percent across various series.

The latest issue

InCred Financial’s latest NCD issue offers coupon rates ranging from 9.45-10 percent per annum, with a quarterly and annual interest payment option. The effective yield goes up to 10.02 percent per annum.

According to the company, the NCDs will be secured by way of exclusive first charge over certain identified receivables, such that a security cover of 1.05 times the outstanding principal and all interest due and payable is maintained at all times until the maturity date.

The NCDs have been rated A+, with a stable outlook, by CRISIL Ratings.

In its rating rationale, CRISIL noted that InCred Financial has a strong capitalisation position supported by a high-pedigree investor base, with experienced promoters and senior management, and a diversified loan portfolio.

A moderate earnings profile, scale of operations and market position were key weaknesses, per the ratings agency.

What should investors do?

One should note that InCred Financial’s NCD comes with a fair bit of credit risk as it is not rated AAA, which is the highest safety rating.

Also read: Edelweiss Financial launches debt paper that may fetch up to 11% returns

Rushabh Desai, Founder, Rupee With Rushabh Investment Services, who doesn’t recommend low-credit papers, says that a lot of people don't understand that credit risk has its own nuances.

“If you're venturing into a low credit space, it's very important to look at the health of the company, whether the company is in profits, and whether it is generating a healthy cash flow. I am not recommending this product to my clients, mainly because it's a low credit security. Also, interest rates are going to be hiked further and they are expected to peak somewhere in the first half of 2023. Currently, in the corporate bond segment, AAA papers are giving (yields) in the range of 7.5-7.8 percent. Investors should be patient as yields will become lucrative. Don't take extra risk in a risky NCD,” Desai said.

The two tenure options that the InCred NCD offers are unusually short when compared to other NCDs that usually hit the market. But its coupon rates are higher than what short-term debt funds usually offer.

But InCred NCD pales when compared to debt funds on liquidity grounds. Redeeming NCDs before maturity might be a challenge, as the Indian debt market is not that deep. One must also be mindful of taxation, as the interest earned on these instruments is taxed per your income tax slab. Besides, a credit rating below AA doesn’t inspire confidence.

The issue is scheduled to close on January 27, and the allotment will be done on a first-come, first-served basis.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.