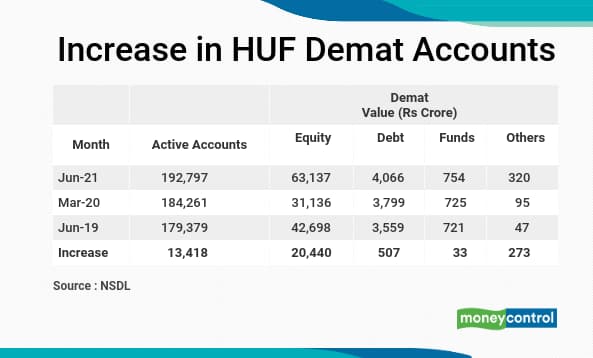

Many investors are deploying funds in initial public offers (IPOs) through the Hindu Undivided Family (HUF) mode. As on June 30, 2021, HUF accounts have risen to 1.92 lakh, up from 1.79 lakh two years ago.

Also, a total of Rs 21,252 crore have been added across debt, equity, funds and other assets in HUF accounts between June 2019 and June 2021, as per the data provided by National Securities Depository. CDSL declined to share the number of demat accounts held by HUFs.

“As many initial public offerings (IPO) are being launched, investors want to get more IPO allotments. So, apart from opting for IPO investments from their own accounts, family members, they are owning additional ones in the name of their HUF. Hence, this breed of HUF demat accounts is on the rise,” says Deven Choksey is the MD of KR Choksey Investment Managers.

Another reason to register as an HUF is to gain taxation benefit as a family.

What is HUF?

A HUF is a structure devised to lower your income-tax burden.

To reduce your tax outgo, many tax experts suggest setting up a HUF. This is a separate income-tax structure where an entire family’s assets are held together. It helps to lower an individual family member’s tax outgo, as a part of her income is added to this HUF account and the collective unit is taxed independently.

So, you would be paying taxes in your own individual capacity on the salary you earn and if you have some rights in the family business on which you need to pay taxes, the latter can be taxed under the HUF.

Any Hindu, Sikh, Buddhist and Jain person with at least two members in the family can start an HUF, with the eldest male being the Karta.

How does a HUF benefit taxpayers?

Income tax slabs for HUF are the same as that of an individual. Similarly, the exemption limits such as Rs 1.5 lakh for 80 C, upto Rs 75,000 for Section 80 D and other exemptions under Section 80 G for donations would be applicable to HUFs as well. Moreover, the capital gains exemptions under Section 54 and 54F, too, can be reaped through HUFs.

“HUF is used by some to stay in the lower tax bracket if there is a likelihood of shifting to the higher tax bracket due to surge in income. So, if a person has a separate entity and registers as an HUF, then he can claim the additional deduction of up to Rs 2.5 lakh under the HUF account thereby reducing the tax liability,” says Paras Savla, tax partner at KPB & Associates.

To claim all these benefits, the income tax returns, too, would have to be filed as a HUF. In assessment year 2018-19, about 11.30 lakh returns (8.97 lakh for assessment year 2013-14) were filed under the HUF category as per income tax records, of which 6.13 lakh returns stated that their business income was nil (zero), while a majority of the others indicated an income in the range of Rs 2-3.5 lakh.

HUF needs more compliance, adding to costs

Before you opt for a demat account as a HUF, understand that such accounts are given to a group (non-individuals) and hence there is no facility to make a nomination.

There is also additional compliance burden of maintaining a separate PAN, bank account and a demat account in the name of the HUF and filing of tax returns. These also add to the cost burden in terms of minimum balance in the bank account, maintenance charges for demat account and tax-return filing fees.

“Only if there is substantial tax benefit should the decision to opt for HUF be taken,” Savla suggests.

Vishal Dhawan, a certified financial planner and founder-CEO of Plan Ahead Wealth Advisors says that while many families have set up HUFs, they are cumbersome and costly to maintain. A withdrawal from – or liquidation of – the HUF is possible and it’s possible to walk away with your share of a HUF, he says. But this needs consent from all the other members. “Increasingly, families are getting nuclear and they want far more control over their wealth. For them, a HUF is far less attractive than others,” he says.

Additionally, banks are reluctant to offer loans when an individual property in registered under the HUF. “A HUF is a fluid entity and in case of a default, they face difficulty in recovering the money,” points Savla.

Assets of women

As per Hindu laws, property from joint family obtained by a daughter would be her own property and the subsequent income from that property would be taxed in her hands. Even the stridhan received after marriage and the income from it is not taxable as income for the HUF, but in the hands of the woman.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.