As the Reserve Bank of India (RBI) prepares to start a policy easing cycle, fixed-income investors are likely to face a key challenge – managing reinvestment risks in a period of falling bond yields.

Though the RBI maintained a status quo on policy rates in its December policy review, a sizeable reduction in the cash reserve ratio of 50 bps to ease liquidity and a balanced forward guidance on growth and inflation, indicates its preparedness to cut rates to support growth. This could lead to a further decline in bond yields, raising risks for fixed income investments that mature in the near term.

Why cash and short-term investments can be most vulnerable?When the RBI embarks on monetary tightening, the bond yield curve 'flattens' - policy rate-sensitive short-term yields rise faster and trade closer to the long-term yields. In this phase, higher yields on cash and cash-equivalents make them an attractive investment choice, besides their lower sensitivity to interest rate changes.

Also read | Here is how your marriage can affect your credit score

This situation reverses during rate-cut cycles when short-term yields decline faster than long-term yields leading to a steepening of the curve. As a consequence of this, reinvestment of new funds at lower future rates can often result in diminishing returns on the fixed-income portfolios.

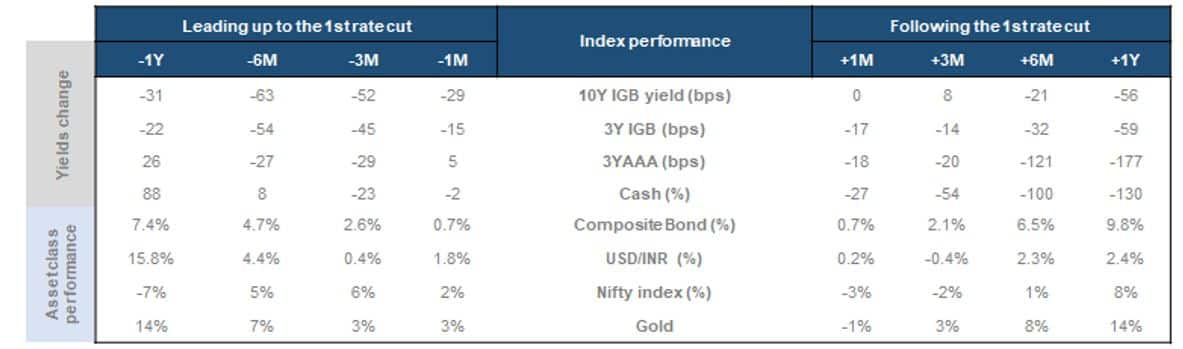

Historically, bonds have delivered consistent performance around the RBI’s easing cyclesAverage change in domestic bond yields (bps) and asset class performance around the first rate cut by the RBI since 2002

Source: Bloomberg, Standard Chartered. Performance analysis for the past 5 RBI policy easing cycles (2002, 2008, 2012, 2015 and 2019)What can investors do?

Source: Bloomberg, Standard Chartered. Performance analysis for the past 5 RBI policy easing cycles (2002, 2008, 2012, 2015 and 2019)What can investors do?In a scenario of falling yields, fixed income investors could focus on preserving their current income streams while managing risks. This can be done through the following ways:

Shift to bonds with longer maturity: Historically, longer-term bonds offer a 'term premium' over short-term bonds and cash, as an additional compensation to investors for taking longer term risks - delayed consumption and inflation uncertainty. As the spread between short-term and long-term yields increase, locking in higher yields through longer-term bonds can provide more stable income over time and mitigate the risks of reinvesting at lower rates. Moreover, longer-dated bonds, particularly those issued by the government and high-quality companies, tend to appreciate in value as interest rates fall, creating a potential for capital gains. This makes them an attractive option for income-focused investors looking to balance return and risk during periods of declining short-term rates.

Also read | Weathering the storm: Smart wealth preservation strategies in volatile markets

Use a 'laddering' strategy: With a ‘laddering’ strategy, investors spread their bond investments by purchasing bonds that mature at regular intervals. Through this, investors can structure a steady income stream that closely match their cash flow requirements and regular liquidity while maintaining exposure to varying yields. In a falling-rate environment, this strategy can smooth out the impact of declining yields by locking in higher rates on longer-maturity bonds early on, while allowing the flexibility to reinvest proceeds from maturing bonds into new ones. For income investors, bond ladders provide a mix of both short- and long-term bonds, creating a steady flow of income while reducing the risks associated with market timing.

Opportunistic allocation to corporate bonds: The current yields available on high-quality corporate bonds issued by AAA-rated entities (PSU, Quasi-government, Private) are attractive and offer spreads over government bonds that are currently above the long-term averages. Historically, decline in yields on AAA-rated corporate bonds outpace the decline in yields on government bonds during rate cut cycle. This makes corporate bonds attractive from both, locking in absolute yields as well as relative performance – potential to appreciate in value as yields decline.

Also read | Invested Rs 1 lakh in stocks, debt, gold, real estate in Jan 2024? Check how your money has grown

Diversify into multi-asset strategies: Another approach to dealing with falling yields is to add to strategies that target returns from a dynamically managed combination of assets - equities, bonds, commodities and cash. The advantage of multi-asset strategies lies in their lower correlation with asset classes, which lowers portfolio risk, and its ability to target income from multiple sources, that include high-dividend yielding equities, longer-term bonds, and sometimes even alternative assets such as real estate investment trusts (REITS) and preferred stocks.

That said, investors need to be mindful of the increased risks associated with multi-asset strategies when compared to bonds, and limit the allocation to levels in line with one’s risk appetite.

Also read | Steer clear of these four financial planning misconceptions in 2025

While it could be challenging to fully insulate fixed income portfolios against the impact of declining bond yields, having a structured plan in place through approaches discussed above, can help limit the drag on performance, while ensuring periodic liquidity to capitalise any on any opportunity, should rate cycles turn.

Saurabh Jain is Managing Director & Head, Wealth Solutions at Standard Chartered Bank, India; and Ravi Kumar Singh is the Chief Investment Strategist at Standard Chartered Bank, India.Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.