Bhavana Acharya

Mutual funds’ asset allocation preferences can be split over two periods – pre- and post-SEBI recategorisation – for better analysis.

And, in the post-SEBI recategorisation era, multi-cap funds appear more like large-cap schemes. Their allocation to large-cap stocks in their portfolios has been creeping up over the past year and a half. Fund houses, however, seem to have redirected their aggressive approaches to the new large-and-mid-cap category. Here’s more on the trend.

Large-cap allocations up

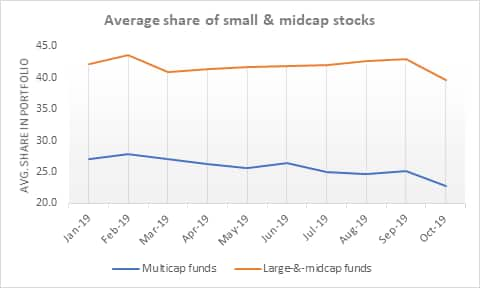

Consider the past year (2019). With the steep correction in mid-cap stocks, multi-cap funds could have caught these opportunities. However, they have either reduced mid-cap allocations or maintained them at best. Average allocations to small-and-midcap stocks for this category dropped from 27.9 per cent to 22.7 per cent.

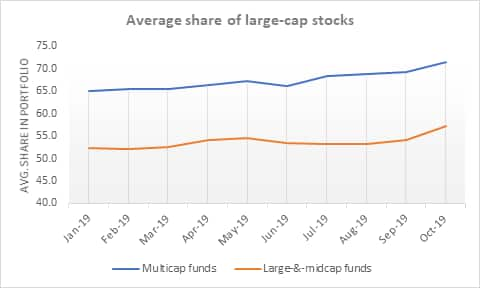

On the other hand, large-cap stocks accounted for an average of 71.6 per cent of the portfolios against 65 per cent at the start of the year. Large-cap allocations today are also above the 57-60 per cent they used to be at the start of 2018. Of the multi-cap funds, close to 40 per cent have a large-cap allocation of over 75 per cent, going by the October 2019 portfolios (latest available data for all funds). This type of allocation is similar to some of the aggressive pre-recategorisation large-cap funds.

Large-and-midcap funds have slowly built up their mid-cap positions; this time was needed, given that the category was introduced only after the categorisation exercise and came into being around June 2018. Funds needed to adjust their earlier portfolios for complying with the category’s requirements.

The average exposure now to small-and-midcap stocks averages about 40 per cent for funds in this category. Large-cap allocations did creep marginally higher recently, but the average share has stayed between 50 and 60 per cent. Of the entire category, about half the funds have large-cap allocations of less than 55 per cent. Large-and-midcap funds, therefore, have tended towards being more aggressive.

New category, new opportunities

What explains this trend? One, it could be that multi-cap funds are just not seeing opportunities yet in the mid-cap/small-cap space. Two, and more likely, it could be because of the similarities the multi-cap and the large-and-midcap categories could otherwise have.

By SEBI’s definition, multi-cap funds are ‘go anywhere’ schemes that can invest in stocks across market capitalisation. Large-and-midcap funds, on the other hand, have to maintain a 35 per cent allocation each to large-cap and mid-cap stocks. These funds, then, already have a good range available to play with small-cap, mid-cap and large-cap allocations. They also have a risk component built in.

If a multi-cap fund were to move across market capitalisations, it could get similar in profile to a large-and-mid-cap fund. Multi-cap funds, while being more dynamic pre-recategorisation, still tended to maintain half or more of their portfolios in large-cap stocks, give or take.

What is the takeaway?

The upshot of this trend is that multi-cap funds can suit less aggressive investors as well. In fact, it could step into the large-cap fund’s shoes. The room now to make adjustments to market capitalisation of large-cap funds has also shrunk with an 80 per cent mandated allocation to large-cap stocks. It is getting harder for these funds to deliver returns and multi-cap funds are getting more conservative.

Replacing large-cap funds with a multi-cap fund that’s maintaining a 70 per cent-plus large-cap allocation could be a good move. Adding in a large-and-midcap fund could boost return potential without increasing the risk too much, unlike adding a pure mid-cap fund.

(The writer is Co-founder, PrimeInvestor.in)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.