Your home loan interest burden is set to come down, with the Reserve Bank of India (RBI) announcing a repo rate reduction of 40 basis points on Friday. A basis point is one-hundredth of a percentage point. The repo rate has dropped from 4.4 per cent to 4 per cent. This is the rate at which the RBI lends to banks. A reduction of repo rate is the signal banks that they can borrow funds at cheaper rates from the RBI and lend deploy those.

Lower home loan rates

For borrowers who took loans after October 1, 2019 or switched to the external benchmarking regime, this will automatically translate into an equivalent reduction in their home loan interest rates. For example, State Bank of India’s minimum home loan rate will come down from 7.35 per cent to 6.95 per cent when the rates are reset.

Under the external benchmarking regime, introduced by the RBI in October 2019, all new floating-rate retail loans have to be mandatorily linked to an external benchmark. Most banks have chosen to price loans based on the repo rate. Banks have to reset their rates at least once every quarter.

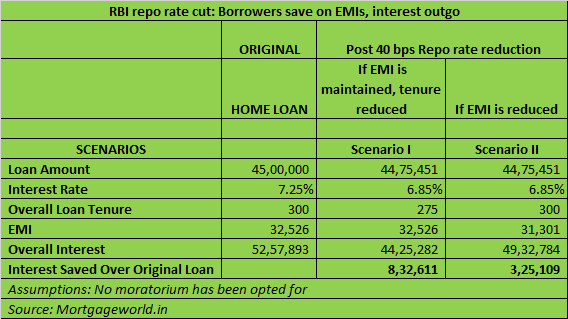

So, now, for a borrower with an original loan amount of Rs 45 lakh, carrying a 7.25 per cent interest rate and tenure of 25 years, the equated monthly instalment will come down from Rs 32,526 to Rs 31,301, a saving of Rs 1,225 per month. If you choose to maintain the EMI and reduce the tenure, which is advisable if you can afford it, you will save Rs 8.33 lakh on interest outgo, as the tenure shrinks by 25 months.

Borrowers whose loans are still linked to the marginal cost of funds-based lending rate (MCLR) should look to switch to the new external benchmarking regime, which offers greater transparency and more effective transmission of RBI’s policy actions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.