Harjot Singh Narula

Individuals often depend on their employer-provided group health insurance to meet any hospitalisation-related emergencies. But solely relying on your group policy is not prudent as it is applicable till the time you are employed with the organisation and comes with various caveats.

Personal health insurance is required to cover your healthcare expenses. A basic health cover based on your age, existing diseases (if any), place of residence and existing health cover is essential. Buying a health cover at an early age will be economical as the health premium advances with age.

To begin with, a basic health cover ranging from Rs 2 lakh to Rs 5 lakh is sufficient, but one cannot assume it to be adequate considering medical inflation. Ironically, the cost of health insurance for a higher sum insured, say for Rs 10 lakh and above, gets expensive. It might not fit into a middle-class family’s budget resulting in out of pocket expenses for being under-insured. So, enhancing your health cover to make it audacious enough to combat the rising health care costs is imperative.

Top-up /super top-up health plans come to the rescue

A top up or a super top health plan is a way to increase the health insurance cover at a nominal cost. It comes with the deductible or threshold limit. The deductible amount is the amount to be borne by the policyholder, either through his basic health plan or personal out of pocket expense.

Top-up, or super top-up, plans get triggered for the claim amount over and above the deductible amount else, such plans remain dormant or inactive. Top-up plans are beneficial for those looking for enhanced health coverage at a nominal cost to make it an affordable proposition. Such plans are available as an individual or a floater cover basis.

The advantage of opting for a top-up or super top-up health plan is that such plans come at a reasonable and affordable cost. Thus, it serves an individual’s purpose of being guarded by an audacious health cover at a low cost. Higher the deductible, lower the premium cost for top-up and super top-up plans.

The cost of a basic health insurance plan is more than the pricing structure of top-up and super top-up plans. The fundamental reason for this cost disparity is because the probability of claiming a benefit is higher under a basic health insurance plan as compared to top-up plans. Top-up and super top-up plans trigger only beyond the deductible limit. Higher the deductible limit, lower is the premium under these supplementary plans.

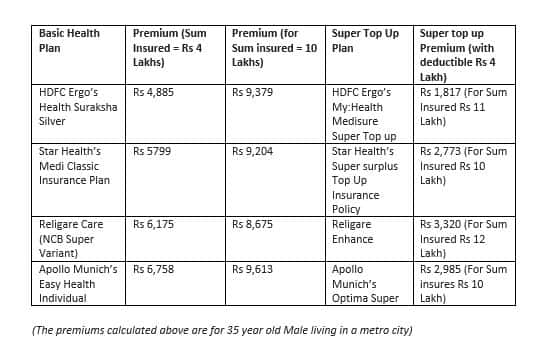

Buying a top-up/super top-up plan of Rs 10 lakh is far more economical than buying a basic health plan of Rs 10 lakh. Let us understand the same by comparing various premium in the table below:

Hence, it is evident that buying a basic health insurance plan and supplementing it with top plans is the prudent way of combating rising health care costs in a cost effective way to avoid out of pocket expenses.

How do top-up and super top-up plans differ from one another and a basic health insurance plan?

A basic health plan is an indemnity-based health insurance which initiates in case of hospitalisation, day care procedure, etc. The maximum benefit availed under a basic health insurance policy is subject to the sum insured under your health plan.

As the name suggests top-up and super top-up health insurance plans provide additional and expanded health cover above basic health insurance. These plans are supplementary which allow you to avail enhanced health cover to combat medical inflation at a nominal premium cost. Top-up and super top-up plans get triggered once the claim amount surpasses the deductible limit, which is the minimum threshold limit. In case the claim amount is below the deductible limit, one cannot claim the same from a top-up and super top-up plans.

Under a top-up plan, the deductible limit is evaluated for every single claim in a policy year. On the other hand, a super top-up plan evaluates the deductible limit by taking into account multiple claims in the policy year. Top-up plan works on the principle of ‘per claim’ or ‘per hospitalisation’ in a policy year, whereas super top-up plans works on the principle of ‘multiple claims’ in a policy year.

For example, if you have a basic health insurance policy of Rs 4 lakh and a top-up health plan with a sum insured of 10 lakh with a deductible limit of Rs 4 lakh. In case of an Rs 6 lakh claim, one can claim Rs 4 lakh from the basic health insurance cover. Since the claim amount is more than the deductible limit, the top-up plan gets triggered. The remaining Rs 2 lakh deficit can be claimed from the top-up plan.

Now, let us understand how super top-up plans work. These plans calculate the deductible even for a multiple claims in a policy year. Let us assume one has a same Rs 4 lakh deductible for a super top-up plan along with a basic health cover of Rs 4 lakh. In case of the first claim of Rs 3 lakh in a policy year, one can claim the same from the basic health insurance plan of Rs 4 lakh. If there is a second claim of Rs 3 lakh in the same policy year, one will be able to claim only Rs 1 lakh from the basic health insurance plan and the super top-up policy gets triggered as the total/aggregate claim amount in a policy year is Rs 6 lakh (Rs 3 lakh from the first claim and Rs 3 lakh in the second claim), which is more than the deductible limit.

However, if one had a top-up plan it would not have triggered as it considers deductible as per a single claim basis.

In nutshell, an individual must have a personal health insurance cover (irrespective of the fact that he/she holds a corporate health policy). Further the health insurance cover could be broadened with a top-up or super top-up plan.

The author is Founder and CEO of ComparePolicy

(Disclaimer: The health plans from various insurers mentioned in the article above are purely for the purpose of concept understanding only and in no way showcase the biases towards any insurer or health plan)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!