The Government of India (GOI) has announced the much-awaited scheme for the waiver of compound interest that was payable by the borrower who had opted for loan moratorium between March 1, 2020, and August 31, 2020.

Called the scheme for grant of ex-gratia payment of the difference between compound interest and simple interest for six months to borrowers in specified loan accounts (March 1, 2020, to August 31, 2020), it would bring marginal relief to borrowers of loans of up to Rs two crore.

Also Read: What is compound interest waiver, other details

Who is eligible for wavier of compounding interest on loan moratorium?

As per the guidelines, retail loans such as home, education, auto, personal and credit card debt of up to Rs 2 crore are eligible for this relief.

To be eligible the loan account should be a standard account, and not a non-performing asset (NPA), as on February 29, 2020. In simple words, up until February 29, you should not have defaulted on any of your monthly installments. The lending institution should either be a banking company, public sector bank, co-operative bank or regional rural bank, an all India financial institution, a non-banking financial company or a housing finance company.

Even if you have not opted for the moratorium, you can now opt for this relief scheme. “You should get advantage of the scheme even if you have taken a part moratorium or not availed the loan moratorium. The scheme is not limited to full moratorium borrowers,” says Vipul Patel, Founder, Mortgageworld.in.

How compound interest scheme will work and benefit?

The amount saved through compound interest waiver will turn out to be much smaller. This is because only the interest that would have been charged on the interest of your original loan during the six months moratorium period is waived off, as per the guidelines.

In other words, your loan repayment will continue as per term and you will still need to pay back not just the principal amount but also the simple interest you would have paid if you had not opted for the loan moratorium. Only, that compounding interest goes off.

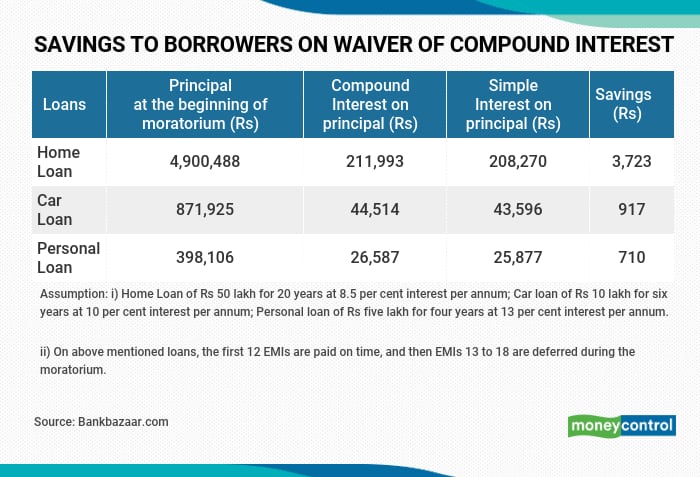

Back of the envelope calculations that Bankbazaar.com- an online marketplace for financial products- shared with us shows that on a home loan of Rs 50 lakh, the amount that you will now save thanks to the government’s scheme is just Rs 3,723. Reason being: your original interest levied on loans taken would have anyway continued. The only relief you have now is that interest on that interest has been waived off. “Since the waiver is small, the borrowers who had availed a moratorium will still have to figure out their near-term finances,” says Adhil Shetty, Founder and CEO, Bankbazaar.com.

My moratorium ended sometime ago and I had started my EMIs again. Will I get the extra money I paid back?

Yes, if you had opted for either the full moratorium or part moratorium, you would get the interest on interest portion paid by you back. The lender needs to deposit the interest in their bank accounts by November 5, as per guidelines.

However, Patel expects the amount to be adjusted in the loan account instead of getting credited to the savings bank account of the borrower. “Banks may approach the consumer informing the particular amount being refunded to you and it is being credited to your loan account and reducing the outstanding. As against, crediting the bank account as it could potentially reach the wrong account. Alternatively, bank could seek consent to pay the linked bank account,” he says. However, the best option is to adjust the outstanding loan amount. This will reduce the principal amount and technically that’s the best approach to adapt.

“However, there may be a lot of challenges in implementing this, considering only a part of interest may get waived off,” says a co-founder of the loan aggregator firm seeking anonymity.

Try to clear your loan soon

Look at your investment portfolio. Try and get rid of your dud investments; mutual funds that haven’t worked out, low-yielding traditional endowment insurance policies, or other assets like gold, to slash the amount owed. Start by paying off your credit card dues or personal loans as these are high-cost loans and can lead you straight into a debt trap.

Instead of taking it easy after this announcement of compound interest waiver, utilise all your resources to help you get out of the debt trap sooner and revert to your pre-moratorium position. For borrowers with large dues especially, it would be prudent to make principal pre-payments periodically to erase the additional debt that accumulated due to the loan moratorium. “Paying 120 percent of your deferred equated monthly instalments (EMI) within 12 months of the last deferred EMI would help achieve this,” says Shetty.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.