Barring some unforeseen circumstances, interest on accrued interest during the COVID-19 induced loan moratorium is set to go. Retail borrowers could be in for some festive cheer if the Centre’s proposal to waive off the compound interest accumulated during the six-month moratorium period is implemented. Retail loans such as home, education, auto, personal and credit card debt of up to Rs 2 crore are eligible for this relief. So, can retail borrowers afford to celebrate now? Here are some answers.

Is it certain that the interest on interest during the moratorium period will be waived off?It seems highly probable. On October 14, the Supreme Court directed the Centre to come out with an action plan on the proposal mentioned in its affidavit by November 2. “We will expect implementation of the government’s interest waiver by then and will review its implementation,” the apex court said. The court has previously said there is "no merit in charging interest on interest."

The Centre’s proposal entails waiving off compound interest accruing during the moratorium period that was announced by the Reserve Bank of India (RBI) in March and extended up to August 31 in May.

“The government has come forth with its decision to waive interest on interest…should be implemented at the earliest. While the government takes time, banks are levying interest of interest. If the government has already decided to exempt small borrowers from interest on interest, it should not be debited from accounts,” the SC observed.

Do note that the modalities of implementation are yet to be clearly laid out. These details – and their measurable impact -- will be clearer closer to November 2.

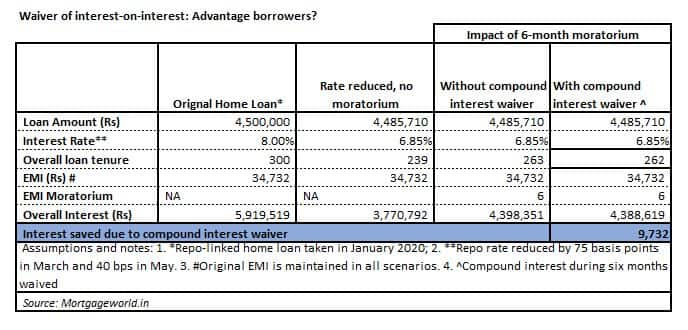

If the compound interest accumulated during the six-month moratorium period is indeed waived off, do I stand to make huge savings?The amount actually saved could turn out to be much smaller (see table below). This is because we have assumed that only the interest that would have been charged on the interest of your original loan during the six months moratorium period is likely to be waived off, going by the government’s affidavit. In other words, your loan still goes on and you will still need to pay back not just the principal but also the normal interest you would have paid if you had not opted for the moratorium. That extra bit of interest on interest -- also known as ‘compounding’ in financial terms -- would most likely go.

“The government, therefore, has decided that the relief on waiver of compound interest during the six-month moratorium period shall be limited to the most vulnerable category of borrowers,” the affidavit filed with the SC on October 1 stated.

“At present, it seems that it is only the compound interest during the six months, and not the total accrued interest, that will be waived off,” Vipul Patel, Founder, Mortgageworld.in, a loan consultancy firm, said.

The standard interest levied on your loan will continue to be payable. “This standard interest as per your amortisation schedule has continued to accumulate during the moratorium period. Only the interest on this interest is being waived off. The standard interest would get added to your loan amount and therefore, you will not revert to your pre-moratorium position (see table),” Patel said. The computation takes into account RBI’s cumulative repo rate cut of 115 basis points in March and May and assumes that the EMI will remain constant throughout the period.

Thus, at present, it looks like your benefit will remain limited, unless the government comes up with greater clarity on November 2.

Adhil Shetty, Founder and CEO, Bankbazaar.com, said the exact mechanism of how the banks will waive the interest on interest is still not clear. “Waiving of compound interest on the outstanding amount during six months of the moratorium – as stated in the government’s affidavit – will bring a very small relief to borrowers. The accumulated interest would still be high and would become even larger when repaid through the tenure of the loan,” he explained.

How should I go about reducing this debt burden?Look at your investment portfolio. Try and get rid of your dud investments; mutual funds that haven’t worked out, low-yielding traditional endowment insurance policies, or other assets like gold, to slash the amount owed. Start by paying off your credit card dues or personal loans as these are high-cost loans can lead you straight into a debt trap.

Instead of taking it easy once the formal announcement of compound interest waiver comes through, command all your resources to help you get out of the debt trap and revert to your pre-moratorium position. “Use the bounce back method, that is, aim to prepay up to 120 percent of the EMIs you had deferred within 12 months from September. For example, if you had deferred five EMIs, you should pre-pay six EMIs over and above your regular EMIs. This will erase the burden of the additional interest you will have to pay, and you loan will be regularised in terms of the number of EMIs left,” Shetty said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.