Direct plans of mutual fund schemes turned 10 on January 1, 2023. Hailed as one of the biggest reforms in the Rs 40 trillion Indian Mutual Fund (MF) industry, direct plans were aimed at reducing costs for investors when it comes to investing in MFs.

When introducing direct plans in 2013,capital market regulator Securities and Exchange Board of India (SEBI) had rightly said that if an investor wants to invest directly with the fund house, and doesn’t want to avail of a distributor’s services, she shouldn’t pay distributor fees.

That gave birth to the direct plan; an identical plan of a mutual fund scheme, but without the distributor fees embedded.

Everything else about the scheme -- the investment cost other than distributor commission, portfolios, taxation status, risk profile--remained the same. SEBI mandated all schemes to launch a direct plan.

For those who wanted to go through a mutual fund distributor(MFD), the existing plan- rechristened a regular plan--continued.

Fast forward to 2022. As of April 30, Assets Under Management (AUM) routed through direct plans of MFs schemes stood at Rs 16.94 trillion, which was 45% of the total AUM. Of the direct plan AUM of MFs, participation by individuals — other than high net worth individuals, Hindu undivided families, and non-resident individuals — was 11.2%, as per SEBI.

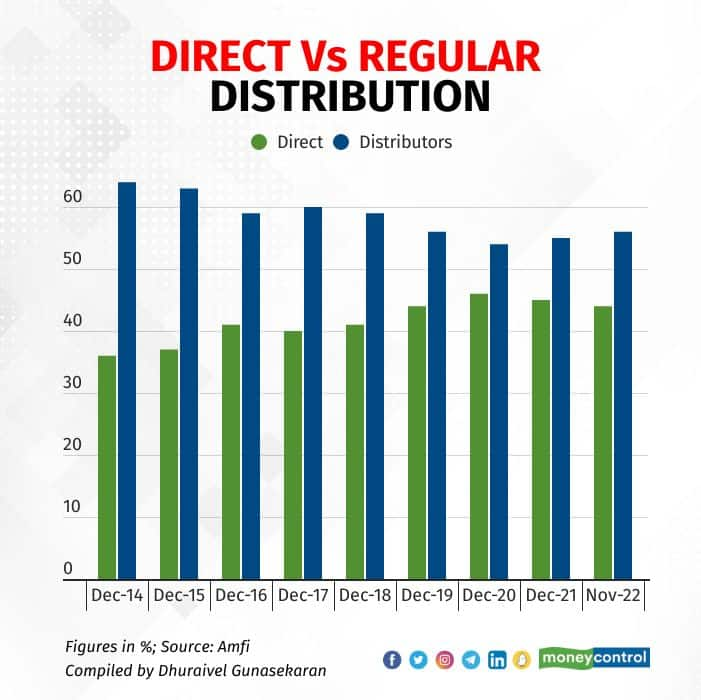

Percentage breakup of Direct and Regular plan AUM

Percentage breakup of Direct and Regular plan AUM

Experts say that one benefit of direct plans that investors have appreciated over the years is the higher difference in returns resulting from such plans, which happens in a very transparent way.

“What has actually resulted is something which could not have been anticipated. Direct plans coupled with fintechs, Aadhaar, online banking and Jan-Dhan program, have combined together to make investing very powerful,” said Dhirendra Kumar, CEO of Value Research.

Kumar estimates that investing in direct plans typically adds around 1 percentage point of the investments per year.

Slow to take off

The first class of investors to move into the direct plan category were institutional investors, which were largely fixed-income investors.

These investors immediately realized that benefits of such products were very significant. Reason being most institutional investors park their proprietary money in liquid and overnight funds, even short-term debt funds where returns are low.

Distributor commissions, within a scheme’s total expense ratio, can shave off quite a bit of the return.

The small investor was another matter. Lack of awareness of a big impediment. Many individual and retail investors didn't knew the direct plan came about. And even if they knew, they had little wherewithal to shift to the direct plan. "Remember, that was 2013, 2014, 2015..in those days, not many fintech apps were there that could make it easier for investors to shift from regular to direct plan," says Kirtan Shah of Credence Wealth Advisors. Besides, most of the sales of MF units were done by distributors in those days and they did transaction through the regular plan that came with commissions embedded, because that is how they earned their livelihood.

But things had already started, albeit slowly. Even before SEBI came up with the idea of the direct plan, Quantum Mutual Fund, now India’s 34th largest fund house with assets of around Rs 1,881.92 crore, had taken the lead. When it launched in 2006, it became India’s first direct-to-investors asset management company in India, refusing to pay distributor commission. Infact, Quantum normalised the direct plan by selling only one plan- without distributor commission- without even calling it direct.

Back in those days, distributors were free to sell Quantum MF schemes, but they didn’t earn any commission from the fund house in its first few years of existence. The fund house maintained that distributors are free to collect fees from their customers.

Eventually in 2017, the fund house launched a regular plan and started paying distributor commission. But even today, close to 95 percent of its assets lie in direct plans.

On challenges faced by the AMC in initial days, Jimmy Patel, managing director and CEO, Quantum MF, said: “It was difficult to convince customers that there is a way beyond distribution, which can be used to invest in mutual funds. The customers were a little hesitant at first. Retail investors always look at the convenience factor, which is a human psychology.”

Apart from retail investors, AMCs were also slow to adopt direct plans.

“Fund companies were not interested in promoting these plans. In fact, they did not want to be seen as promoting direct plans, because their substantial revenue was coming from the people who were selling it,” said Value Research’s Kumar.

Advent of fintechs

In a consultation paper recently SEBI said that with the increasing focus on financial literacy, digitization, online banking, usage of smartphones, and awareness about mutual funds, more and more investors may be in a better position to leverage technology and invest directly in MF schemes.

Also read | Coming soon: How execution-only online platforms will bring more direct plans your way

Experts believe that financial technology players such as online mutual fund platforms have resulted in a higher uptick for direct plans.

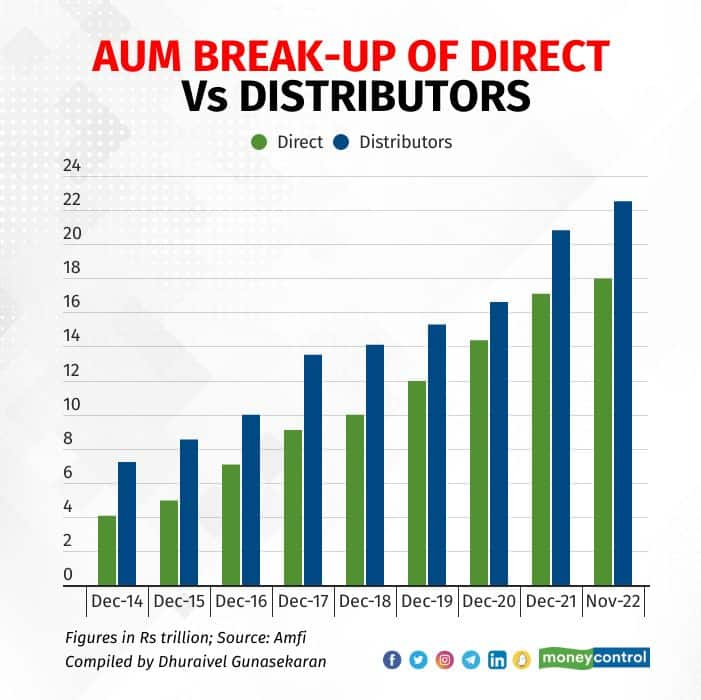

How assets under management went up in Direct plan vis-a-vis Regular plan

How assets under management went up in Direct plan vis-a-vis Regular plan

Bhuvanesh R, assistant vice president-business, Zerodha, believes that without online platforms, the direct participation would be far less then what it is today.

“Online platforms have been a major catalyst in popularizing direct plans by constantly educating users about the importance of costs,” he said. Zerodha only offers direct mutual fund plans on its platform.

Another factor that has boosted direct plans of mutual funds were Covid-19-induced lockdowns, which gave a fillip to the do-it-yourself investment trend in India.

SEBI data highlights that there been a significant rise in the number of unique investors in MFs —from 29.2 million as of March 31, 2020 to 35.2 million as of October 31, 2021.

Bhuvanesh is of the opinion that with investors becoming more savvy and educated, the share of direct plans will increase exponentially over the next decade.

Regular plans still have a roleExperts say that for a certain set of investors, handholding is a very essential thing, as they don't feel confident enough about taking action around investment on their own.

Harshad Chetanwala, co-founder of MyWealthGrowth, has been on both sides of the equation.

Ironically, before founding his own firm, Chetanwala was with Quantum MF, which was predominantly a direct-to-investor mutual fund, where he spent close to 11 years reaching out to investors directly and convincing them of the benefits of investing in mutual funds, among many other things.

“One important thing which is missing is the element of education and advice. There's ample scope for advisor-driven business as well as direct plans. The crucial element to investing in a mutual fund is education, which is where distributors’ or IFAs’ (Independent Financial Advisers’) role continues to remain strong considering their present reach and how underpenetrated mutual funds are when compared to any other investment avenues,” he said.

Chetanwala, a SEBI-registered investment adviser, has also founded MyWealthGrowth.com, which holds a corporate AMFI Registration Number (ARN) for mutual fund distribution under the name of Northpoint Fintech. This platform helps investors who want to invest in Mutual Funds and build their portfolio.

SEBI had directed fund houses through the Association of Mutual Funds in India (AMFI) to provide direct plan feeds to Registered Investment Advisers (RIAs) in 2016.

G Pradeep Kumar, CEO of Union Mutual Fund, agrees, “The risk for direct investors is that due to lack of proper guidance, they may exit at the wrong time, thereby resulting in a negative experience. So, while the concept (of direct plan) is good, it is only suitable for people who have the knowledge, experience and skills to manage their own investments. Most investors need help from distributors or advisors.”

Experts also warn that by looking at just some additional returns, investors may do more harm than good.

“For probably 1-2% (point) more returns, investors may fail to generate optimum returns, whether it is in equity or debt. They may also overlook the right, suitable investment products and investment avenues such as international, gold or real estate. Further, the debt side is even riskier, as when a default happens, investors are at a risk of losing their money,” said Rushabh Desai, founder, Rupee With Rushabh Investment Services.

To be sure, there is no additional benefit in choosing a direct or regular plans from a taxation perspective.

“The tax laws never distinguish gains arising from direct or regular plans. However, in the terms of wealth, direct plans make more sense,” said Archit Gupta, founder and CEO, Clear.

Direct plans have a come long way. A recent note by AMFI pegged the share of direct investments in equity AUM at 19%, which included high-net worth individuals.

“It's a mixed bag. You can say that direct plans have failed to take off, but I say that these plans are in the nascent stage. A lot of education is needed to attract retail investors. In initial days, there was a big struggle, convincing our customers that there is a variable return product, which is different from a fixed return product. People were arguing that Nifty is giving me X return, you're not even giving me that. So, that was a big challenge, but the challenges are there even today,” said Patel.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.