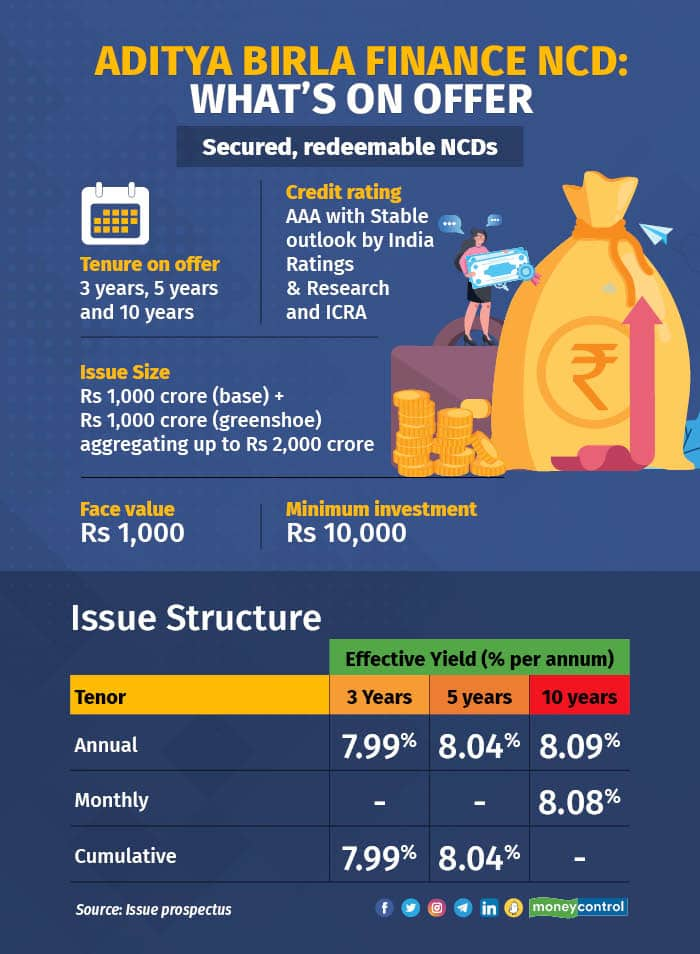

Non-banking financial company, Aditya Birla Finance, has opened the public issue of its Rs 1,000-crore secured non-convertible debentures (NCDs). It comes with a green shoe option of Rs 1,000 crore, making it a Rs 2,000 crore issue.

About the issue

The financial services company’s first public issue of NCDs offers investors six debenture options spread across tenures of three, five, and 10 years. The effective yields range from 7.99 to 8.09 percent per annum, with annual and cumulative interest payouts. The monthly payout option is only available for the 10-year NCD.

Also read | Step up your card safety with cardless cash withdrawals

The proposed NCDs have been rated AAA with a stable outlook by two rating agencies, India Ratings & Research and ICRA, which is rare for an NCD issue.

Trust Investment Advisors, AK Capital Services, JM Financial, and Nuvama Wealth Management (formerly Edelweiss Securities) are the lead managers for the issue.

The NCDs come with a face value of Rs 1,000 and a minimum investment size of Rs 10,000. A demat account is necessary to participate in this issue.

The NCDs come with a face value of Rs 1,000 and a minimum investment size of Rs 10,000. A demat account is necessary to participate in this issue.

The NCDs will be issued on a first-come, first-served basis.

What works

The issue has a AAA rating, which is considered the highest degree of safety regarding the timely servicing of financial obligations and carries the lowest credit risk.

Also, the interest rate offered is decent compared to other similar-rated NCD issues.

For example, Power Finance Corporation (PFC), a Maharatna Central Public Sector Enterprise (CPSE), launched a Rs 5,000-crore AAA-rated public NCD issue in July. The coupon offered ranged from 7.45 percent to 7.54 percent per annum.

Also read | Want to avoid TDS on FD interest, rent? File Form 15G or 15H

According to Vikram Dalal, Founder and Managing Director (MD), Synergee Capital Services, hardly any PSU or private sector AAA-rated secured bonds offer 8 percent returns.

“The rates are interesting because you do not find any of the secondary market AAA-rated debt issues in the same range,” said Dalal.

As per India Ratings and Research, a strong parent with a high propensity and ability to support the company, an established franchise with a spread-out portfolio, and diversified funding are some of the positives favouring the company.

What doesn’t work

An NCD issue comes with a fair bit of credit risk, even if it is rated AAA. In the past, some issues with even the highest rating had defaulted, leaving investors in a fix.

Additionally, NCD issues pale when compared to debt funds on liquidity grounds.

Further, as per ICRA's rating rationale, the asset quality of the company remains moderate with growth in relatively riskier retail unsecured loans, while India Ratings & Research highlighted Aditya Birla Finance’s sustained below-average operating performance as the key risk.

What should investors do?

In terms of interest rate cycles, rates have gone up too much and are expected to soften one year from now. Given this, investors are looking to lock in rates at the peak of the interest rate cycle for the long term.

“This being a public NCD offering, it is rightly attractive. It's a very well-managed company and has a very healthy book,” said Ajay Manglunia, Managing Director and Head of Investment Group at JM Financial.

Also read | How have India’s oldest MF schemes rewarded investors?

Keep in mind that redeeming NCDs before maturity might be a challenge, as the Indian debt market is not so deep. One must also be mindful of taxation, as interest earned on these instruments is taxed at the income tax slab rate.

However, given the rating and the parentage of the company, retail investors with a high-risk appetite can subscribe to this issue.

"One can consider investing in it from a three- to five-year perspective. This will be the best bet rather than going for the longer term,” said Dalal.

NCDs are typically lapped up by investors who wish to receive regular (monthly/quarterly) payouts. However, the Aditya Birla Finance issue is offering the monthly payout option only for the 10-year tenor, which should be avoided by retail investors. Further, any kind of capital, especially in the debt allocation, is best deployed in multiple instruments.

The issue, which opened on September 27, will close on October 12, 2023. However, it comes with the option of early closure.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.