Through an analysis of complaints and Securities and Exchange Board of India (SEBI) orders against financial advisors, the Association of Registered Investment Advisors (ARIA) study has brought forth the risks involved in providing trading calls and engaging in trading in the stock markets.

Most complaints filed against financial advisors – both registered with SEBI as well as unregistered advisors – and enforcement orders passed by the market regulator are linked to trading calls provided by these entities. “The analysis points to the need for sharply focussed action against unregistered entities and separate treatment necessary for those RIAs that are not trading call providers,” the association said in a press note.

The complaints analysis pertained to grievances received against RIAs since inception via SEBI’s SCORES website, as of June 30, 2024. The study also stated that the majority of SEBI orders (71 percent) were passed against unregistered financial advisors.

Also read: With a few tweaks, SEBI's draft IA regulations can boost the advisory profession

Trading, derivatives segment in focus

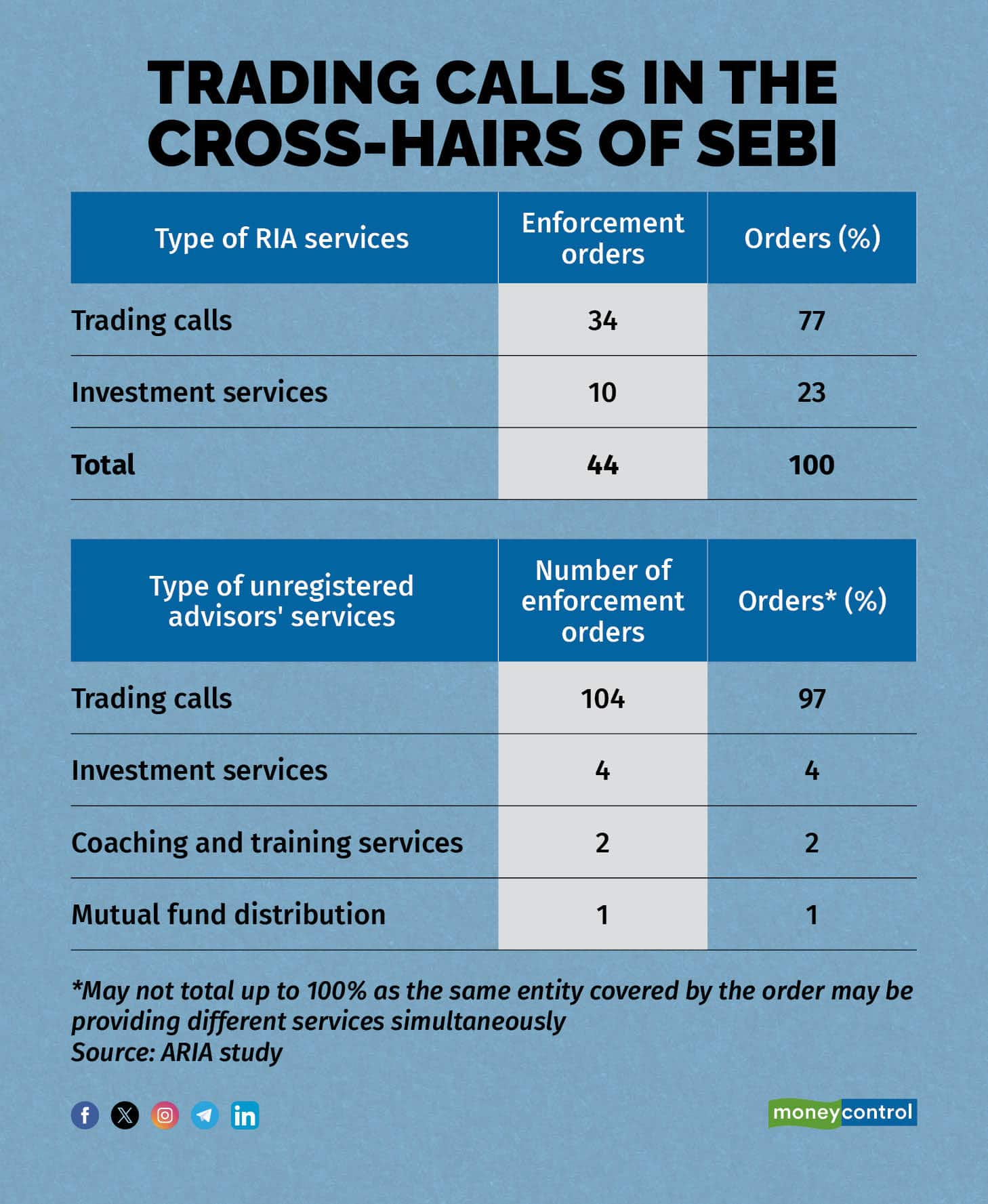

Out of the total number of complaints filed against registered investment advisors, grievances against trading call providers account for 73 percent. In the RIA group, 77 percent (34) out of 44 SEBI orders were passed in respect of entities that were trading call providers. The analysis took into account orders passed from the entities’ inception till March 31, 2024.

Within this group, 32 (72 percent) of the 44 enforcement orders were in respect of services-linked derivatives (futures and options and commodities), followed by equity (39 percent) and intra-day equity or high-frequency trading (23 percent).

This apart, 97 percent (104 out of 107) SEBI enforcement orders were passed against unregistered investment advisors who provide trading calls. “Enforcement orders are primarily against trading call providers whether registered or unregistered,” the study noted. Its analysis last year, too, had reached a similar conclusion.

Also read: SEBI again red flags households losing Rs 60,000 crore in F&O as 'macro issue'

Small proportion of RIAs constitutes maximum complaints

According to ARIA analysis of complaints received through SCORES portal, no complaints have been filed against a vast majority – 74 percent – of RIAs. Out of 963 RIAs, 10 percent (97) RIA accounts for 94 percent of complaints. Over 700 RIAs have not witnessed a single complaint being filed against them. “Sole proprietorships account for 59 percent of such complaints (received through SCORES). LLPs and individuals account for a negligible percentage of complaints,” the study stated.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.