An analysis of capital market regulator Securities and Exchange Board of India's (SEBI) enforcement orders by the Association of Registered Investment Advisers (ARIA) reveals that 95 percent of the orders passed pertain to investment advisers (individuals and firms) that provide trading calls. In other words, just 5 percent of the orders pertain to advisers who provide holistic financial advice. This, says ARIA, makes a compelling case for the easing of the tough regulations that many investment advisers fault for the slow growth of registered investment advisers (RIA) in India.

Ever since SEBI issued its Investment Advisers regulations in 2013 (and updated them in 2020, after four rounds of consultation papers), it has regularly penalised violators.

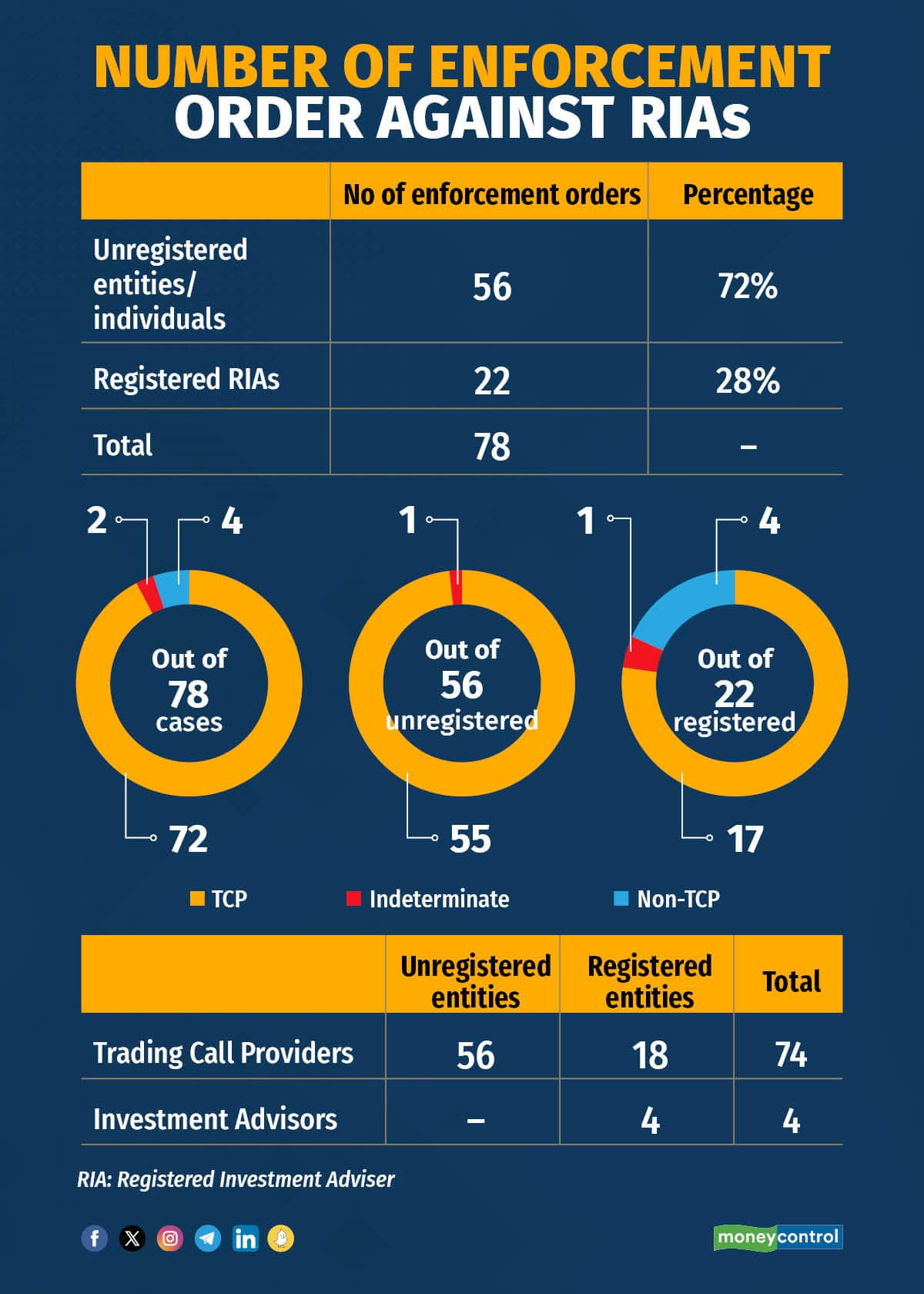

An analysis of 78 main orders passed by the regulator against investment advisers from the inception of the regulations in January 2013 up until June 14, 2023, reveals that 74 of the orders were passed against unregistered entities, while 22 were against registered entities. A majority of the orders were found to pertain to those who provided trading calls to their clients. The problem was bigger in the case of unregistered investment advisers—nearly every one of them was caught providing trading calls.

All SEBI convictions against unregistered entities involved equity and derivatives

All SEBI convictions against unregistered entities involved equity and derivatives

There is currently no official definition for an investment adviser providing trading calls. To make things simpler, ARIA defined a trading call provider as someone who provides advice pertaining to non-delivery trades, equity intraday, derivatives, leveraged trading and so on. In simple words, a trading call provider advises on speculative trading, rather than long-term financial investments and goal-based financial planning.

Indore: A stock tipper paradise

A breakdown of the 78 SEBI orders passed reveals that the majority of violators (51 percent) were from Madhya Pradesh. Moreover, 32 orders were passed against people or entities based in Indore.

Indore has earned a bad reputation as a breeding ground for stock tippers and speculative traders

Indore has earned a bad reputation as a breeding ground for stock tippers and speculative traders

Otherwise known as one of India’s cleanest cities, Indore has earned a bad reputation as a breeding ground for stock tippers and speculative traders, who have nudged many unknown and lay investors to trade speculatively and suffer losses. After Indore, most of the defaulters have been found in Bengaluru, Madurai, Surat, Ahmedabad and Mumbai.

What is the scale of non-compliance among RIAs?

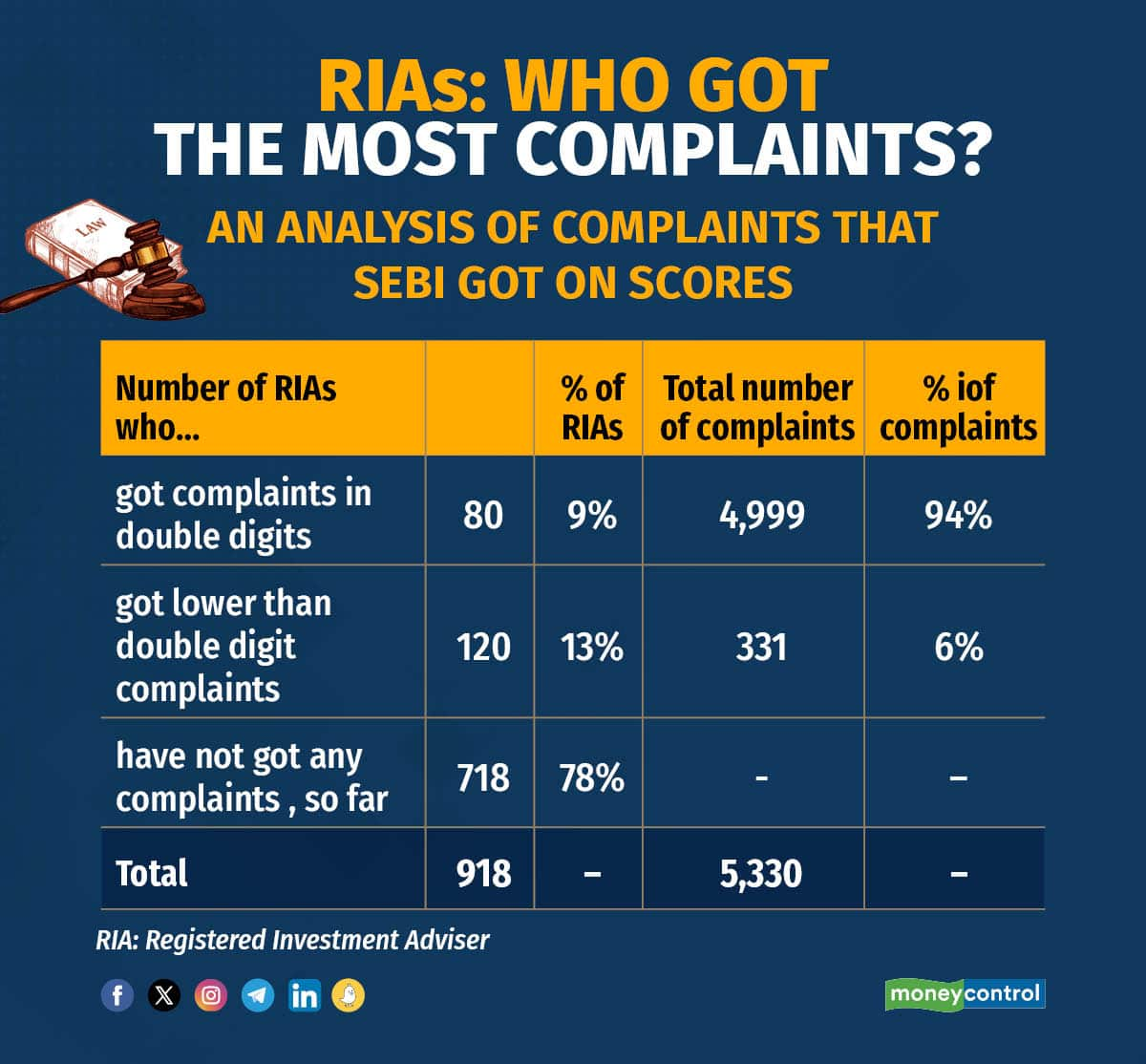

Currently, SEBI accepts investor complaints through SCORES, its complaint mechanism. As per ARIA’s analysis, of the 918 RIAs in the profession, 78 percent have not faced any investor complaints at SEBI.

Nine percent of the RIAs have 10 or more complaints, and the study found that this group of RIAs accounts for 94 percent of the total number of complaints (4,999). “From their names, and the other details of these entities, it appears that all of them are ‘Trading Call Providers’.

Of the 22 SEBI orders against RIAs, only one had a mutual fund related complaint.

Of the 22 SEBI orders against RIAs, only one had a mutual fund related complaint.

Aside from this minuscule number of RIAs who account for the lion’s share of the complaints, a further breakdown of SEBI orders against these violators shows that the majority of them got pulled up for their equity and derivative recommendations. Of the 22 SEBI orders against RIAs, only one had a mutual fund related complaint. The rest got pulled up because of equity and derivative recommendations (speculative trading calls) that presumably went wrong for their clients.

All SEBI convictions against unregistered entities involved equity and derivatives. “From this complaints analysis, it would appear that RIAs that are not ‘Trading Call Providers’ need to be treated differently as their activities have not led to complaints from investors,” the report stated.

Taking trading call providers out

The RIA community has been clamouring to take the stock tippers out of the RIA regulations and perhaps shifting the onerous compliance norms to govern that group more closely. “It’s perfectly fine that financial planners are brought under the ambit of investment advisory guidelines, manly with the purpose to collect fees. But this group of practitioners are very different from those who offer just stock tips and derivatives strategies, aimed at making short-term and often speculative gains. There is a need to carve out a lighter hand of regulations for certified financial planners out of the existing Investment Advisory Regulations. And take trading call providers, make onerous regulations and compliance on them, separately, that would rightly keep their activities in check. Most of the SEBI orders, as this study points out, have caught the trading call providers,” says Kalpesh Ashar, Founder, Full Circle Financial Planners and Advisors.

One such stricture, many RIAs point out, is the need to mandatorily take the examination once every three years, to retain the RIA license. The other requirement that many RIAs too have called for a re-look is the limit of clients that individual advisers can take on. At present, SEBI RIA regulations say that individual advisers cannot take more than 150 clients. "The requirement to limit the number of clients that individual RIAs can have (150) does not really make sense. It is our experience that many individual advisers can handle more than 150 clients. If such advisers have teams under them, it’s possible," says an RIA on conditions of anonymity.

Another contentious regulation on its way is the creation of a safe space. The SEBI has been working on a mechanism whereby an adviser's clients would be able to pay advisory fees only through a registered portal. The fees, then, would be paid off to the advisor. It is yet unclear as to how exactly the payment would work, but it appears that there would now be a middle layer that would filter the fees, which otherwise used to go directly from the client's bank account to the adviser's bank account. One of the intentions is that SEBI can keep an eye on the fees that clients pay to their advisors and intervene if the fees charged are disproportionate. "SEBI’s proposal of a safe space will not really solve the problem because the unregistered advisers will remain out of the ambit of SEBI’s regulations," says Dilshad Billimoria, director and chief financial planner, Dilzer Consultants Pvt Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.