India's credit revolution is being driven by its young population, with a staggering 77 percent of the 119 million credit-monitoring consumers belonging to Gen Z and millennials. This is according to TransUnion CIBIL’s August 2024 report, 'Empowering Financial Freedom: The Rise of Credit Self-Monitoring in India', which offers insights into the credit behaviour of self-monitoring consumers across the country. Self-monitoring consumers are those who have proactively checked their CIBIL score and report at least once with TransUnion CIBIL.

TransUnion CIBIL is one of the leading credit information agencies that maintains credit scores of borrowers and individuals across the country. While TransUnion CIBIL calls its ranking a CIBIL score, other credit bureaus also give out credit scores.

Young borrowers becoming more credit-awareAccording to the report, there is a significant shift in credit behaviour among young borrowers, which includes Gen Z and millennials. “This early adoption indicates that these generations will play a pivotal role in shaping India's consumer credit landscape,” said Rajesh Kumar, managing director and CEO, TransUnion CIBIL. By embracing credit at an earlier stage, younger Indians are recognising the importance of establishing a strong credit foundation, setting themselves up for long-term financial success, he added.

India’s increasing credit awareness quotientA staggering 119 million individuals in India are now actively monitoring their CIBIL scores, according to data as of March 2024.

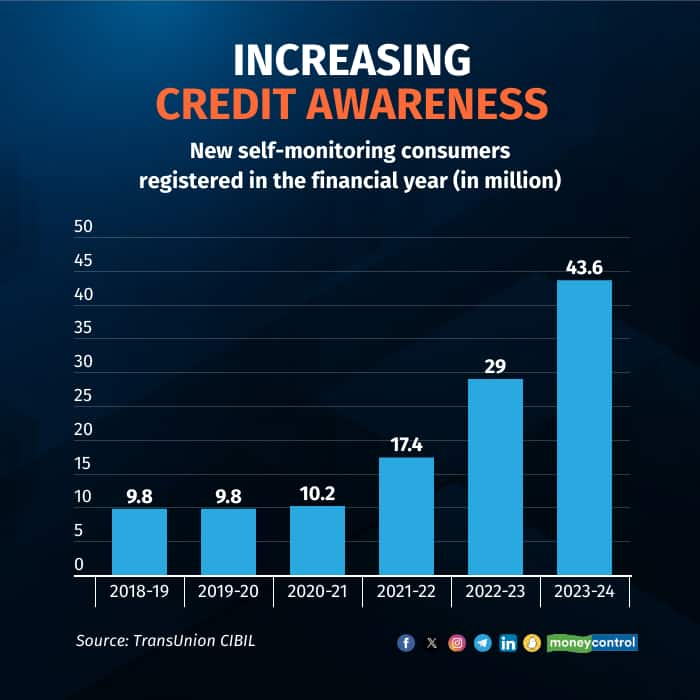

The report reveals a significant surge in credit awareness, with a 51 percent year-on-year increase in consumers monitoring their credit profiles in 2023-24. This translates to an additional 43.6 million individuals (see graphic) taking a proactive approach to understanding their credit status, indicating a growing emphasis on financial literacy and responsibility.

The surge in credit score awareness can be attributed to the ease of digital access, making it simpler for individuals to understand and monitor their credit scores. Consumers who actively monitor their credit scores tend to have higher average scores, with a notable difference of 17 points (729 versus 712) compared to those who do not. This suggests that credit awareness and engagement are linked to better credit health.

Maintaining a good credit profile can grant you access to a range of privileges, including quicker approvals of loan, at lower rates of interest, financial products tailored to your needs, and enhanced credit limits. By demonstrating responsible credit behaviour, you can unlock these benefits and enjoy greater financial flexibility and convenience.

Also explore: Free credit report and regular credit score updates on the Moneycontrol app and website.

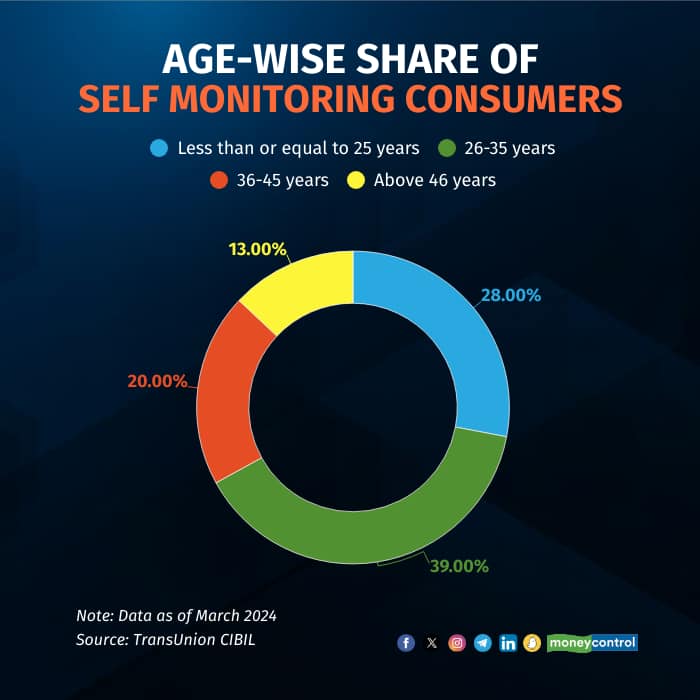

Breaking down the 119 million self-monitoring consumersAmong those who have checked credit score for the financial year ended March 2024, 28 percent are those up to 25 years of age.

Those between the ages of 26 and 35 years have emerged as the largest cohort that checked their credit scores. A higher proportion of credit score trackers in this age group indicates a growing emphasis on early and sustained credit awareness, as younger adults take proactive steps to manage their financial health.

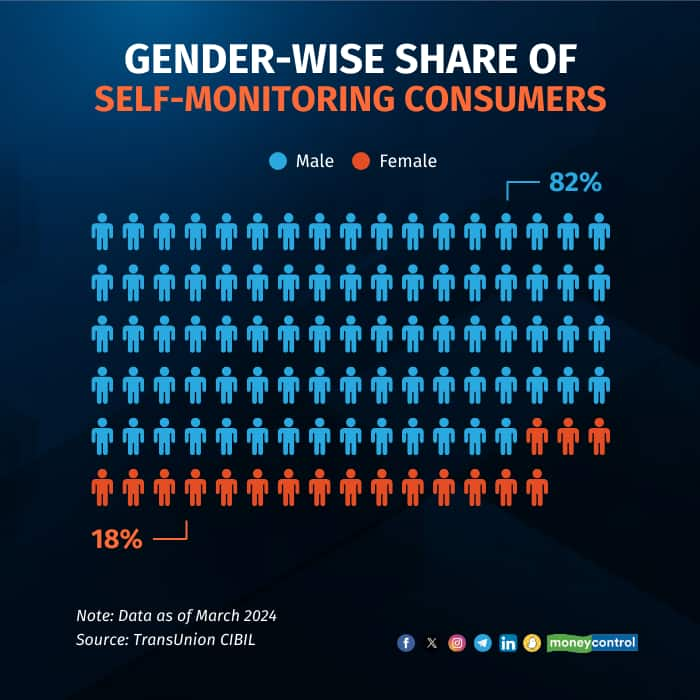

According to the report, men dominate credit monitoring, accounting for 82 percent of consumers, while women make up 18 percent (see graphic). Although the gender gap remains substantial, the rising involvement of women in credit monitoring signals a promising trend of increased financial engagement and empowerment among female financial consumers.

Forty-six percent of those who checked their credit scores showed improvement in their scores soon thereafter. This surpasses the 41 percent improvement rate among non-monitoring consumers, indicating a growing trend of credit consciousness in India. Improved credit scores benefit borrowers as they are able to get better interest rates and enjoy higher credit limits with their higher scores.

The report reveals a significant correlation between credit score monitoring and the opening of new credit lines. Within three months of checking their score, self-monitoring consumers demonstrated a remarkable sixfold increase in opening new credit lines compared to non-monitoring consumers.

Personal loans were the most preferred credit product by self-monitoring consumers within three months of monitoring, followed by a consumer durable loan and loan against gold/jewellery (see graphic).

Furthermore, data indicates that 44 percent of consumers are actively engaging with their credit health by monitoring their CIBIL score and credit report at least four times within a 12-month period.

Also explore: Online personal loan up to Rs 15 lakh via Moneycontrol

Self-monitoring women borrowers showcasing increased credit confidenceAs women's understanding of credit implications and possibilities deepens, India's credit market is witnessing a surge in informed borrowers. According to the report, a remarkable 70 percent growth in self-monitoring women consumers indicates a significant shift towards prioritising financial planning and proactive credit management.

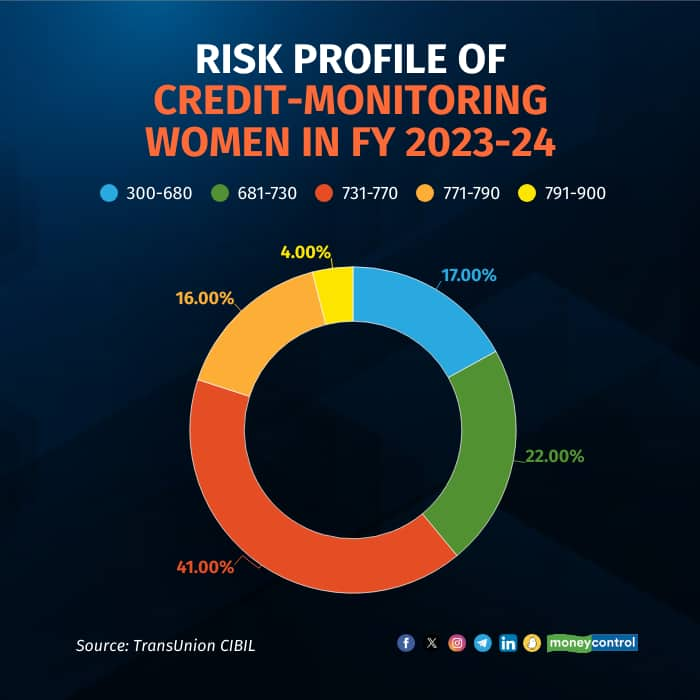

Moreover, the number of women consumers with a CIBIL score of 730+ was 61 percent in 2023-24 (see graphic), demonstrating their commitment to maintaining excellent credit health and unlocking better financial opportunities.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.