Active equity mutual funds pared their cash levels marginally in August, though overall buffers remained elevated, reflecting continued caution among fund managers amid volatile markets.

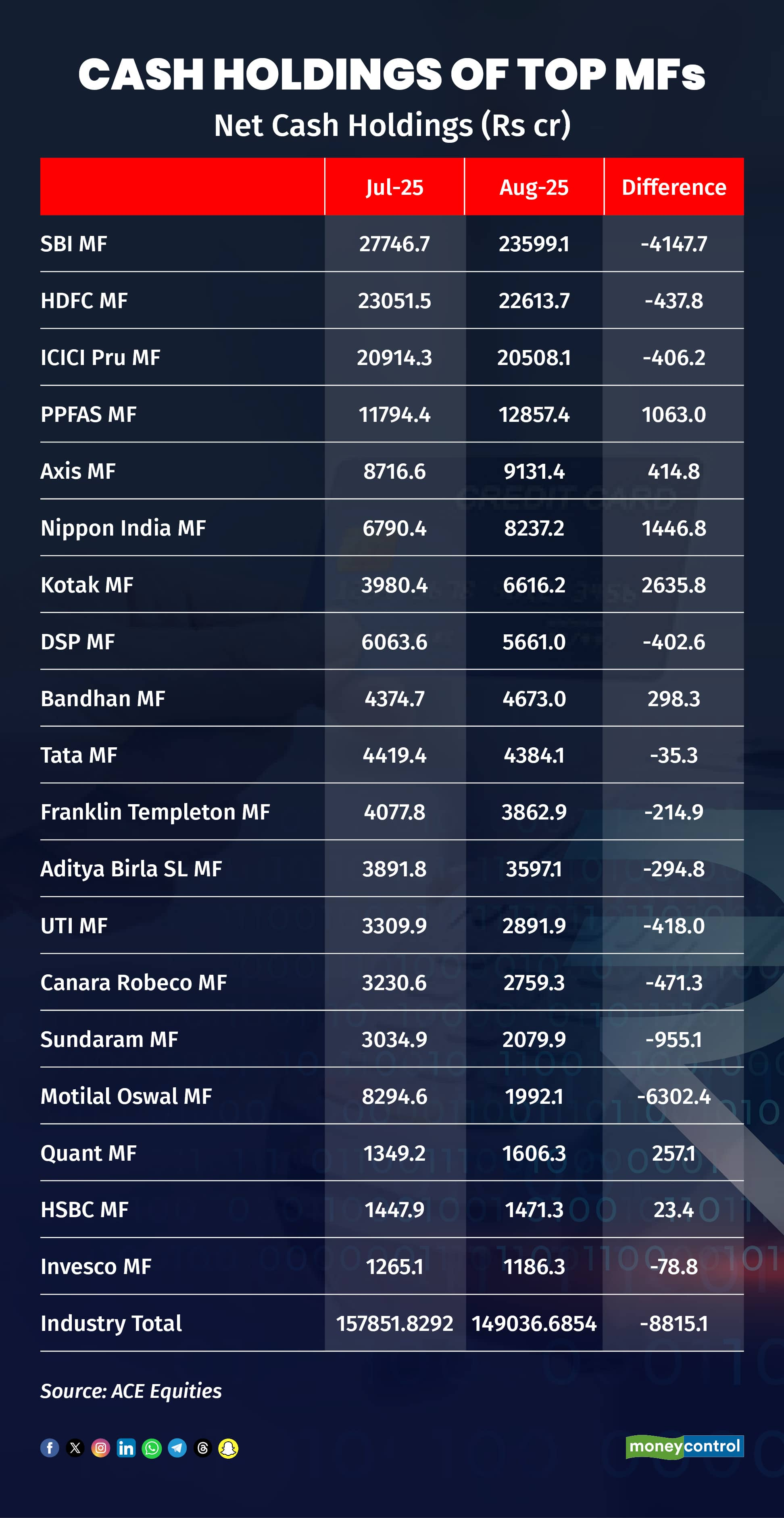

Data from ACE Equities shows cash reserves in the equity segment slipped marginally to Rs 1.49 lakh crore in August from Rs 1.57 lakh crore in July.

SBI Mutual Fund held the largest equity cash balance at Rs 23,600 crore, down from Rs 27,750 crore in July. HDFC Mutual Fund and ICICI Pru followed with cash holdings of Rs 22,613 crore and Rs 20,508 crore respectively, compared with Rs 23,050 crore and Rs 20,914 crore a month earlier.

Other large fund houses maintaining high cash levels include PPFAS, Axis Mutual Fund, Nippon India, Kotak Mahindra and DSP.

Analysts note that despite the decline, cash positions remain higher than usual, as valuations across market-cap segments continue to trade above historical averages. Fund managers are largely refraining from aggressive cash calls, with earnings growth and valuation trends playing a decisive role in deployment strategies. While holding cash offers flexibility in turbulent markets, they caution that it also carries opportunity costs if equity momentum resumes.

The cautious stance comes against the backdrop of heightened market volatility in August, when benchmark indices Sensex and Nifty slipped 1.6 percent and 1.4 percent, respectively. The BSE MidCap index lost 2.5 percent, while the SmallCap index declined 3.7 percent.

Cash holdings have eased steadily from Rs 1.73 lakh crore in April to Rs 1.65 lakh crore in May and Rs 1.50 lakh crore in June, before the August dip. Experts attributed earlier drawdowns to deployment in block deals and initial public offerings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!