The average assets under management of the mutual fund industry rose 7 percent taking the total AUM to a record high of Rs 19.52 lakh crore at the end of June quarter, according to the data on the Association of Mutual Funds in India.

Fund managers attributed the increase in AUM to robust markets matched with growing participation from retail investors.

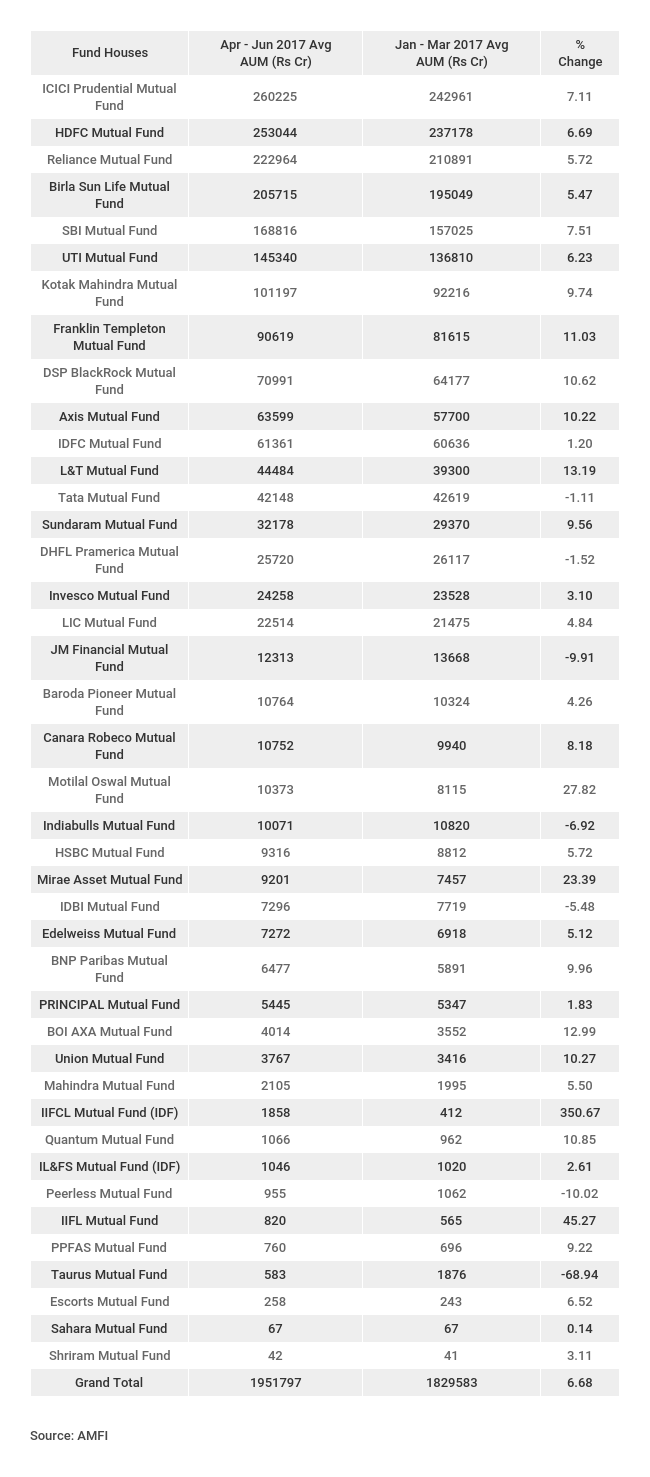

In January-March, the average AUM of 42 MF players stood at Rs 18.3 lakh crore, as per AMFI.

Mutual fund experts believe that the growth in AUM is largely due to continuous inflows in equity funds particularly through systematic investment plans or SIPs. Fund managers also applauded the fact that retail investors have matured and they do not withdraw when markets fall.

"The good part is investors do not react in a knee-jerk way to any of the event and withdraw. There is more of long-term money coming into the industry," said a Mumbai-based distributor.

SIP is an investment plan (methodology) offered by mutual funds wherein one could invest a fixed amount in a mutual fund scheme periodically at fixed intervals – say, once a month, instead of making a lump-sum investment.

The SIP instalment amount could be as small as Rs 500 per month. SIP is similar to a recurring deposit where you deposit a small /fixed amount every month.

SIP is a very convenient method of investing in mutual funds through standing instructions to debit your bank account every month, without the hassle of having to write out a cheque each time.

SIP has been gaining popularity among Indian MF investors, as it helps in rupee cost averaging and also in investing in a disciplined manner without worrying about market volatility and timing the market.

In terms of ranking, ICICI Prudential MF with 7 percent rise in AUM maintained the numero uno position for the second consecutive quarter. HDFC Mutual Fund stood at the second position and Reliance MF at the third spot.

The new entrant among the top 10 fund houses was Axis MF with average assets under management touching Rs 63,599 crore.

Below is the comparison of average assets under management on quarterly basis:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.