Krishna KarwaMoneycontrol Research

As India gets ready to face the scorching summer heat, air conditioner (AC) companies are gearing up for the seasonally strong quarters ahead. With disposable incomes rising and government’s push towards pan-India electrification evident, white goods manufacturers have quite a few tailwinds to look forward to.

In this context, the quarterly numbers of Voltas and Blue Star, two of India’s most popular AC companies, beckon attention. Here’s a look at how things panned out for each of them:-

Voltas (market cap: Rs 19, 616.5 crore)

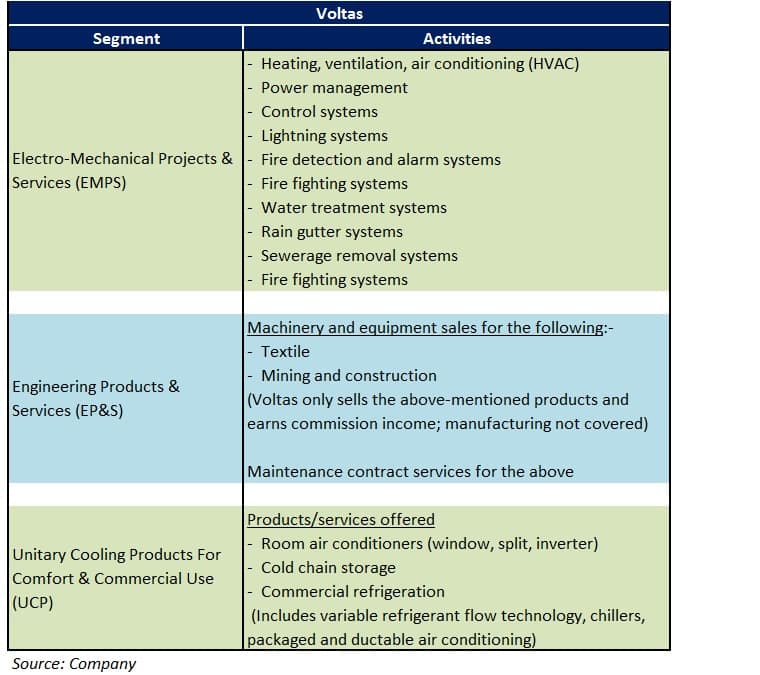

Business Overview

Q3FY18 Review

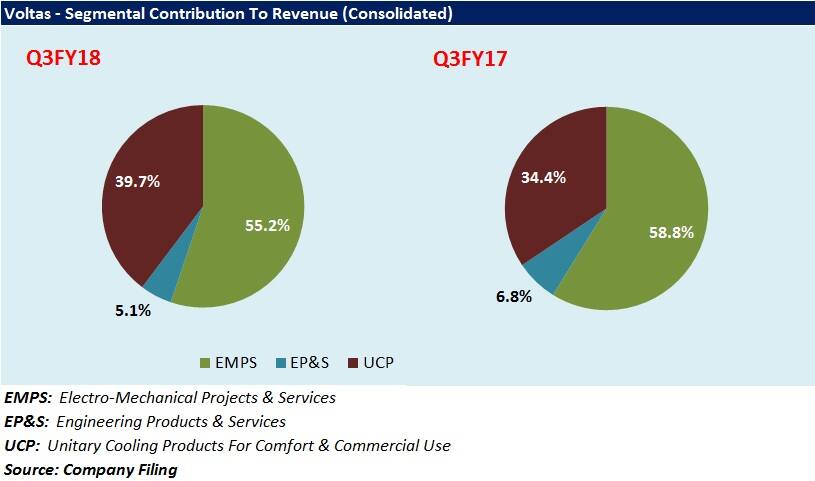

In the ‘UCP’ segment, pre-buying prior to the air conditioner (AC) energy rating change in January 2018, post-GST re-stocking, market share gain, launch of new inverter window AC models, and operating leverage were the factors that led to an improved performance.

The ‘EMPS’ segment’s revenue growth was attributable to faster order executions, whereas the margin uptick was on account of emphasis on profitable projects. The ‘EP&S’ segment’s sales bore the brunt of GST-related transitions and weak demand from the textile sector.

The path ahead?

‘UCP’ segment

Currently, Voltas’ products in the 4 and 5-star AC category are inverter-based, whereas the 3-star category is a mix of inverter and fixed speed ACs. Going forward, the company may consider introducing fixed speed ACs in the 4-star category. Simultaneously, new inverter AC models will be competitively priced.

From a consumer demand perspective, the shift towards inverter ACs is likely to be gradual because of constraints such as lack of reliable power supply in most markets and varied usage pattern (inverters are more economical for 24x7 usage, whereas fixed speed ACs are better suited for occasional use).

‘EMPS’ segment

Voltas will focus more on execution of high-margin projects and expects margins from the segment to remain at steady levels of 5-6 percent. To prevent any dent in profitability, bidding for new projects will be done selectively after duly considering risks associated with delays and commercial closure.

Public sector and externally funded projects will be the core focus areas. Voltas aims to capitalise on the Government’s thrust on electrification projects as well. Moreover, order intake from infra projects such as metros and water treatment is anticipated to increase.

‘EP&S’ segment

In mining, Mozambique-based projects will continue to drive the segment’s performance in the near future. Announcements by the government to increase spending on road infrastructure could augur well for Voltas over the medium-term, particularly in case of sale of crushing and screening equipment.

Blue Star (market cap: Rs 7,147.92 crore)

Business Overview

Q3FY18 Review

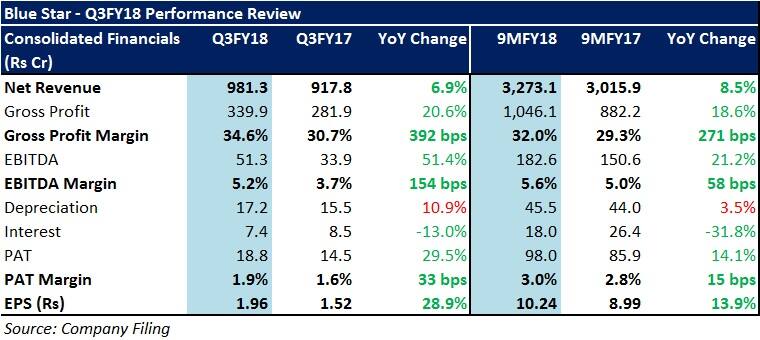

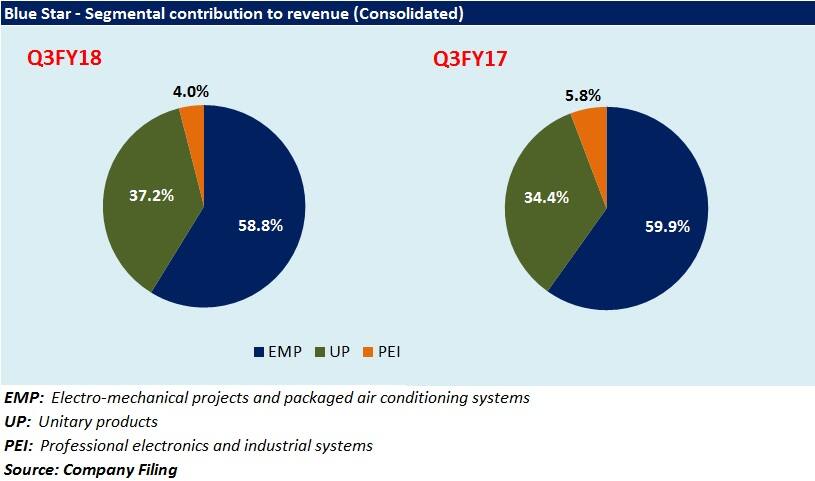

Blue Star’s decent performance was primarily attributable to the ‘UP’ segment (revenues grew due to recovery in demand for cooling products, whereas margins improved due to better product realisations). This led to an overall margin uptick for the company.

The ‘EMP’ segment’s sales were affected due to a slowdown in order executions (low capex from the private sector) and delayed billing (GST disruptions).

Why consider Blue Star?

‘EMP’ segment

Variable Refrigerant Flow, a technology that manages heating/cooling of refrigerators, is of prime importance to Blue Star owing to the company’s leadership position in this domain and an ability to grow at a faster pace than the market.

Trade normalisation post-GST should revive demand for centralised ACs too. A healthy export order book in case of water chillers, in addition to promotional efforts undertaken by Blue Star to enhance international visibility, should facilitate incremental revenue traction going forward.

‘UP’ segment

Blue Star’s ‘UP’ segment has always outperformed the market and aids noticeably in top-line and bottom-line growth. The company, in a bid to bag new orders, will continue to lay impetus on this segment by introducing new product variants from time to time.

On the back of gradual supply channel regularisation, the fast-growing commercial refrigerators (especially in connection with dairy businesses and ice cream parlours) and water purifiers market provides a good platform to Blue Star to derive a higher share of the market.

Should you invest in Voltas or Blue Star?

Voltas

High raw material (copper) prices may impact Voltas’ ‘UCP’s segment margins negatively. The company needs to invest heavily in brand promotion activities, while simultaneously expanding its dealer network, to be better positioned to retain market leadership for inverter ACs.

For Voltas’ ‘EMPS’ segment, a high domestic order backlog (65 percent of the total) is a concern. Bankruptcy of Carillion (a UK-based company operating as a sub-contractor for projects in Dubai/Oman in JV with local entities) in January 2018 may lead to delayed receipt of funds worth Rs 180 crore.

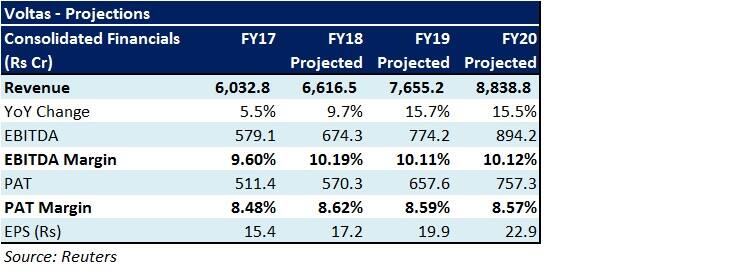

Despite the short-term impediments, at 26x FY20 projected earnings, Voltas’ valuation isn’t too steep. Investors may consider accumulation during the course of the recent market volatility.

Blue Star

Blue Star introduced its range of water purifiers in Q3FY17 in 100 Indian towns through 400 distribution channels and targets leveraging its network of AC products for providing after-sales services. Because of the initial investment in this space, the company’s margins will remain under pressure in the near future.

Though Blue Star’s international business (for water coolers, room air conditioners, VRF, chillers) seems promising, a strong rupee vis-à-vis the dollar and commodity price hardening are some of the factors that could play spoilsport.

A mandatory change in energy efficiency norms for ACs (erstwhile 3-star ACs to be discontinued from January 1, 2018, and 5-star ACs before this date would now be classified as 3-star) led to some inventory clearance in Q3FY18. Therefore, in the first half of Q4FY18, AC sales are expected to be a little subdued.

Uncertainties at the macroeconomic level suggest that capex from private players could remain tepid for a while.

At 27.4x FY20 projected earnings, Blue Star trades at a steep discount to other consumer durable companies. Thus, the stock may be considered from a medium to long-term perspective.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.