Highlights

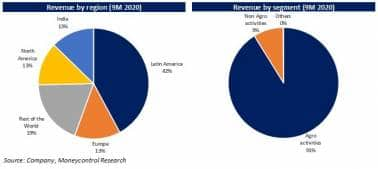

- Healthy performance got a helping hand from Latin America

- Acquisition synergy drives up margins

- Europe a drag after adverse weather conditions

- Trade tension takes sheen off North America

- Indian operations grow on healthy Rabi sowing-Noticeable jump in debt, a point of concern

------------------------------------------------------

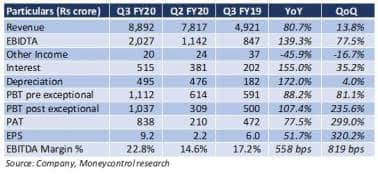

Crop protection solutions provider UPL (CMP: Rs 592; Mcap: Rs 45,277 crore) made headway in the December quarter as it came out with a healthy set of numbers. A significant improvement in both operating and net margins on the back of synergy from the Arysta acquisition marked the quarter.

A decent show in Latin America aided revenue and volume growth, which triggered a stock run-up.

But the rising debt level of the company during the quarter is something to watch out for.

About the company

UPL is a leading producer of agrochemicals, specialty and industrial chemicals. It primarily deals in agricultural products (91 percent of the portfolio), which includes seeds, crop protection (herbicides, insecticides and fungicides), pest control and soil fumigants. The second segment the company deals in is industrial chemicals and specialty products (9 percent).

Financial performance

Key Highlights

The company reported a jump in revenue, buoyed by a 10 percent year-on-year (YoY) rise in volumes. Realisations, however, saw a 1 percent YoY decline. There was a dip in gross margins too due to the geographical mix. Net margin expanded, aided by lower depreciation expense in Arysta and lower fixed costs during the three months to December.

It was last year when UPL completed its acquisition of the US-based Arysta LifeScience (Arysta) from Platform Specialty Products for $4.2 billion.

Adverse weather conditions, coupled with a high channel inventory and softer demand, made the going tough in Europe. In South Europe, however, the company gained some market share in the bio solutions segment.

Trade tensions between the US and China saw a shift in demand South America, because of which North American operations turned lacklustre.

The trade conflict mostly explains why the Lat-Am business gained traction despite drought-like conditions in a few regions. The product portfolio was also synergistic. The company notched up market share in Brazil, too.

On the domestic front, it turned out to be a strong growth driven by a healthy Rabi sowing amid high water level in reservoirs across the country. New product launches and high-margin insecticides added to the momentum.

Even West Africa and certain parts of Southeast Asia did not disappoint. Australia took a hit, give the drought-like conditions and forest fire resulting in depressed demand.

Worryingly, the debt in the books went up during this quarter. It was mainly an outcome of exchange rate fluctuations. The management maintained the guidance for debt reduction, which is a key monitorable.

Other comments

While there have been rising concerns over the spread of the Coronavirus and the impact on agrochemical companies, UPL has indicated that the company is well covered and there would be no major impact. While the actual impact is still not quantified, the outbreak offers an opportunity to its various manufacturing facilities in India, the management said. These units will benefit from the shift of demand from China to India.

The acquisition of Yoloo Bio-technology in China is expected to be completed by the end of March 31, 2020. The catch, however, is it might get delayed in case the epidemic spread worsens.

Outlook

After back-to back weak quarters, the agrochmeical major is now showing signs of recovery despite challenges of a big acquisition and adverse macro and weather conditions.

The management said operations in North America and Europe are on the mend and the Q4 performance should be better in these regions.

Post the Arysta takeover, the company has a better product basket on the back of a larger distribution network and access to more advanced technologies.

We expect the performance to improve owing to the attractive line-up of product portfolio. However, the company has substantial exposure to various geographies, and anomalies related to weather conditions and exchange rates bring uncertainty to the future road map.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!