Ruchi Agrawal

Moneycontrol Research

In a bold move, UPL announced plans for a heavy weight acquisition of agro chemical manufacturer Arysta LifeScience for a whopping USD 4.2 billion which is close to UPL’s own market capitalization. Post the announcement, the shares of UPL have zoomed up 14 percent in the last two trading sessions. The all-cash deal is expected to bring in a substantial amount of debt on UPL’s books though the management indicates that the synergies stand to be EPS accretive for UPL from FY20 onwards.

The Deal

UPL has signed a definitive agreement with Platform Specialty Products Corporation to acquire Arysta LifeScience for USD 4.2 billion (c. Rs 28500 crore). Investor William Ackman’s hedge fund Pershing Square Capital Management owns 14 percent in the Platform Specialty Products Corp, the parent of Arysta LifeScience.

About Arysta

Arysta LifeScience is an agrochemical player with a product portfolio comprising of chemicals to protect crops from weeds, insects and diseases. It was built through the $3.5 billion acquisition of Arysta in 2015, the $1 billion takeover of CAS in 2014 and the $370 million purchase of Agriphar in 2014.

How will the deal be financed?

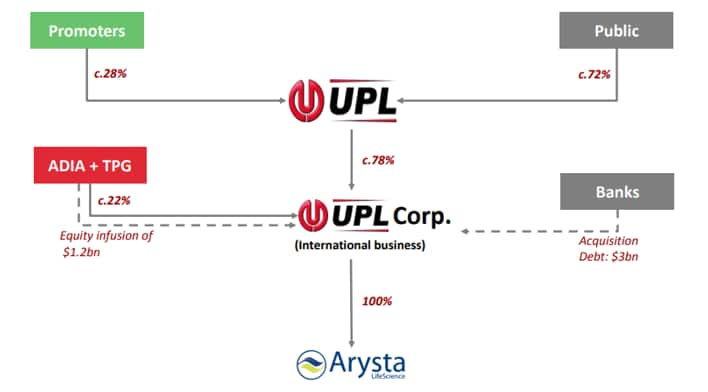

The deal will be financed through a mix of debt and equity with 1.2 billion in equity and 3 billion in debt. UPL Corporation, the international arm of UPL has collaborated with Abu Dhabi Investment Authority and TPG (a global alternative asset firm) who will infuse USD 600 million (c. Rs 4140 crore) each for a 22 percent stake in UPL Corp. The remaining USD 3 billion (c. Rs 20,700 crore) is planned to be financed via debt from Rabo Bank and MUFG Bank.

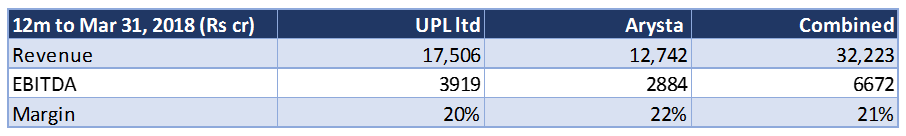

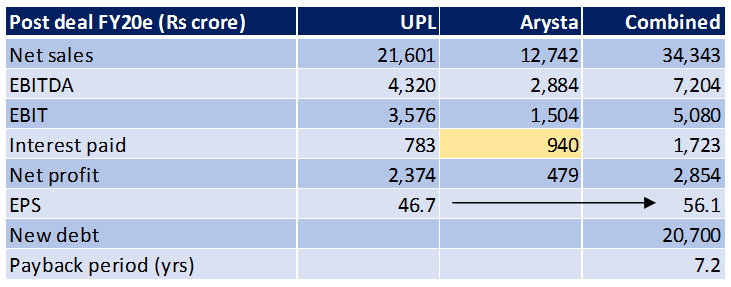

Combined financials

What is in for UPL

Economies of scale

The combined entity would be the fifth largest agrochemical company in the world, which would help in bringing economies of scale in both manufacturing and marketing and according to the management this would facilitate substantial cost savings in the future. The management expects the acquisition to bring in EPS accretion of around Rs 10 – 12 by FY20.

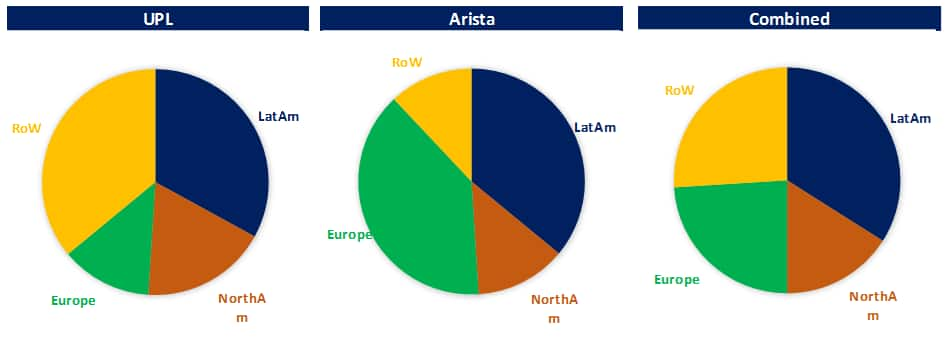

Marketing expertise and complementing geographies

The acquisition brings in benefits of forward integration. Arysta will bring in marketing specialization which would help UPL market its own products globally. Both UPL and Arysta have complementing geographies and with UPLs specialization in manufacturing and Arytas marketing expertise the combined entity would be able to gain market share rapidly across regions and help strengthen its footprint. Moreover, the deal would give UPL greater exposure to Africa, China, Russia and Eastern Europe.

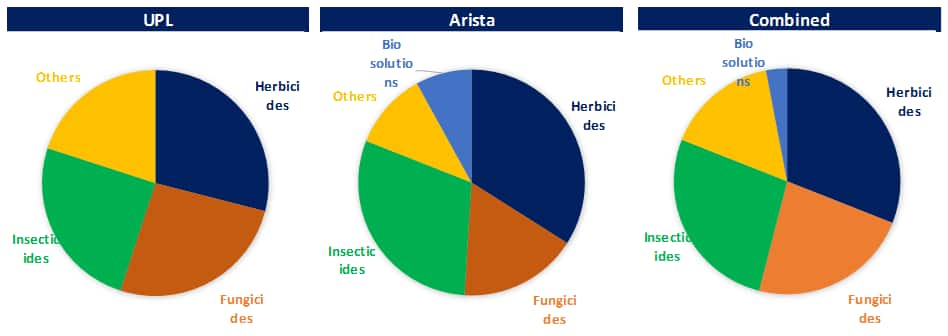

Complementing product Mix

Both companies have a complementary product portfolio. Arysta brings in expertise in specialty molecules where UPL is relatively weak. This would facilitate the combined entity to possess an aggressive product portfolio of more than 13000 product registrations and extensively covering the agrochemical space.

Concern over debt

The acquisition brings in heavy debt and substantially alters the capital structure of UPL. This has been one major concern surrounding the acquisition and also led to the significant correction in the stock in the last few weeks. $3 billion (c. Rs 20700 crore) of debt would enter the books of UPL. This would bring the debt equity ratio to 2.1x from the current 0.4x.

The acquisition introduces $3 billion in debt in the books of UPL. Assuming 4-4.5 percent rate of interest, this debt would spike up the interest cost by almost Rs 800-950 crore. Net Debt to EBITDA would spike up to 3.5x from the current 0.6x. The return on capital employed (ROCE) will be reduced to around 18 percent from the current 22 percent.

Outlook

Though the acquisition alters the capital structure substantially, it also pushes UPL in the global big leagues, the benefits of which would help in improving overall margins for the company in the longer run. We expect some near-term uncertainty and returns might get impacted. However, given the synergies, the deal seems a favourable one in the longer run.

Despite the increase in the interest cost in the future, the deal is EPS accretive in the long run. Our analysis shows that the deal has a long payback and it will take around 7.2 years for UPL to pay back the new debt from the additional EBITDA coming from the deal.

Even with the volatility in the currency market, UPL remains an attractive pick given the steep correction in the stock in the past weeks. Post the uptick in the last two days, the stock is now trading at a 2019e PE of 12.5x and should be kept on the radar of investors.Follow @Ruchiagrawal

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.