Neha Dave

Moneycontrol Research

Highlights:

- Private non-life players continue to gain market share

- State owned insurance companies report muted growth in premiums

- Sector in a sweet spot supported by progressive regulations

-ICICI Lombard General Insurance better positioned in a growing sector

---------------------------------------------------------

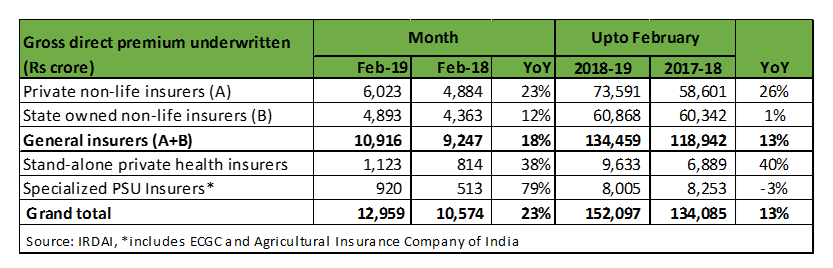

Total gross direct premiums underwritten by non-life insurers (general insurers, standalone private health insurers and specialised state-run insurers) grew a healthy 23 percent year-on-year (YoY) in February, data released by Insurance Regulatory Development Authority of India (IRDAI) on March 18 showed.

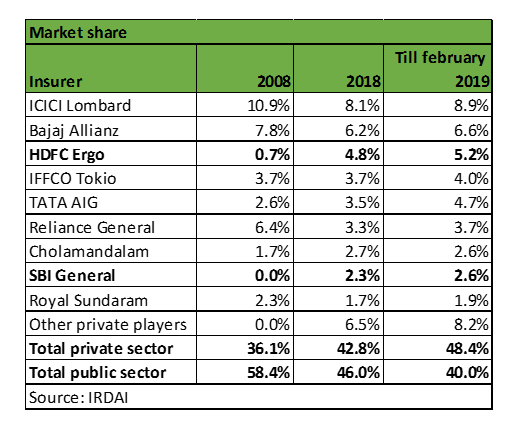

Market share continues to edge up for private insurers

Overall growth in premium was led by private general insurance companies, which reported a 26 percent growth in the current fiscal till February-end. On the other hand, premium growth of four state-owned general insurance companies was almost flat around a percent in the same period. Consequently, private players continue to gain market share, which now stands at around 48 percent as compared to 40 percent for state-owned insurers.

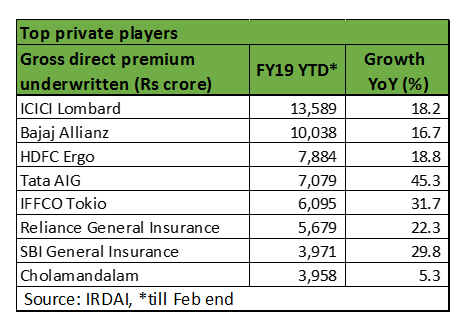

Among private players, HDFC ERGO General Insurance Company and SBI General Insurance Company are the biggest market share gainers over the last 10 years. The only listed non-life insurance company -- ICICI Lombard General Insurance Company -- continued reporting healthy growth.

Immense sectoral opportunities

The Indian general insurance industry saw compounded annual growth rate (CAGR) of 17 percent in gross direct premium income (GDPI) over the last 17 years. There are several growth levers that will drive the high-teen growth for the general insurance industry over the next few years.

India continues to be grossly underpenetrated market with a non-life penetration at one third of the global average in 2017. Insurance density (non-life insurance premium per capita) also remains significantly lower than other developed and emerging market economies.

As of now, motor insurance forms the largest product segment, contributing more than 30 percent of GDPI for the sector. Motor, along with health, contributes nearly three-fourth of gross premiums written in India.

The underlying sub-segments offer multiple opportunities. Higher cost of healthcare and rising incidences of critical illness will likely increase health insurance penetration. Increase in new vehicle sales will be a key growth driver for motor insurance segment. Significant growth in the segment like crop insurance was driven by government initiatives like Pradhan Mantri Fasal Bima Yojana.

Progressive regulations support growth

Regulations too continue to be progressive and supportive of growth in the sector. For instance, following Supreme Court’s order, IRDAI made third party insurance cover for new cars and two-wheelers mandatory for a period of three years and five years, respectively, starting September 1, 2018 as against one year earlier. This was a positive development as it addressed the problem of non-renewal of motor insurance in case of older vehicles. Read: SC third party motor insurance ruling: Here’s how it impacts general insurance companies.

Another example of supportive reform is the passage of the Motor Vehicles (Amendment) Bill, a legislation approved by the Lok Sabha and currently awaiting approval of the Rajya Sabha, is expected to improve long-term profitability of insurers in the motor segment.

ICICI Lombard well placed in the growing sector

ICICI Lombard, the largest private sector non-life insurer, is well poised for earnings growth, with an increase in insurance penetration, focus on profitable segments and improvement in operating efficiency. The stock is up 25 percent in the last one year and has significantly outperformed the Nifty index. At the current market price of Rs 974, the stock is richly valued at 8.7 times its 9M FY19 trailing book value.

Leading companies in the secular growth sector tend to trade at a higher multiples for a long period in time. In the absence of suitable and comparable listed peer, ICICI Lombard trades as a proxy for the sector, commanding a higher valuation. While the premium valuation will sustain, near-term upside in the stock price is limited. Nevertheless, for investors with a long-term horizon and wanting to participate in the growth in non-life insurance sector, the stock is worthy contender.

Follow @nehadave01For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.