Neha Dave

Moneycontrol Research

Highlights:

-A capital market player with its fortune now tied to housing finance business as MOFS has invested close to Rs 850 crore in Aspire

- Capital market businesses saw profit decline in Q3

- Losses in Aspire increased on higher write-offs

- Asset management business slowed down on weakening sentiments in equity market

- Wealth business adversely impacted by regulations

- Valuations not cheap

-------------------------------------------

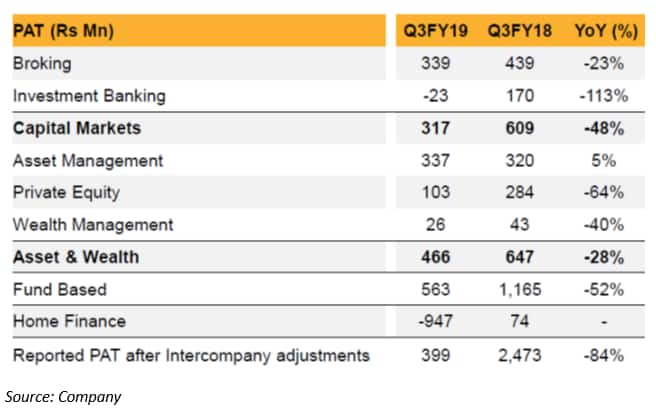

Motilal Oswal Financial Services (MOFS) reported weak Q3 FY19 earnings. Performance was dragged down by its housing finance subsidiary, Aspire Home Finance, which continued to post losses. Muted performance in the capital market as well as fee-based businesses (asset and wealth businesses) further added to the company’s woes. Profit before tax collapsed 95 percent year-on-year (YoY) in Q3.

In an effort to reduce its dependence on the capital market, MOFS had ventured into affordable housing finance through Aspire. The diversification decision is backfiring at present. After having infused Rs 650 crore of capital till September-end, MOFS further infused Rs 200 crore in Aspire in Q3. Despite the capital infusions, Aspire’s near term growth outlook appears bleak. So, what justifies the management’s focus on nurturing a housing finance business?

First, the diversification will help MOFS mitigate cyclicality in capital market-related earnings. Second, given that most of MOFS' businesses are fee-based and have limited requirement of incremental capital, the housing finance business provides an avenue to deploy excess capital for creating long term value.

Lastly, some of its peers have successfully diversified and created a niche in a non-broking business line, thus creating value for shareholders and pushing MOFS to follow a similar path. For instance, both IIFL Holdings and Edelweiss Financial Services have a market capitalisation (m-cap) of around Rs. 15,000 crore each, while that of MOFS is hovering below Rs 10,000 crore.

Its broking and asset management business were the main contributors to MOFS’ Q3 net profit. As such, the diversification in profit streams seem some time away.

Retail broking and distribution aids group profit

- The capital market business of MOFSL, which consists of the broking, retail distribution businesses and investment banking business, witnessed a decline in revenue and profit in Q3

- The broking segment is highly volatile and faces multiple challenges of declining volumes and increasing competition from low-cost brokers

- Retail distribution witnessed strong traction in Q3, taking the assets under management (AUM) to Rs 8,960 crore, a growth of 20 percent YoY

- Investment banking segment reported a loss in Q3 due to slowdown in capital market-related activity

Growth in asset management business slows

The AMC business (mutual fund, portfolio management services and alternative investment fund) saw the growth in assets managed slowing down to seven percent due to a lacklustre equity market with a weakening outlook. Overall AUM stood at Rs 37,400 crore as at December-end.

Wealth management impacted by adverse regulations and high cost incurred for expansion

Though wealth management AUM increased seven percent to Rs 16,400 crore, revenue increased a mere two percent YoY. Revenue growth was adversely impacted by the Securities Exchange Board of India's (SEBI) order to cap total expense ratio as most AMCs followed up with a cut in distributor commissions. At the same time, operating costs increased 17 percent as MOFS continues to hire relationship managers to grow this business. As a result, profit in the wealth business declined 40 percent YoY.

Aspire Home Finance: Asset quality pain continues

Aspire's reported loss increased on significantly high provisions and write- offs of Rs 178 crore in Q3. Asset quality continued to deteriorate with gross non-performing assets (GNPA) increasing to 8.68 percent as at December-end as compared to seven percent in the last quarter.

The management confirmed that most of its legacy problem assets have been written-off. However, we see profitability remaining under pressure in the next 2-3 quarters, with modest loan disbursements, as the lender tries to shore up the provision coverage ratio, which currently stands at 40 percent. We can expect reported numbers to improve meaningfully from FY20 onwards.

Stock upside contingent on improvement in Aspire’s performanceThe moot question is whether MOFS can pull it off from here on? MOFS’ capital market business is inherently volatile, while the asset and wealth business is on a gradual yet steady growth path. While we are encouraged by growing contribution from fee-based businesses (asset and wealth management), the same is also linked to the state of capital markets to a large extent. All eyes are on Aspire’s performance which can make or break MOFS’ fortune. With unfavourable macro factors like tight liquidity, rising competition and no identified niche in affordable housing, we see a daunting task ahead for Aspire.

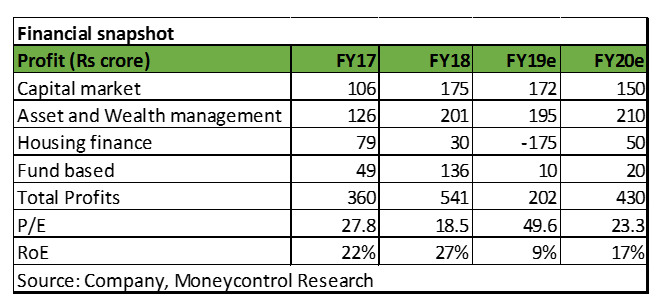

After a dream run till December 2017, the MOFS’ stock has corrected more than 50 percent from its 52- week high price in January 2018. The deterioration in housing finance was the key catalyst for the correction in stock price in addition to market factors. The stock is currently trading at 23 times FY20 estimated earnings. Valuation isn't cheap as earnings have come off.

We don’t see a quick pullback in the stock price until we see an improvement in Aspire’s performance. That said, a big jump in FY20 profit is possible if the capital market businesses doesn’t deteriorate further and Aspire’s performance stabilises. Long term investors with appetite for some volatility can keep the stock on their radar and wait for further correction before taking an investment call.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.