Nitin Agrawal

Moneycontrol Research

Highlights:

- Overall industry witnessed net additions in subscribers

- Reliance Jio added the highest number of customers in the month among all players

- Vodafone-Idea has lost customers for eight months on a trot

--------------------------------------------------

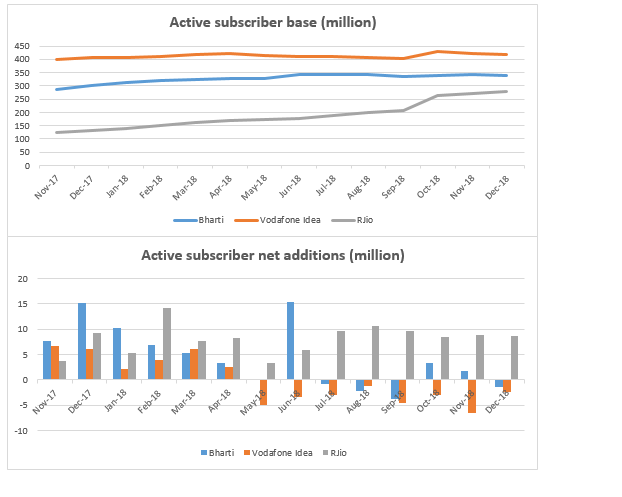

As per latest subscriber addition numbers reported by the Telecom Regulatory Authority of India (TRAI), Reliance Jio continues to trouble other key players. Jio continues to add subscribers on the back of aggressive pricing while others struggle to add and maintain their market share.

What does the latest TRAI data suggests?

TRAI recently published subscriber data for December 2018. Overall, the industry continues to grow and witnessed an addition of 4.5 million new customers, taking its total subscriber base to 1.176 billion.

Jio – reducing the gap with leaders

Jio continues to maintain its momentum and added 8.6 million subscribers in December, the highest number of subscribers added in the month among all. Jio currently has an active subscriber base of 280 million. On the back of its competitive pricing strategy, it continues to gain market share and is reducing the gap with incumbents. Its market share reached 23.8 percent in December, up from 23.2 percent last month.

Bharti Airtel – lost again!

Bharti Airtel reversed the trend of last two months and lost 1.5 million subscribers, taking its subscriber base to 340 million as at December-end. Further, it saw a 23 basis points (100 bps=1 percentage point) loss in market share month-on-month at 28.9 percent.

Vodafone–Idea: Struggle continues

The company that is struggling the most is Vodafone-Idea, which has been continuously losing market share. It has seen its subscriber base fall by 29 million over the last eight months and market share shrink by 656 bps. The company lost 2.3 million customers in December 2018, taking its subscriber base to 419 million at the end of the month.

What to expect going forward?

We see no signs of rising average revenue per user (ARPUs) as Jio continues to aggressively add customers on the back of its Jio Phone and post-paid customers. As Jio has not been slashing tariffs further, we expect stability in ARPUs going forward. But the competition is not expected to ebb in the near term and hence we advise investors to tread cautiously in the sector.

For more research articles, visit our Moneycontrol Research page

Disclaimer:

Reliance Industries is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments

Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.