Madhuchanda Dey Moneycontrol Research

Kotak Mahindra Bank headline numbers for the June quarter were lower than analyst expectations, but the core numbers were strong. The bank is gaining market share at the expense of public sector banks, many of which have regulatory restrictions on lending. In the post-earnings analyst call, KMB said pricing power was slowly returning to lenders. At a group level, the conglomerate continues to benefit from the strong performance of its subsidiaries.

KMB is cautious on the small and medium enterprises, but expects credit growth to be between 20 and 30 percent. It has stepped up its provision cover although asset quality remains pristine. The stock has already been rewarded for its impeccable execution and so could move in a narrow range for a while. At a valuation of 4 times FY20 book, chances of the stock being re-rated in the near future are slim. Still, investors should look at the stock as a core holding in their portfolios for the stable double digit earnings growth and value unlocking opportunities from its non-banking businesses.

Group profitability – driven by capital market businesses & asset management

An analysis of the numbers for the June quarter reveals that the 17 percent growth in the group’s profits was contributed not only by the bank but also the subsidiaries. Kotak Mahindra Capital, Kotak AMC and the international subsidiaries reported a strong performance.

KMB: Sharp rise in bond yield takes away the sheen

KMB’s performance was steady though the headline profitability was impacted by higher mark to market (MTM) provisions on the bond portfolio. As bond yields hardened during the quarter, the bank chose to make the entire provision at one go, rather than spreading it over four quarters as allowed by the RBI.

This provision shaved Rs 200 crore from the pre-tax profits. Out of the total provision of Rs 470 crore in the quarter, Rs 210 crore is for investment depreciation.

The post-tax profit growth of 12.3 percent was supported by 15 percent growth in net interest income (difference between interest income and interest expenditure). While advances grew at a healthy clip of 24 percent, interest margin moderated by 20 basis points YoY (year on year) to 4.3 percent.

Non-interest income grew 28.5 percent. The management mentioned that over 70 percent fees come from the retail business. The cost to income ratio moderated to 45.76 percent.

Asset quality – still no stress

Asset quality showed no signs of stress with the percentage of gross and net NPA declining sequentially and SMA2 (special mention accounts) of Rs 189 crore still insignificant at 0.11 percent. As a prudent measure, the bank has stepped up its provisioning on the asset book. Consequently, the provision cover (the total provision on gross NPA) has improved to 61 percent.

Growth – making a come back

KMB is an extremely well-capitalised entity (Capital Adequacy Ratio of 18.3 percent) and it is steadily but carefully pushing the growth pedal – the risk-adjusted growth strategy in the bank’s parlance.

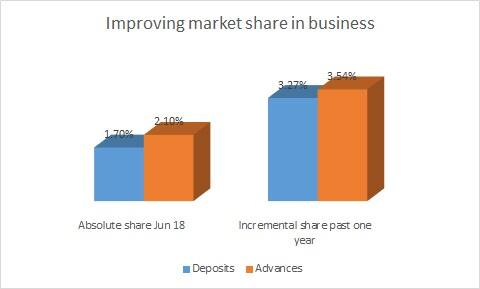

With PSU banks, especially the ones on the RBI’s prompt corrective action (PCA) watch list out of the market, KMB has improved its market share. KMB's absolute share in deposits and advances stood at 1.7 percent and 2.1 percent in June 18, but share of incremental deposits and advances in the system stood at 3.3 percent and 3.5 percent respectively, indicative of smart gains in market share.

Source: Company, RBI

The bank is seeing early signs of pricing power coming back which should have a positive impact on its interest margin, going forward. It is planning to enter new high yielding business like consumer durable financing as well.

The red flags that ought to be taken note of

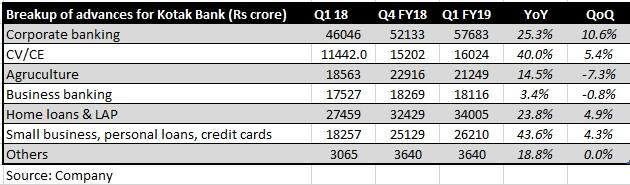

While advances have grown 24 percent YoY, the bank is growing the book carefully, considering risks emanating from several pockets. For instance, KMB is going extremely slow on its business banking – primarily the SME segment. According to the management, most SMEs have been impacted due to external factors like GST, demonetisation and are experiencing funding issues as they were mostly borrowing from PSU banks. To compound matters, they have very low equity in the business and therefore, their ability to absorb shock is limited.

Uday Kotak also warned the entire banking system about the valuation of collaterals that is held by banks as security. KMB’s experience suggests that only a fraction of the value that is certified by external valuers can actually be realised. While this does raise red flag on secured lending in the banking sector in general, KMB in particular may not get impacted as it has a decent provision cover and is stepping up its internal technical valuation capability.

Strong liability franchise

In a hyper competitive retail lending landscape, KMB is able to compete thanks to the robust liability profile it is steadily building. The ratio of low-cost deposits at the end of the quarter stood at 50.3 percent.

In the quarter gone by, while overall deposits grew 16 percent, savings account and CASA (current and savings accounts) grew by 51 percent and 33 percent respectively. While KMB’s average cost of CASA is about 200 bps higher than competition at 5.6 percent and it has an additional annual cost of Rs 1,600 crore, the CASA nevertheless gives it a competitive edge in a retail environment where the lending yields are better. Thanks to its 811 initiative (digital banking) the bank is on track to double its customer base to 16 million by September.

Supportive subsidiaries

Life Insurance Business reported New Business Premium growth of 25 percent, Kotak Securities had 8.3 percent market share in the cash segment, Kotak Mahindra Capital had a strong quarter and Kotak Mutual Fund’s market share in equity AUM rose to 3.76 percent.

Overall, the Kotak Group’s assets under management rose 31 percent YoY to Rs 1,99,193 crore.

We believe that going forward as these non-banking businesses assume higher share of consolidated profitability (bank contributed 65 percent in Q1FY19) investors may see valuation upside emanating from the consolidated business.

In the near term, the stock might consolidate after the recent outperformance, especially if some of the corporate lenders witness asset quality pains abating. However, for a high quality business like KMB, any consolidation is an opportunity for long-term investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!