Nitin Agrawal

Moneycontrol Research

Amid weakness in the overall market due to multiple macroeconomic challenges, many fundamentally strong companies have become available at attractive valuations. In this note, we analyse three companies (Lumax Industries, Fiem Industries and Varroc Engineering) in the auto component segment, which are into automotive lighting and have strong fundamentals and are available at reasonable valuations.

In terms of latest quarterly performance, these companies posted good revenue growth on the back of strong demand from original equipment manufacturers (OEMs); however, margins were impacted due to sharp rise in raw material (RM) prices.

Market leadership, marquee clients, focus on developing technologically- advanced products and the adoption of LED-based products provide improved earnings visibility for these companies and therefore, merit investors’ attention.

Quarter in a snapshot

Lumax Industries

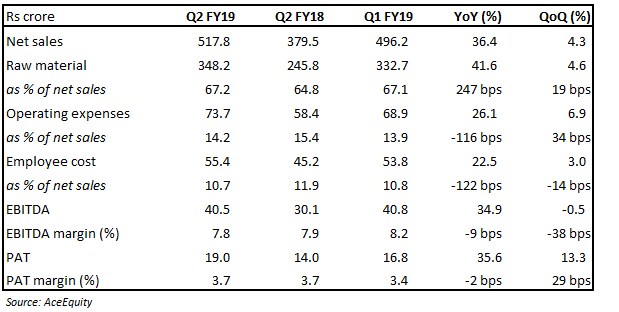

In the quarter gone by, net revenue from operations grew 36.4 percent year-on-year (YoY) on the back of strong volume and value growth driven by higher adoption of LED products. LED sales now contribute around 35 percent of the total sales, up from 8 percent in FY17.

In the quarter gone by, net revenue from operations grew 36.4 percent year-on-year (YoY) on the back of strong volume and value growth driven by higher adoption of LED products. LED sales now contribute around 35 percent of the total sales, up from 8 percent in FY17.

On the profitability front, the company posted 34.9 percent YoY growth in earnings before interest, tax, depreciation and amortisation (EBITDA) whereas margin remained largely flat. Margins, however, were down 38 bps on quarter-on-quarter (QoQ) basis. This is primarily due to the higher import of raw material (RM) for its LED products.

Fiem Industries

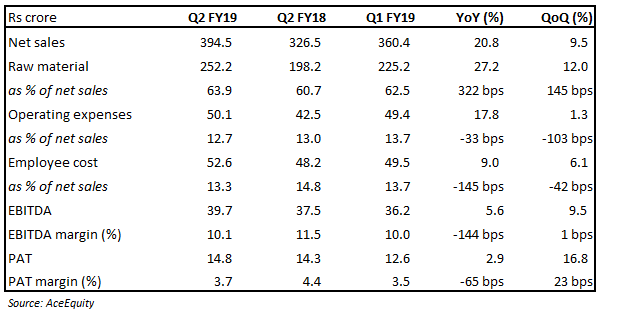

Riding well on the growth coming in from 2W segment, the company posted a strong year-on-year (YoY) growth in sales of 20.8 percent driven by 19.8 percent YoY growth in the automotive segment. This was driven by strong volume growth from key clients HMSI, TVS and Yamaha. Interestingly, LED luminaries business clocked revenue of Rs 6.9 crore and grew 1.4 times as compared to same quarter last year.

Riding well on the growth coming in from 2W segment, the company posted a strong year-on-year (YoY) growth in sales of 20.8 percent driven by 19.8 percent YoY growth in the automotive segment. This was driven by strong volume growth from key clients HMSI, TVS and Yamaha. Interestingly, LED luminaries business clocked revenue of Rs 6.9 crore and grew 1.4 times as compared to same quarter last year.

The company posted a YoY contraction of 144 bps in its earnings before interest, tax, depreciation and amortisation (EBITDA) margin primarily due to a significant rise in raw material prices. This got partially offset by the operating leverage and cost reduction efforts undertaken by the company. It reported a profit after tax (PAT) of Rs 14.8 crore, up 2.9 percent (YoY).

Varroc Engineering

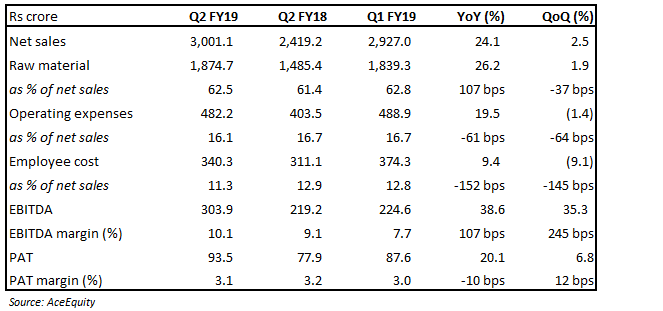

Net sales grew 24.1 percent YoY. Growth was 26.5 percent on a like-for-like basis, excluding the impact of Ind AS 115, the Interior Plastics Business in North America (phased out during FY18) and excise duty. On a like-for-like basis, the growth was fuelled by 27.4 percent YoY growth in Indian business and 24.1 percent in global lighting business (VLS) and 47.4 percent in other geographies.

Net sales grew 24.1 percent YoY. Growth was 26.5 percent on a like-for-like basis, excluding the impact of Ind AS 115, the Interior Plastics Business in North America (phased out during FY18) and excise duty. On a like-for-like basis, the growth was fuelled by 27.4 percent YoY growth in Indian business and 24.1 percent in global lighting business (VLS) and 47.4 percent in other geographies.

On a like-for-like basis, EBITDA margin contracted 30 basis points (bps) in the quarter as compared to the same quarter last year. The contraction came due to 130 bps contraction in VLS business due to the additional costs of rapid volume ramp-up which got partly offset by 40 bps expansion in Indian business.

What factors are working in favour of these companies?

Robust client base

All of these companies have partnered with marquee clients in the space they cater to, indicating their strong footing in the market and the acceptance of their products by the clients.

Lumax has Maruti as the largest client with 34 percent revenue share followed by Honda Motorcycle and Scooter India (HMSI) and Honda Motors (HML) with 14 percent and 11 percent share, respectively. The top 5 customers generate around 72 percent of the total revenues.

FIEM also boasts of having marquee clients in its kitty and services almost 90 percent of OEMs (original equipment manufacturers) in India. It has TVS and HMSI as its top customers generating around 70 percent of total revenues.

Varroc, on the other hand, has a very strong footing in global markets and caters to Ford, JLR, Volkswagen, Renault-Nissan, Chrysler, Peugeot and an EV (electric vehicle) major Tesla. In the Indian market, its clientele includes Bajaj Auto, Honda 2Ws (HMSI), Hero MotoCorp, Royal Enfield (RE), Yamaha and M&M.

Strong focus on research and development

All companies in the segment flourish on the back of superior product quality and new product innovation and hence focus on technology is of utmost importance for any business in the space.

Lumax has a strong financial and technical collaboration with Stanley Electric Company (Stanley), Japan, which is a world leader in vehicle lighting and illumination products for automobiles. Apart from that, the company also has in-house research and development facilities and design studio that help it in working on innovative products.

FIEM also has strong in-house research and development (R&D) centre and has become India’s First NABL Accredited Lab for Testing of Automotive Lamps. Through the strong focus on R&D, the company was the first to supply LED-based lamps for a two-wheeler model.

Varroc has its own dedicated R&D centres in India, Czech Republic, China, the USA, Mexico, Germany, Italy, Romania and Poland, which houses 1,414 engineers focusing on the development of new products, designing, prototyping, and product upgrades. Its R&D efforts have resulted in having 185 patents in its kitty, globally.

LED – key growth driver

Faster and wider adoption of LEDs continues to augur well for the companies in the space both in India and across the globe. LEDs are high value and high margin products for these automotive lighting companies. LED penetration in India is still very low (15-20 percent) and hence there is a huge potential for the companies both in terms of sales growth and margin expansion, going forward.

BSVI and EV adoption – upcoming opportunities

Bharat Stage (BS) VI norms are to be implemented by 2020 and would require the vehicles to be more energy efficient, which is expected to lead to faster adoption of LEDs. The management expects huge growth from this in the coming year.

Additionally, the company’s products are unaffected by the upcoming electric vehicle (EV) disruption. In fact, EV adoption would lead to increased adoption of LED products as EVs require products to be energy efficient.

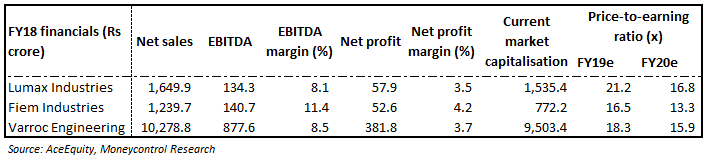

ValuationThe recent correction in share prices due to overall weakness in midcap stocks and demand concern is giving a good opportunity to consider these companies for investment. Lumax, Fiem and Varroc are currently trading at valuations of 16.8, 13.3 and 15.9 times FY20 projected earnings. We advise investors to consider these businesses with an eye on the long term.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!