Jitendra Kumar Gupta

Moneycontrol Research

Few infrastructure companies survived the downturn in the sector between 2009 and 2016. Among the survivors, H G Infra Engineering has grown its topline at 30.8% annually to Rs 1000 crore in the last three years (FY14-17) and is now coming out with a public issues to raise Rs 300 crore (fresh Issue).

Huge toplines are not surprising in the infrastructure space, given the high volume-low margin nature of the business.

Harendra Singh, Chairman and Managing Director, H G Infra Engineering said his company has followed a disciplined approach to growth.

“Having seen the difficult market conditions very early, we have been conservative," said Singh, adding that HG Infra has stuck to its core business, kept a hawk eye on balance sheet and has not chased topline growth at the cost of profitability.

The company in the past stayed away from the build-own-transfer (BOT) assets, and thus escaped the problems that come with the need for huge debt to own BOT assets.

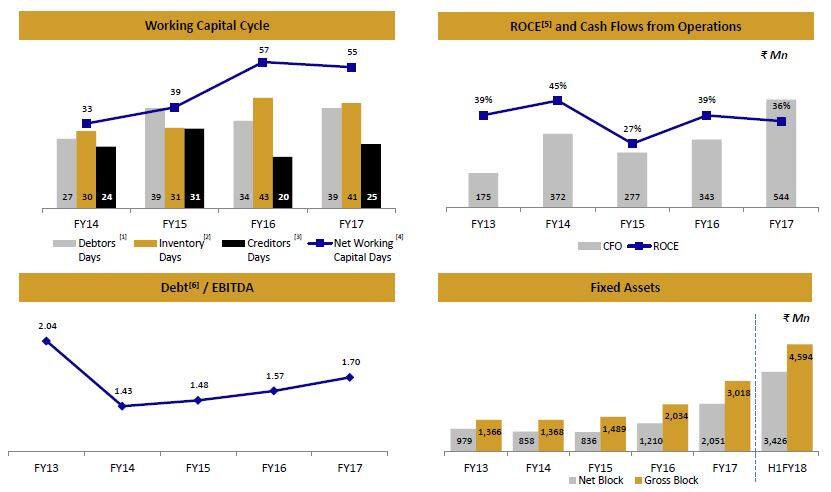

In the engineering, procurement and construction (EPC) business, the key to profits is keeping the cost of equipment hiring low. Since inception, HG Infra has been building its own stock of equipment. This has helped it reduce costs and at the same time have better control on execution. Almost 50% of its capital is deployed in fixed assets, comprising mainly of equipment, without putting pressure on the balance sheet. A direct benefit of this is lower working capital requirement. It is working capital at 35 days is much lower than the industry average of about 100 days. One healthy sign of this has been that historically its debt financing has been less than equity and profits (before interest) are roughly three times more than its interest cost.

Moving the value chain

Moreover, the company is now leveraging these advantages of cost and execution capabilities to build scale. Starting as a sub-contractor, HG Infra has gradually built technical and financial muscles to qualify for the projects as main contractor. Today it is qualified to bid for a single EPC order of about Rs 925 crore, which will further improve with the infusion of IPO money (Rs 300 crore), to about Rs 1200 crore next year. In addition, the company will be qualified for a single hybrid annuity model (HAM) project worth Rs 1300 crore. The company has a pending order book of close to Rs 3700 crore or 3.5 times its FY17 revenues.

Outlook and valuation

In the first half of the current financial year, the company made a profit of Rs 29.3 crore. Adjusting for the IPO money (interest income) and building marginal 10% growth on the annualised profit, we arrived at a net profit of close to Rs 65 crore this year. This on an adjusted market capitalisation (net of cash) gives us a price to earnings ratio of 22 times its FY18 earnings. This is quite attractive considering the earnings growth visibility largely backed by strong order book and structural opportunities in the sector. Moreover one should also factor in the management’s conservative approach and prudent capital allocation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!