We had initiated coverage on GNA Axles, which is a niche player in the auto-component segment with strong brand, long term relationship with clients, and strong financials. The company posted a very strong set of numbers for the quarter-ended June, primarily on the back of strong industry opportunities. However, operating margin was marred by a significant rise in raw material (RM) cost.

We continue to like the business on the back of its leadership position in domestic market, significant presence in leading economies and plans to enter in the sports utility vehicle (SUV) and light commercial vehicle (LCV) axle shaft business. This, coupled with positive industry outlook and reasonable valuations, make the company worthy of investor attention.

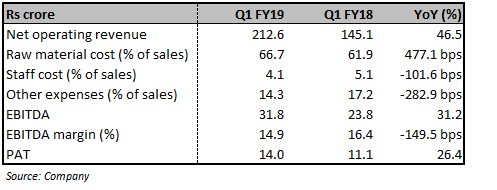

Quarter in a snapshot  The company posted a very strong year-on-year (YoY) growth of 46.5 percent in net operating sales (less of excise). Earnings before interest, tax, depreciation and amortisation (EBITDA) witnessed 31.2 percent YoY growth. EBITDA margin, however, was marred by significant rise in RM prices and contracted 149.5 basis points on the back of 477 bps rise in RM prices as a percentage of net sales. Rise in RM prices was partially offset by the company’s efforts to reduce other expenses and staff cost as a percentage of net sales. Profit after tax (PAT) witnessed 26.4 percent growth, lower than EBITDA growth due to higher depreciation recorded by the company.

The company posted a very strong year-on-year (YoY) growth of 46.5 percent in net operating sales (less of excise). Earnings before interest, tax, depreciation and amortisation (EBITDA) witnessed 31.2 percent YoY growth. EBITDA margin, however, was marred by significant rise in RM prices and contracted 149.5 basis points on the back of 477 bps rise in RM prices as a percentage of net sales. Rise in RM prices was partially offset by the company’s efforts to reduce other expenses and staff cost as a percentage of net sales. Profit after tax (PAT) witnessed 26.4 percent growth, lower than EBITDA growth due to higher depreciation recorded by the company.

The management attributes the strong performance to overall market conditions including normal monsoon and government’s push towards infrastructure, which led to higher demand for tractors and CVs.

Points to look out for in future:Foray into SUV and LCV segments The management said it is foraying into SUV and LCV axle shaft business. The company is already in the process of setting up a manufacturing facility with a capacity of 600,000 units a year, which may be increased depending upon market conditions. The company is targeting clients from North America, Europe and India in that order. This could be an Rs 100 crore opportunity for the company.

Capacity expansion GNA has earmarked Rs 90-100 crore for capacity expansion from 3 million units to 4 million units in the next two years. This additional capacity will strengthen its topline.

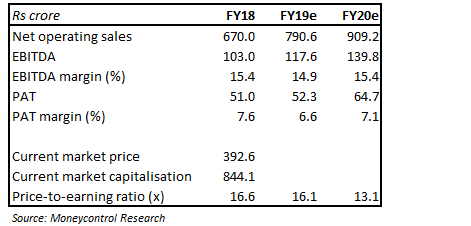

Strong guidance The management has guided to a topline growth of over 20 percent in FY19. It indicated that EBIDA margin will remain stable in the 14.5-15 percent range going forward.

Strong outlook On the global front, there is a significant pick-up in demand for heavy trucks compared to last year on the back of stronger freight growth in the US. This has been propelling growth for the company. Continued renewal and fleet expansion along with a strong freight environment is supporting truck demand in Europe. Additionally, the management is targeting other geographies like Australia and South America which would help de-risk the business from a significant dependence on North America and Europe.

On the domestic front, with many of the regulatory headwinds behind, volume pick-up in M&HCV is continuing, riding on the positive impact of GST rollout and the government’s increased focus on infrastructure spending. Apart from the medium and heavy CV segment, healthy growth in domestic tractor sales on the back of normal monsoon and improved rural sentiments, have also improved the company’s domestic business.

The management said there would not be significant impact of a change in axle norms on demand.

Valuations The company is currently trading at 16.1 and 13.1 times FY19 and FY20 projected earnings, which is very reasonable.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.