Jitendra Kumar GuptaMoneycontrol Research

Adani Ports & SEZ built a dominant position in port logistics at a time when others were exiting the business.

It acquired Dhamra and Kattupalli ports in the past and recently signed an MoU to take over a container terminal in Myanmar. Additionally, it completed acquisition of innovative B2B Logistics in August. Its total asset base has increased to $8.1 billion by 2018-19, from $1.4 billion in 2008-09, nearly 6-fold jump.

Today, it has the largest commercial port in India with one under-construction and nine operational ports at key locations. While its investment phase is now over, the company is reaping the benefits of these assets as the utilisation improves.

Performing well in difficult times

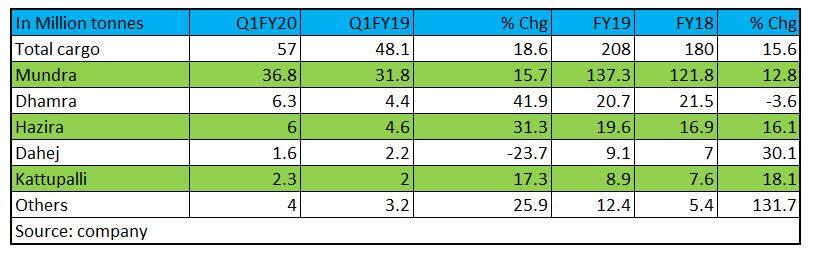

During the June 2019 quarter, the company reported 19 percent growth in cargo volumes as against the industry growth of 8 percent. What is more, its all-India market share has improved by 100 basis points to 22 percent. Its growing scale, presence in strategic locations and the right mix of cargo are now yielding huge dividends.

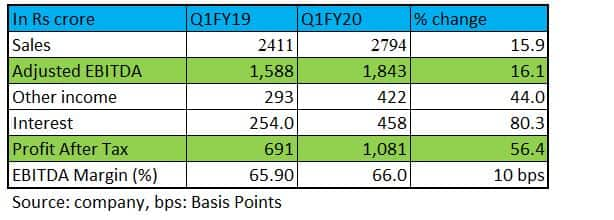

In the June quarter, its major ports such as Mundra port notched up a strong 16 percent year-on-year (YoY) growth followed by 20 percent (Hazira), 16 percent (Kattupalli) and 43 percent (Dhamra port). Among cargoes, coal volumes grew 38 percent annually whereas the figure for other bulk cargoes stood at 33 percent. This resulted in an overall 16 percent YoY growth in consolidated revenues. The company maintained its EBITDA margin at 66 percent because of which consolidated operating profit too went up 16 percent.

Good revenue visibility

In light of the slowdown, the company has conservatively guided a cargo volume growth of 10 percent for 2019-20. However, despite lower volume growth in the core business, it is expected to do well because of the higher contribution from other segments.

The SEZ business has seen some traction. This year, the SEZ business is expected to fetch a revenue in the region of Rs 900-1,000 crore as against Rs 770 crore in FY19. Besides, with the acquisition of B2B Logistics, its logistics business now stands to gain at 33 rakes, up from 22. The company has also placed an order for 12 new rakes which will be available by February 2020.

The logistics business, which recorded an annual revenue of Rs 580 crore, is expected to expand at a fast pace with an expected figure of Rs 800 crore in FY20 and Rs 1,000 crore by FY21-end. Overall, these business initiatives are now adding to the overall growth in the core port business, providing strong revenue visibility.

Valuation: Attractively priced

Even in poor market conditions, Adani Ports continues to trade near its all-time high because of the strong growth in earnings and cash flows. In terms of valuations, at the current market price of Rs 376 a share, the stock is trading at 14 times its FY21 estimated earnings, which is quite attractive considering good earnings visibility, dominant position in the port logistics space, continuous improvement in the return ratios and strong cash flows.

For more research articles, visit our Moneycontrol Research Page.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.