At one point, Mehul Choksi and his nephew Nirav Modi, were regular faces in the gem and jewellery industry’s annual events in Mumbai’s five star hotels. The duo commanded a leadership position in the industry. Banks queued up to lend to Choksi's Gitanjali group, merely trusting his personal guarantees.

All that changed with the Rs 14,000 crore Punjab National Bank (PNB) scam in February 2018. Choksi's role came to light; by then the billionaire businessman had flown to safer pastures -- just weeks before the PNB scam was reported on February 15. Choksi boarded his flight on January 7, 2018 to Antigua.

Was Choksi tipped off about the lenders’ move?

“He was highly connected. So, there is every reason to believe that he got some tip and flew away,” said C H Venkatachalam, general secretary of All India Bank Employees Association (AIBEA).

A charge sheet by the Enforcement Directorate (ED) named Choksi as a person who ran an organised racket to cheat customers and lenders across India, Dubai and US. Though the scam was reported by the bank in February, internal enquiries and investigations had begun much before, which would have alerted the Choksi-Modi duo, said another banker.

Choksi claims he flew out of the country for medical reasons while investigators claim he left to avoid arrest. The businessman used his deep-pockets to buy citizenship in November 2017 under the island nation's Citizenship by Investment programme. He hasn’t returned since then. “Apparently he had been planning for such contingencies for years. At the first whiff of trouble he scooted,” said the banker quoted above.

He declined to be named.

A Diamond King

Choksi family built the Gitanjali empire from mid-60s, but the business got a corporate makeover by Mehul Choksi. A commerce graduate, Choksi was instrumental in launching and establishing various successful jewellery brands of the group in India’s unorganised diamond and jewellery industry. As Chairman and MD, Choksi drew an annual compensation of Rs 1.1 crore, according to Gitanjali Gems FY17 annual report.

In its 2016-17 annual report, the group called itself the largest integrated branded jewellery manufactuer-retailer in the world with annual turnover of $2.5 billion, spread to brands like Gili, Nakshatra, Asmi, Sangini, Nizam and Parineeta. But, the expansion into different brands and aggressive online marketing didn’t help the company’s fortunes.

Its finances were turning into bad shape.

For the quarter ended March, 2017, Gitanjali Gems reported a net loss of Rs 15.40 crore as against net loss of Rs 3.26 crore during the previous quarter ended March 2016. “Early in the year, we faced some challenges in terms of falling diamond prices and a strengthening Rupee," Choksi said in the FY17 report. "There was also some upheaval in sections of the market due to certain regulatory and policy changes specially introduction of excise duty and demonetization,” Choksi said.

In the fourth quarter of 2017-18, Gitanjali became an NPA to banks. A loan becomes NPA if there is no repayment of principal or interest for a period of 90 days.

Gitanjali Gems' total outstanding balance of working capital borrowing from consortium of bankers including IFCI Ltd as at March 31, 2017 amounted to Rs 4,993.96 crore, for which among other collaterals, Choksi had given his personal guarantee.

In the FY17 annual report, Gitanjali said in the month of May/June 2013, there have been changes in RBI Policy relating to issuance of BG/LC for purchase of gold. Due to this restriction, there has been sudden and severe impact on cash flow which started in May 2013 and continued to affect cash flows during 2016-17. During the year, there were delays in servicing the interest on working capital borrowing and repayment of principal amounts. As at March 31, 2017, the facilities are overdrawn by Rs 31.15 crore mainly on account of non-servicing of interest, the firm said.

But, according to people familiar with the company, trouble was brewing for the group as early as 2012-13 due to financial loss and mounting debt and corporate governance issues, recalled a senior banker who didn’t want to be named. In July 2013, the National Stock Exchange (NSE), following a decision from Securities and exchange Board of India (Sebi), barred Choksi and 26 other entities from trading in the market for a period of six months, or till the investigations were over, whichever was earlier. Ban was revoked in October 2013, after three-month of deactivation.

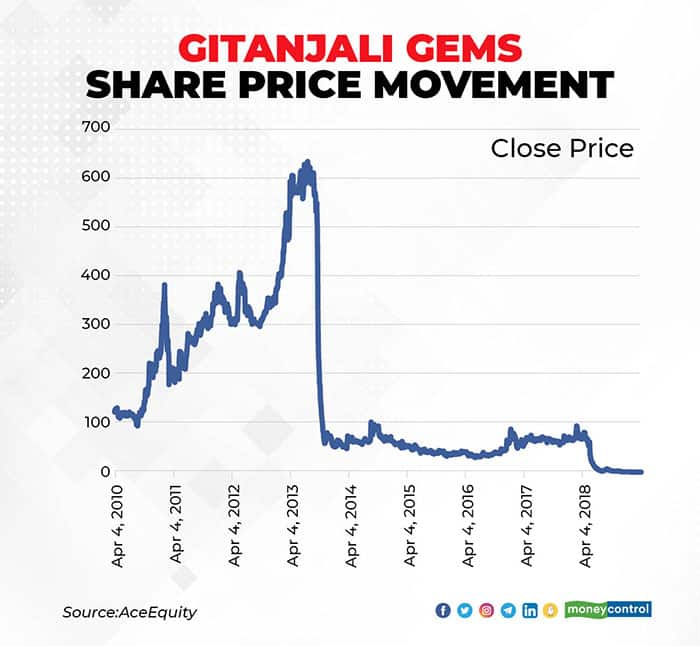

In 2013, the share price saw a roller-coaster ride. From a peak price of Rs 631.30 per piece on April 22, 2013, the share price fell to Rs 0.97 per share on December 17, 2018. After the PNB scam came to light in 2018, in just eight sessions, investor wealth plummeted by over Rs 436 crore. From September 10, 2018, the stock exchanges suspended Gitanjali Gems shares for non-compliance of listing norms.

As per the latest shareholding available on BSE, Mehul Choksi has 23 percent stake in Gitanjali Gems as of December, 2017, while other promoter group companies Partha Gems, Priyanka Gems, Rohan Diamonds and Mozart together hold less than five percent stake. Interestingly, that was the period when the time another firm, Winsome Diamonds owned by Jatin Mehta too became an NPA to banks.

Ill-gotten money

But, towards 2015-16, things appeared to change in Gitanjali dramatically, recalled another banker asking not to be named. The company yet again started making big expansion plans including doubling the number of its retail stores in India and overseas from 5,000 to 10,000 in a two-year period. According to FY17 annual report, consolidated revenues increased from Rs 1,415,9.20 crore in 2015-16 to Rs 1,683,1.43 crore in 2016-17. The company cited the increase in revenues to global demand.

Was this improvement based on the ill-gotten wealth in the PNB scam? “I presume this turn around was linked to the kind of frauds conducted by the Choksi and Modi in PNB,” said the banker. "Many companies which were the recipients of Gitanjali existed only on paper or were his own firms. These entities disappeared once the consignment was received at the destination," said the banker.

Based on the complaint by PNB, Choksi was part of the scam which involved issuing fake LoUs in the favour of Nirav Modi and others causing losses to the bank. The ED subsequently said Choksi was also involved in money laundering to overseas accounts. Choksi has been booked under charges including the Prevention of Money Laundering Act, cheating, criminal conspiracy of the Indian Penal Code and the Prevention of Corruption Act.

Choksi has, all along, denied his role in PNB scam.

In September, 2018, Choksi released a video from Antigua saying all the charges against him by the Enforcement Directorate (ED) are false and baseless. "All the allegations levelled by the ED are false and baseless. They have attached my properties illegally without there being any bases of same," Choksi said.

Choksi is tagged as a wilful defaulter by his lenders. A wilful defaulter is someone who wouldn’t pay back to his lenders even if he has the ability to do so. No other bank will lend to a person declared as a wilful defaulter.

The Caribbean Drama

Choksi was in Antigua since 2018. On May 23, the fugitive was found missing from his Antigua Home. According to a Police statement, Choksi was found leaving in a car at around 5.15 pm. The car was recovered later but the man was missing. Two days later, Choksi was arrested in the small Caribbean island nation, Dominica.

While Antigua has requested Dominica to deport Choksi directly to India, Dominica on May 27 issued a statement indicating that Choksi will be extradited to Antigua. " Indian government should take urgent measures to bring him here and put him on fast track trial for this huge financial fraud,” said Venkatachalam of AIBEA.

With the latest turn of events, a quick extradition of Choksi to India looks extremely difficult unless the Indian government steps up pressure. Choksi has an army of top lawyers, deep pockets and is well connected in the Caribbean. There may be a long battle ahead for India before Choksi is brought back.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.