As per the new guidelines, a multi-cap scheme has to invest a minimum of 75 percent of its corpus in equity, compared to 65 percent earlier. Further, a minimum investment of 25 percent each in large, mid and small-cap categories has been mandated.

To simplify it further, the large-cap allocation can range from a minimum of 25 percent to a maximum of 50 percent. All multi-cap schemes have to comply with these revisions by February 2021.

SEBI also clarified that apart from re-balancing portfolios, MFs can alternatively facilitate a switch to other schemes for unit-holders, or merge the Multi-cap scheme with a Large-cap scheme or convert it to another scheme category.

If MFs adopt these approaches, the need to incrementally buy mid and small caps would be lowered significantly than the amounts stated above. But, there would be some amount of money which will chase small & midcaps.

The money will move to small & midcap stocks, and especially those which have strong fundamentals, and have enough liquidity as some money of mutual funds will start moving from large-caps space to small & midcaps.

Data suggests that Multi-cap schemes of mutual funds have an AUM of Rs 1.47 trillion as of August 2020 with large, mid, and small caps accounting for 74%, 16% and 6%, respectively.

ICICI Securities in a report highlighted 15 small & midcaps that are likely to benefit the most from the SEBI move. These are Akzo Nobel, Balkrishna Industries, Aavas financiers, Prince Pipes, Westlife, JK Cement, Galaxy surfactants, MCX, Dixon, Techno Electric, Zee Entertainment, Natco Pharma, Mishra Dhatu Nigam, VRL Logistics and Sumitomo Chemicals.

The adjustment is likely to result in buying of small & midcap stocks in the near future to bridge the gap, suggest experts. Although mutual funds are exploring various other options to comply with the norms. One such option could be the re-classification of existing multi-cap schemes under another category.

“The new rules set by SEBI will entail multi-cap funds to increase their holdings in mid and small caps by 9% (Rs127bn) and 18% (Rs270bn) while reducing their large-cap allocation by 24% (Rs355bn) over the next 5 months,” ICICI Securities said in a report.

“Short squeeze in small/micro caps likely given the higher quantum of buying expected and relatively lower supply. The situation in our view, however, remains an evolving one, as mutual funds might explore options to reduce the actual impact,” it said.

As per our analysis using end-August holdings, ICICI Securities is of the view that the change entails buying of Rs127 bn and 270 bn in mid- and small-caps each, which amounts to 0.9% and 2.9% of their free float market cap. To match the above, multi-cap funds will have to sell large-cap holdings worth Rs 355bn (0.6% of free float mcap), it said.

The new guidelines will result in forced buying into smaller names. Experts are of the view that the selling impact on large-cap will be minimal, but the buying impact in small-cap stocks is quite significant.

“The volume distribution is 60% in large-cap stocks, 30% in mid-cap stocks, and only 10% in small-cap stocks. This creates a big anomaly in the system & can create a frenzy if necessary supply is not available. We have seen liquidity based frenzy in the past. They can be quite sharp and bring significant move just on the back of the scarcity premium,” Elara Capital said in a report.

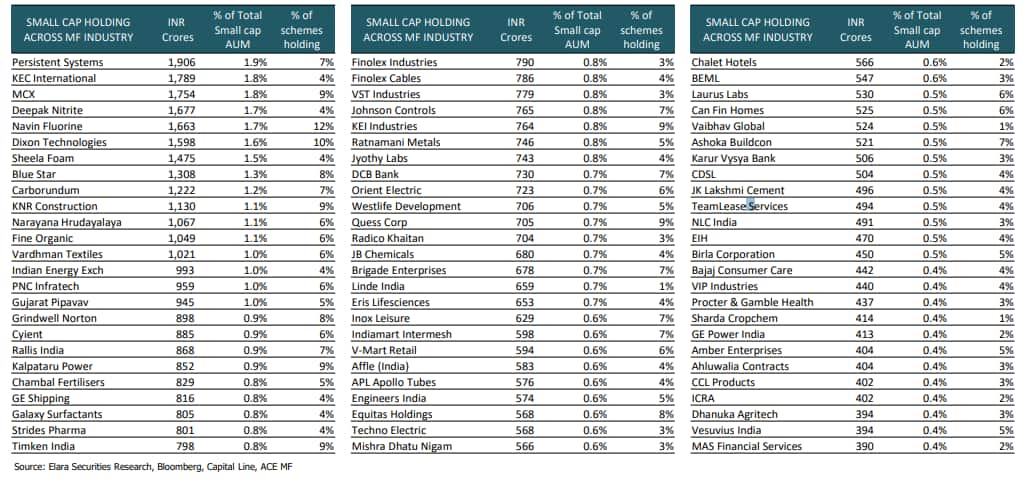

“The MF industry as a whole (equity + hybrid schemes ex of ETFs) own about 220 small-cap names. The median holding in each stock is just INR 2.5bn (median of top 110 stocks at INR 5.2 bn & bottom 110 stocks at just INR 0.8 bn),” added the report.

The report further added that on the basis of the above calculation, we could see the demand of INR 100-150 bn in small-cap stocks which could roughly translate into buying in 40-60 small-cap names.

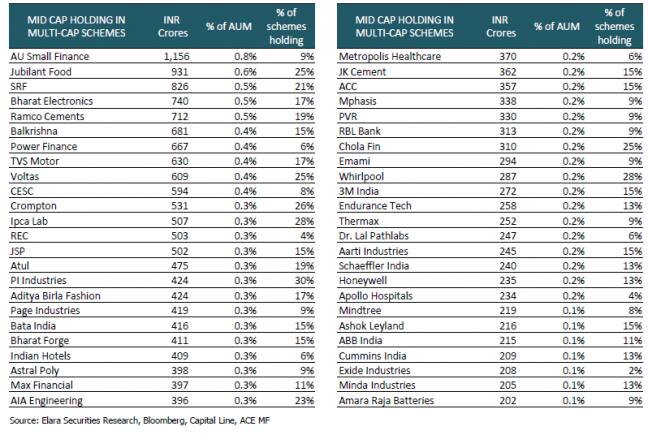

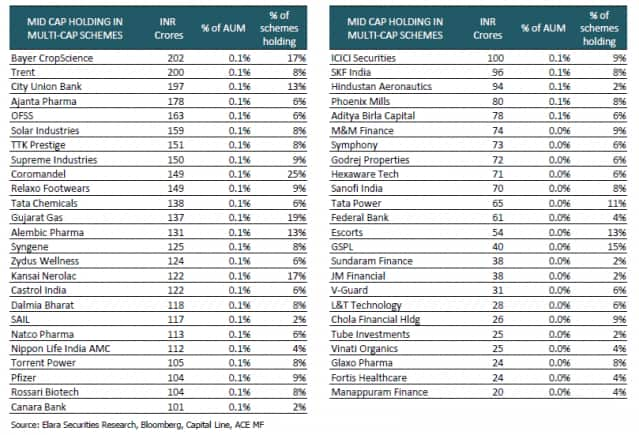

Elara Capital highlights nearly 100 Mid-cap names that could see some buying. The table gives the existing mid-cap holdings in multi-cap schemes where some buying can be seen over the next few months to adhere to the new allocation. A total of Rs 12,777 crores worth buying is supposed to happen in mid-cap stocks.

There are a total of 100 mid-cap stocks currently in multi-cap schemes indicating buying of Rs 128 crores in each stock. The higher number of schemes holding the stock would mean impact could be higher as it could be broad-based buying.

In terms of small-caps. A total of Rs 28,500 crores worth buying is to happen in small-cap stocks. As of now, the current median small-cap holding is Rs 250 crore in each stock. Hence the impact here seems meaningful, as per Elara Capital report.

Top Picks from Emkay:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!