With exit polls predicting a comfortable win for the BJP-led NDA coalition, markets are likely to see sharp moves on Monday. Still, the verdict is not a given, and traders will need to position themselves for any unexpected development.

Akshay Bhagwat, Vice President of Derivative Research at JM Financial, shares his strategies on how to position trades on election result day, considering various scenarios: What if BJP-NDA fails to form a government, wins 280-320 seats, wins 320-360 seats, or wins more than 400 seats.

Trading Plan by Bhagwat

Scenario 1: If BJP-NDA Gets More Than 400 Seats (Moderate Probability)

Bhagwat's View:

Nifty could rally 4-5 percent as this would be much higher than market expectations. However, with a sharp fall in implied volatility (expected to drop to 11-12 percent), the out-of-the-money calls will not perform at the same rate as the rise in the index. Therefore, we recommend avoiding deep OTM call buys as premiums have swelled significantly ahead of the election outcome. We advise a ratio call backspread to enjoy unlimited profits with a fixed risk setup."

Strategy 1: Call Ratio Backspread (27 Jun Expiry)

Sell 1 lot 22400 CE at Rs 680-715

Buy 2 lots 22600 CE at Rs 575-600

Outflow: Approx. 450 points

Profit: Unlimited

Risk: Limited to the outflow

Scenario 2: If BJP-NDA Gets Around 320-360 Seats (High Probability)

Bhagwat's View:

Moderately positive with a 2-3% upside. IV cool-off may cause significant premium decay, so we recommend deploying a market-neutral Iron Condor strategy for the 13 Jun expiry.

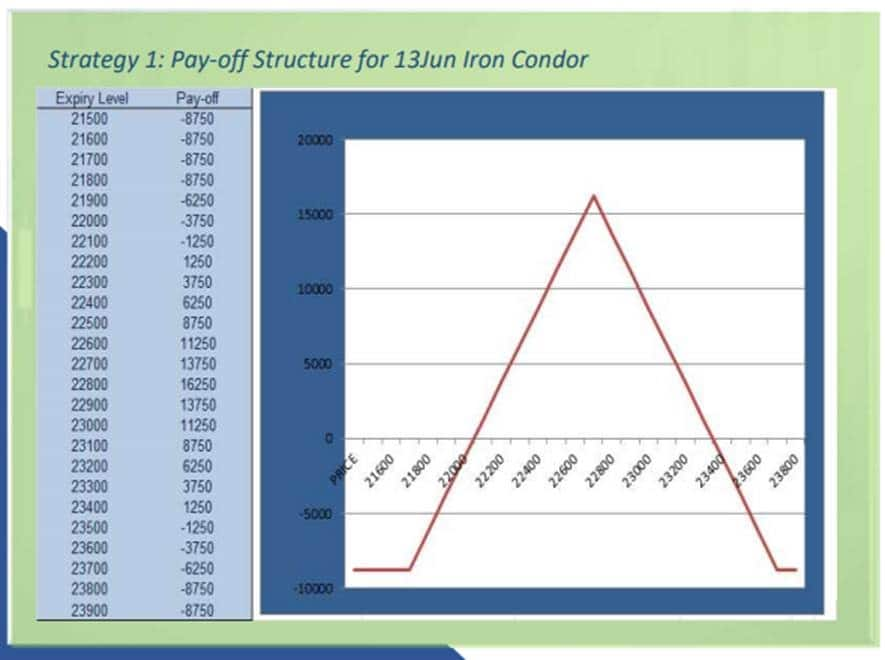

Strategy: Iron Condor (13 Jun Weekly Expiry)

Sell 22800 Straddle CE at Rs 350-370 and PE at Rs 550-570) (Combined Premium of 900-940)

Buy 23800 CE at Rs 80-90

Buy 21800 PE at Rs 180-190 (Combined Premium of 260-280)

Max Profit: In the range of 22150-23450 - 630-640 points

Max Fixed Loss: 350-360 points

Scenario 3: If BJP-NDA Gets Around 280-320 Seats (Low Probability)

Bhagwat's View:

Expect a knee-jerk downside reaction with a fall of 3-4%. We recommend a hedging strategy. However, as the cost of buying puts as insurance is high and implied volatility fall may depreciate premiums, we advise selling a deep OTM call while buying a deep OTM put to reduce hedging costs.

Hedging Strategy: Collar Strategy (Strictly Against Portfolio)

For Nifty 27 Jun Expiry:

Sell 24000 CE at Rs 120-150 (Almost 6 percent away from CMP)

Buy 21500 PE at Rs 170-200

Profits: Unlimited

Risk: Above 24000, where losses in call sell will be mostly offset by gains in the portfolio

Scenario 4: If BJP-NDA Fails to Form Government (Very Low Probability)

Bhagwat's View:

Expect a sharp crash with a vertical slide of 8-10 percent. The best strategy would be to buy naked vanilla puts.

Strategy: Buy Naked Vanilla Puts (6 Jun Expiry)

Buy 21500 Strike at Rs 125

This would see a significant spike in premium gains if this event unfold

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.