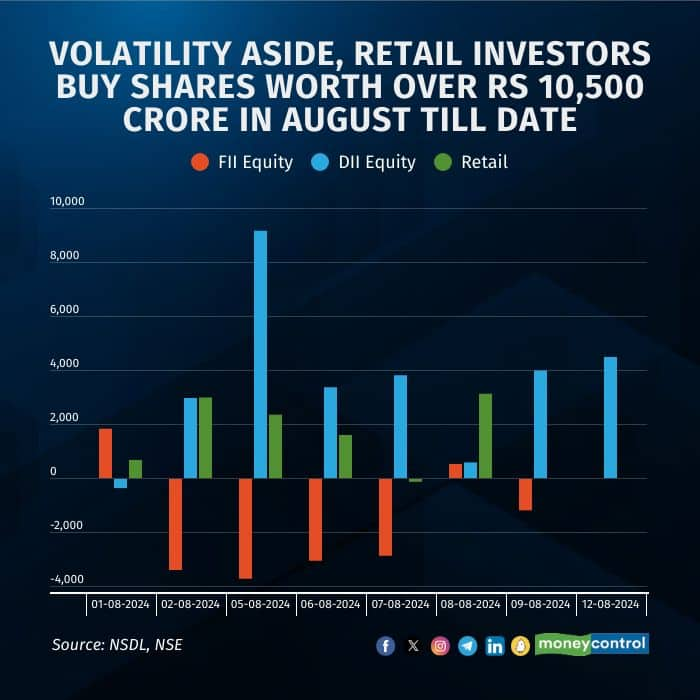

Despite extreme market volatility, retail investors have remained active, purchasing shares worth over Rs 10,600 crore so far this month.

Interestingly, the volume of retail buying is nearly equivalent to the selling activity of foreign portfolio investors (FPIs), who have offloaded approximately Rs 11,740 crore in Indian equities in August.

Data from the NSE indicates that retail investors have been net buyers in every trading session this month, except for one day, August 7, when they were net sellers by just over Rs 100 crore. In contrast, FPIs have been net buyers on only two days—August 1 and 8—while being net sellers on all other trading days, according to NSDL data.

Additionally, domestic institutional investors have also made significant purchases, acquiring shares worth around Rs 27,977 crore this month, as per provisional data from the NSE.

Prashanth Tapse, Senior Vice President and Research Analyst at Mehta Equities said it is very clear that Indian retail investors are the reason for the market to stand up on every dip. He attributes this trend to a combination of factors including India's large and young population, rising middle class, urbanisation, changing consumption patterns and favourable financial inclusion towards investment that are proving to be a growth engine for the capital markets.

Data from primeinfobase shows that FPIs' share in NSE-listed companies dropped to a 12-year low of 17.38 percent by the end of June, down from 17.72 percent in March. Retail investors' share increased to 7.64 percent from 7.52 percent a quarter ago while domestic institutional investors' share hit record high to 16.23 percent from 16.07 percent last quarter.

Tapse expects the trend to continue going forward as the July mutual fund data also showed that more than Rs 23,000 crore came in through the SIP route. He expects this to touch Rs 25,000 per month, which means a cumulative Rs 3 lakh crore every year which is the highest ever in the Indian capital market.

Analysts, however, also suggest that investors should be cautious moving forward, considering several key factors. The heavy selling by FPIs indicates underlying global uncertainties, including potential interest rate hikes and geopolitical tensions, which could continue to impact market sentiment and contribute to volatility.

Global markets are currently seeing significant volatility due to weak US economic data and recession fears, exacerbated by the Bank of Japan's hawkish stance. Concerns over a rapid economic slowdown and the Fed's decision to hold interest rates steady rattled investors, driving them away from riskier assets.

Japan's market was particularly affected by the unwinding of the yen carry trade, leading to a sharp 20-yen drop in the dollar-yen pair between July 3 and August 5, triggered by Japan's intervention and a Bank of Japan rate hike. However, markets have since rallied after the Bank of Japan reassured investors it wouldn't raise rates during financial instability, and U.S. jobless claims data eased slowdown concerns.

India's benchmark indices, Sensex and Nifty, have recovered about 1.2% since the August 5 drop, while BSE MidCap and BSE SmallCap indices gained around 3% each. However, from August 1 to date, both flagship indices are down 2.5%, with broader markets declining 3% each.

Nirav R Karkera, Head - Research, Fisdom said the recent rally in certain stocks has been driven more by price-to-earnings re-ratings than by actual earnings growth, suggesting that valuations may be outpacing fundamentals. As a result, investors should focus on companies with strong, sustainable earnings growth and be mindful of the potential for further market corrections.

So far in 2024, retail investors have purchased shares over Rs 1 lakh crore, while domestic investors have bought about Rs 2.85 lakh crore in Indian equities. In comparison, foreign investors have invested around Rs18,860 crore.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.