The Federal Reserve has decided to temporarily halt its unprecedented series of interest rate hikes, allowing more time for the impact to fully permeate the economy, it announced overnight in the FOMC meeting. However, it indicated that there is a strong possibility of implementing further rate increases later this year. The unanimous vote to forgo raising rates during this gathering conveyed the consensus among the members of the Federal Reserve.

Following the pause, the dollar index strengthened for the first time in three days as hawkish comments from the US fed prompted traders to mull prospects of further US interest rate hikes.

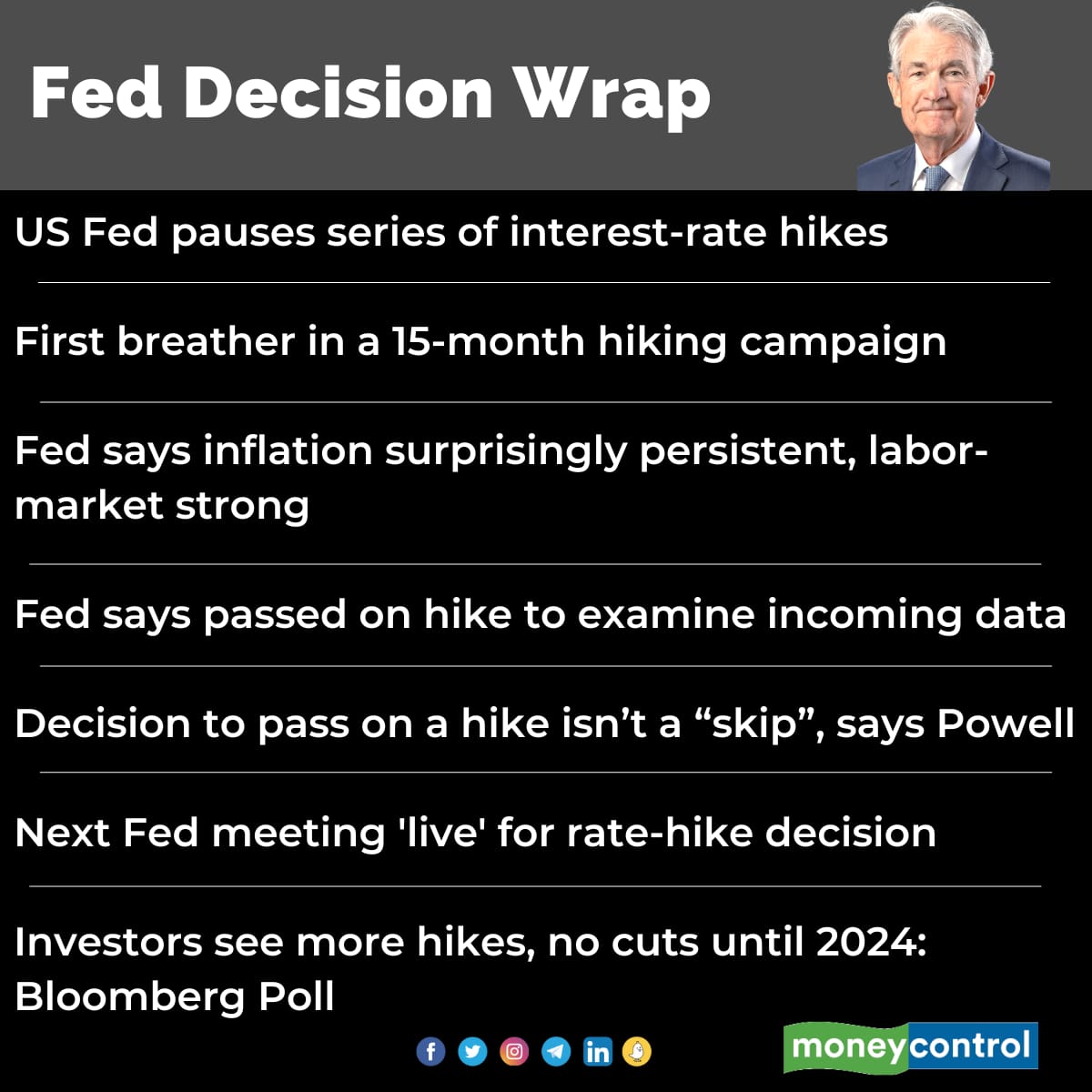

US Federal Reserve Decision Wrap

US Federal Reserve Decision Wrap

Key takeaways from the FOMC June meeting:

-- FOMC members unanimously decided to maintain the interest rate at 5.15% from June 15, 2023. They want to assess the impact of previous rate hikes on inflation and the economy.

-- The decision to keep the benchmark rate at its highest level in 16 years indicates the Fed's belief that their efforts to increase borrowing rates have made progress in controlling inflation.

-- Chairman Powell stated that most Fed officials anticipate further rate increases this year.

-- Future policy decisions will be influenced by upcoming economic indicators, particularly a robust job market. The steady growth in payrolls and wage increases contribute to inflationary pressures. These factors will play a significant role in shaping future policy moves in the weeks and months ahead.

-- While the Federal Reserve believes that further policy action is required to effectively curb inflation, Powell expressed optimism regarding a potential cooling of inflation. He pointed to the slowdown in shelter costs, which constitute over 40% of the core measure of the Consumer Price Index. Powell's optimism stems from the expectation that these factors will contribute to a decrease in inflationary pressures.

Changes to Fed Projections:

a) Core PCE inflation increased by 30 basis points to 3.9%.

b) GDP was revised from 0.4% to 1.0%.

c) Unemployment rate was lowered from 4.5% to 4.1%.

Market expectations

Analysts expect that a further rate hike is unlikely unless commodity prices, including crude oil, move up significantly. "We believe this is more or less the end of the increasing rate cycle by the US and future market movements globally will be determined by economic growth, corporate earnings, and financial stability in the developed world," said Nishit Master, Portfolio Manager, Axis Securities PMS.

Meanwhile, Bloomberg poll expect the US Federal Reserve to keep raising interest rates, with most not anticipating cuts to begin until well into 2024.

According to a survey conducted among 223 respondents, most investors (70%) echoed the above sentiment. The ongoing rate-hiking campaign, which began in March 2022 due to pandemic-induced inflation, is believed by most participants to be incomplete. However, 30% of respondents believe that rates have reached their peak.

When asked about the timing of rate reductions, approximately 56% of respondents stated that they anticipate rate cuts to occur in the second quarter of 2024 or later. Around 35% predicted a decrease in the first quarter of 2023, and one respondent expected a rate cut in the fourth quarter of 2023.

This survey, conducted among Bloomberg terminal users, took place shortly after the Federal Open Market Committee decided to maintain the benchmark US rate within the range of 5% to 5.25% after ten consecutive increases.

Anticipating a pause and hawkish stance from the Federal Reserve, attention in the Asian trading session shifts to China. The People's Bank of China's (PBOC) decision to reduce its medium-term lending facility rate opens the door for banks to lower their lending rates in the following week.

This action by the PBOC is part of a larger stimulus strategy aimed at bolstering the real estate sector and domestic demand. It precedes the release of retail sales and industrial output data, which are expected to indicate a further slowdown in China's fragile recovery.

(Reuters & Bloomberg contributed this story)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.