Domestic indices witnessed significant volatility in Wednesday's trading session as investors awaited the August US consumer inflation report, which will influence the scale of an anticipated interest rate cut by the Federal Reserve next week.

The benchmark indices closed weaker, with the Sensex falling 398 points, or 0.49 percent, to 81,523.16, and the Nifty dropping 122.65 points, or 0.49 percent, to 24,918.45. A total of 1,619 stocks advanced, while 2,345 declined, and 106 remained unchanged.

According to experts, on the daily charts, Nifty has rebounded from the support zone between 24,800 and 24,850. The divergence in the daily and hourly momentum indicators points to near-term consolidation. Price and momentum indicators suggest the market is likely to consolidate within the 24,800 to 25,200 range.

Here are 15 data points to help you spot profitable trades:

Key Levels for Nifty 50:

Support based on pivot points: 24915, 24789.1 and 24555.4

Resistance based on pivot points: 25148.8, 25256.5 and 25490.2

Special Formation: On daily charts Nifty has formed small bearish candle on intraday charts. It has formed lower top formation which suggests temporary weakness.

Key Levels for Bank Nifty:

Resistance based on pivot points: 51439.45, 51606.6 and 52014.35

Support based on pivot points:51031.7 50791.1 and 50383.35

Special Formation: The daily Bollinger Bands are contracting, signalling uncertainty or indecision in the market. In the short term, Nifty Bank may remain range-bound within 50,650 as support and 51,380 followed by 51,500 as resistance.

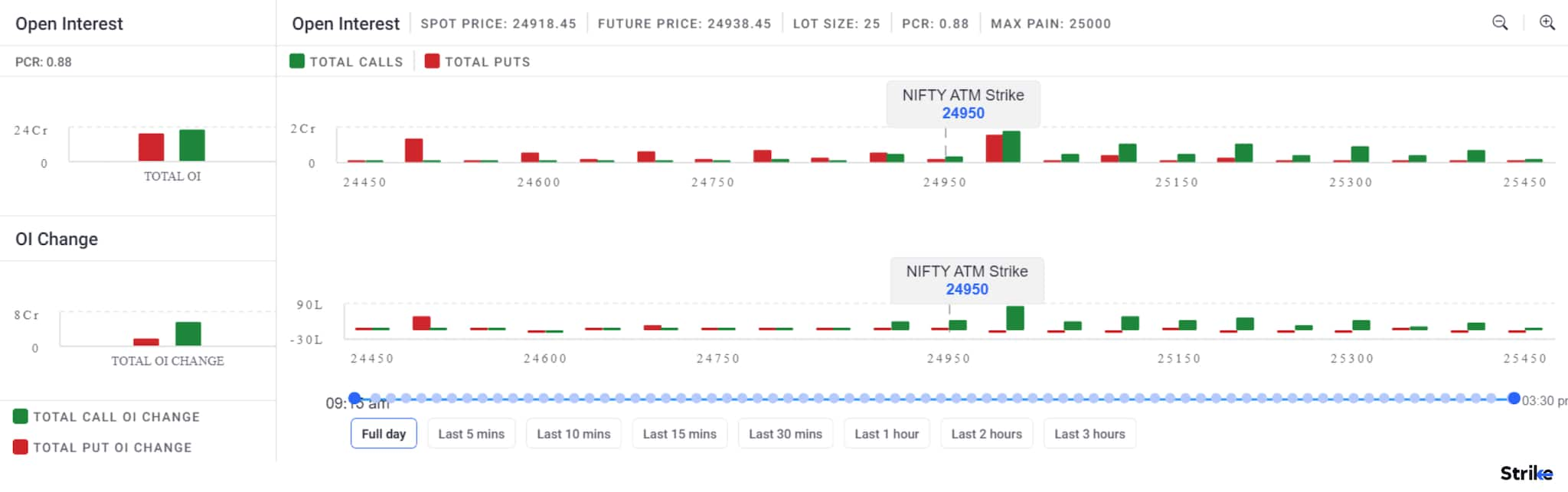

Nifty Call Options Data:

According to weekly options data, the 25,000 strike (with 2.22 crore call and 1.97 crore put combined open interest) had the maximum call and put open interest, forming a key straddle position in the short term.

Heavy call writing was observed at the 25,100 strike (1.33 crore combined open interest), acting as a key resistance level.

Nifty Put Options Data:

On the put side, the maximum open interest was at the 25,000 strike (with 1.97 crore combined open interest), providing key support for the Nifty. Followed by 24,500 strike, with 1.73 crore combined open interest.

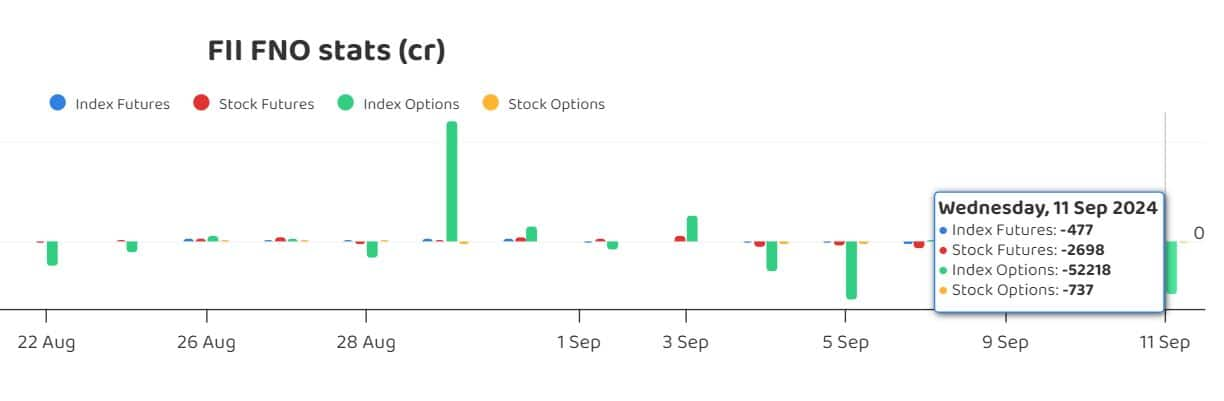

FII Funds Flow (Rs crore):

Put-Call Ratio (PCR): The Nifty's PCR shifts to 0.88 from 1.07 in the previous session. A PCR above 0.7 or approaching 1 generally indicates bullish sentiment, while a ratio below 0.7 or moving towards 0.5 signals a bearish trend.

Put-Call Ratio (PCR): The Nifty's PCR shifts to 0.88 from 1.07 in the previous session. A PCR above 0.7 or approaching 1 generally indicates bullish sentiment, while a ratio below 0.7 or moving towards 0.5 signals a bearish trend.

Nifty Max Pain Point: The Nifty's max pain point continues to stay at the 25,000 strike price, indicating the level where option sellers are likely to experience the least loss on expiry.

India VIX: Volatility, as measured by the India VIX, rose moderately up 2% from the previous session, closing at 13.63 percent, indicating a rise in market volatility.

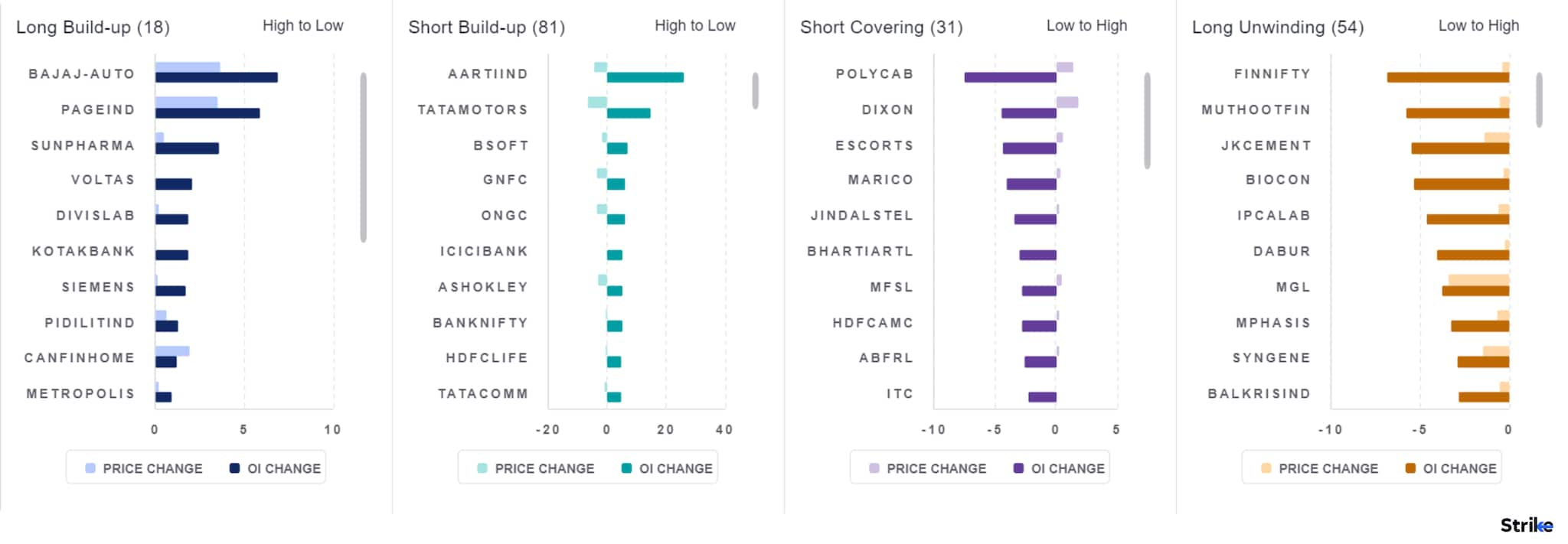

Long Build-Up (18 Stocks): 18 stocks saw a rise in open interest (OI) and price, indicating a long build-up.

Long Unwinding (54 Stocks): 54 stocks saw a decline in both open interest and price, suggesting long unwinding.

Short Build-Up (81 Stocks): 81 stocks witnessed an increase in open interest along with a price decrease, indicating a build-up of short positions.

Short Covering (31 Stocks): 31 stocks witnessed short-covering, with a decrease in OI and a rise in price.

Stocks Under F&O Ban: Securities banned in the F&O segment are those where derivative contracts exceed 95 percent of the market-wide position limit.

Stocks in F&O ban: ABFRL, BALRAMCHIN, BANDHANBNK, AARTIIND, CHAMBLFERT, HINDCOPPER, RBLBANK

Disclaimer: The views and investment tips shared by experts on Moneycontrol are their own and not representative of the website or its management. Moneycontrol advises users to consult certified professionals before making any investment decisions

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.