The market rebounded and closed higher on April 12, but snapped seven-week winning streak to end the week on a negative note amid caution as March quarter earnings season as well as polling for general elections started during the week.

The 30-share BSE Sensex gained 160.1 points to close at 38,767.11 and Nifty rose 46.75 points to 11,643.45 and formed small bullish candle on daily charts on April 12.

For the week, the Nifty lost 0.19 percent and formed 'Hanging Man' kind of formation on the weekly chart.

Price set up on daily scale suggests that supports are intact while the same on weekly scale suggests that hurdles are also visible at 11,761 which is restricting its upside momentum, experts said, adding the rangebound trade is expected to continue in coming truncated week.

"The near-term trend of Nifty is rangebound and one may expect this high-low range of 11,750-11,550 to continue for the next curtailed week. Further upside from here could encounter resistance at 11,710-11,750 in the next week," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

He said the expected range or consolidation movement is unlikely to damage the near-term uptrend status of the market.

Shabbir Kayyumi, Head of Technical & Derivative Research at Narnolia Financial Advisors said index if trades below strong psychological mark of 11,500, it will extend prices lower towards crucial support of 11,420 and below that towards monthly pivot point levels (11,360).

The market will remain shut on April 17 for Mahavir Jayanti and April 19 for Good Friday.

Key support and resistance level for Nifty

Nifty closed at 11,643.5 on April 12. According to the Pivot charts, the key support level is placed at 11,595.77, followed by 11,548.03. If the index starts moving upward, key resistance levels to watch out are 11,674.27 and 11,705.03.

Nifty Bank

The Nifty Bank index closed at 29,938.6, up 152.45 points on April 12. The important Pivot level, which will act as crucial support for the index, is placed at 29,763.43, followed by 29,588.27. On the upside, key resistance levels are placed at 30,057.33, followed by 30,176.07.

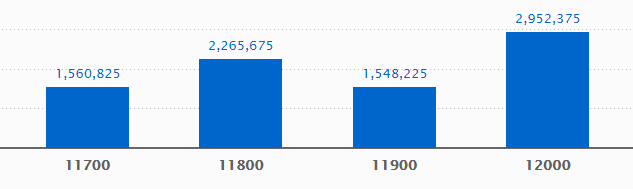

Call options data

Maximum Call open interest (OI) of 29.52 lakh contracts was seen at the 12,000 strike price. This will act as a crucial resistance level for the April series.

This is followed by 11,800 strike price, which now holds 22.65 lakh contracts in open interest, and 11,700, which has accumulated 15.60 lakh contracts in open interest.

No significant Call writing was seen.

Call unwinding was seen at the strike price of 12,000 that shed 3.46 lakh contracts, followed by 11,900 strike price that shed 1.49 lakh contracts.

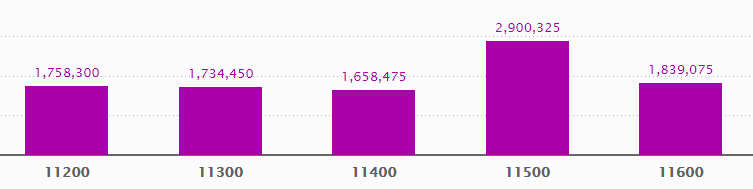

Put options data

Maximum Put open interest of 29 lakh contracts was seen at 11,500 strike price. This will act as a crucial support level for the April series.

This was followed by 11,600 strike price, which now holds 18.39 lakh contracts in open interest and 11,200 strike price, which has now accumulated 17.58 lakh contracts in open interest.

Put writing was seen at the strike price of 11,500 which added 2.40 lakh contracts, followed by 11,700 strike price that added 1.11 lakh contracts and 11,600 strike price that added 0.75 lakh contracts.

No significant Put unwinding was seen.

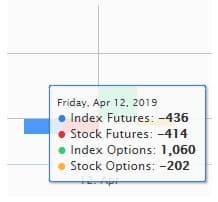

FII & DII data

Foreign Institutional Investors (FIIs) bought shares worth Rs 897.45 crore and Domestic Institutional Investors (DIIs) sold Rs 15.99 crore worth of shares in the Indian equity market on April 12, as per provisional data available on the NSE.

Fund flow picture

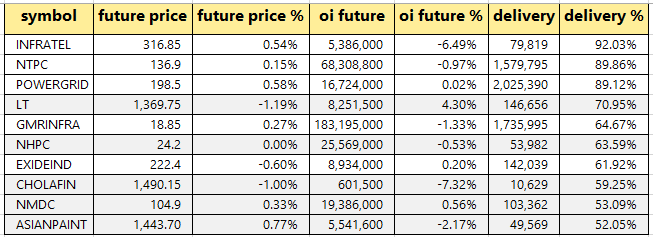

Stocks with a high delivery percentage

High delivery percentage suggests investors are accepting the delivery of the stock, which means that investors are bullish on it.

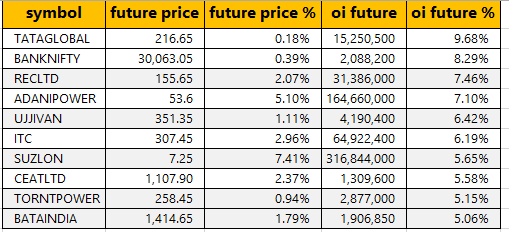

64 Stocks saw a long buildup

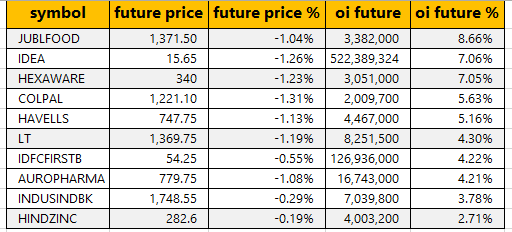

71 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

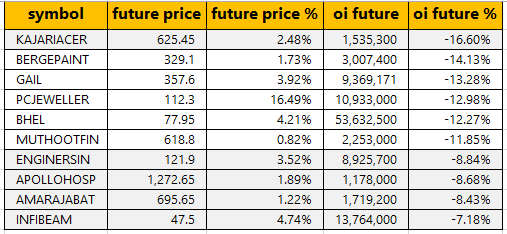

32 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

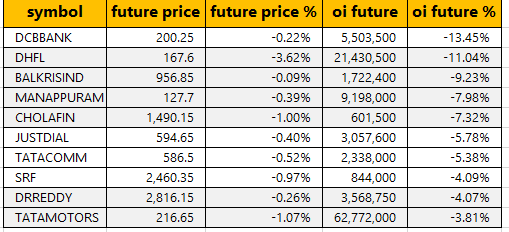

29 stocks saw long unwinding

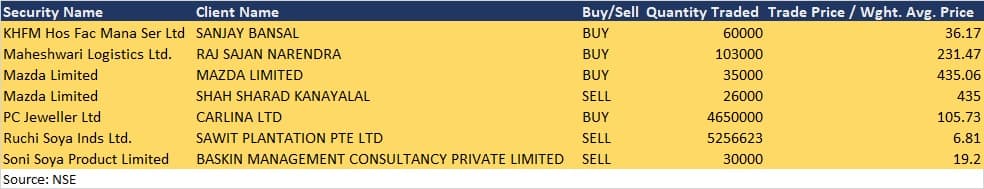

Bulk Deals on April 12

(For more bulk deals, Click Here)

Analyst or Board Meet/Briefings

Sadhana Nitrochem: Board meeting to be held on April 17 to consider interim dividend.

Bajaj Finance: Company's officials will meet certain institutional investors, banks and analysts on debt side at a Non-Deal Road Show in Singapore, Hong Kong and Tokyo during April 15-18.

APL Apollo Tubes: Conference call with investors and analyst to be held on April 16 to discuss the acquisition of Shankara’s manufacturing unit.

Manappuram Finance: Company's officials will meet Creador and Sundaram Mutual Fund on April 16.

Stocks in news:

Results on April 15: Hathway Cable & Datacom, Network18 Media & Investments, TV18 Broadcast, Reliance Industrial Infrastructure, Mac Hotels, TRF, Tata Metaliks, Sanghi Corporate, International Travel House, Gujarat Hotels, Dhruv Estates

Listing: Metropolis Healthcare

TCSQ4: Profit rises 0.3 percent to Rs 8,126 crore versus Rs 8,105 crore and revenue grows 1.8 percent to Rs 38,010 crore versus Rs 37,338 crore QoQ. Revenue in constant currency terms increases 2.4 percent QoQ.

InfosysQ4: Profit jumps 12.9 percent to Rs 4,074 crore versus Rs 3,609 crore, revenue rises 0.6 percent to Rs 21,539 crore versus Rs 21,400 crore; EBIT margin falls 120 bps QoQ. Company sees constant currency revenue growth at 7.5-9.5 percent and EBIT margin at 21-23 percent in FY20.

Jet Airways: SBICAPS acquired 5.19 percent stake in the company on April 11 via pledge encumbrance. Rajshree Pathy submitted her resignation as an Independent Director of the company, owing to time constraints on account of her other current commitments.

Pricol: ICRA downgrades rating on long term - line of credit facilities of the company to BBB (Negative) from BBB+ (Stable).

ITI Limited: Company records a turnover of Rs 2,051 crore for FY19, up 20 percent compared to the previous year.

Sudarshan Chemical Industries: Board approved the proposal to enter into a definitive agreement with GMM Pfaudler (GMMP) to divest industrial mixing solutions division (IMSD) of the company.

Mcleod Russel: Wholly owned subsidiary Borelli Tea Holdings approved Share Purchase Agreement for disposal of its stake in Pfunda Tea Company.

Dr Reddy's Labs: Company entered into a definitive agreement to acquire a portfolio of 42 approved, non-marketed Abbreviated New Drug Applications (ANDAs) in the US.

Persistent Systems: Sudhir Kulkarni, President - Sales, Technology Services Unit has resigned to pursue other interests.

APL Apollo Tubes: Company to acquire Shankara's 2,00,000 MTPA tube manufacturing unit in South India for Rs 70 crore.

Arcotech: Company has completed issue of non- convertible, non-cumulative redeemable preference shares.

Trident Texofab: Company' newly set-up manufacturing unit in Surat, Gujarat started its commercial production and operations and the said unit has been set up for manufacturing grey fabrics.

Adani Enterprises: Adani Transport, a wholly owned subsidiary, incorporated a subsidiary company namely Suryapet Khammam Road Private Limited.

HT Media: As per share purchase agreement, the company will now acquire 69,05,383 equity shares of NRL on or before November 15, 2019.

Suven Life Sciences: Company receives court approval of 'Stalking Horse' Agreement to buy the assets of Rising Pharmaceuticals through its joint venture partner, Shore Suven Pharma Inc.

International Paper APPM: There would be annual outage (maintenance) from April 15, 2019 to April 22, 2019 (both days inclusive) in the manufacturing facility located in Kadiyam, East Godavari District, Andhra Pradesh. The estimated loss of production would be around 200 MTs per day.

Six stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For April 15, DHFL, DLF, IDBI Bank, Jet Airways, Reliance Power and Wockhardt are present in this list.

Out of F&O Ban: Adani Power, PC Jeweller

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust that controls Network18 Media & Investments Ltd and TV18 Broadcast.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.