Markets ended marginally lower after a range-bound session on December 10, taking a breather after the recent surge.

Participants took money off the table amid weak global cues. However, resilience in FMCG majors capped the downside and recovery in metal and banking majors in the last hour further trimmed the losses.

The Sensex closed 144 points, or 0.31 percent, lower at 45,959.88 and the Nifty settled 51 points, or 0.38 percent, lower at 13,478.30.

"Indications are in the favour of some consolidation in the index and it would be healthy for the markets. The Nifty has critical support at 13,350 and its breakdown may result in further correction ahead. In the case of a rebound, the 13,550-13,600 zone would act as a hurdle," said Ajit Mishra, VP-Research, Religare Broking.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13417.23, followed by 13356.17. If the index moves up, the key resistance levels to watch out for are 13521.43 and 13564.57.

Nifty Bank

The Bank Nifty fell 199 points or 0.65 percent to close at 30510.35. The important pivot level, which will act as crucial support for the index, is placed at 30271.61, followed by 30032.9. On the upside, key resistance levels are placed at 30679.51 and 30848.7.

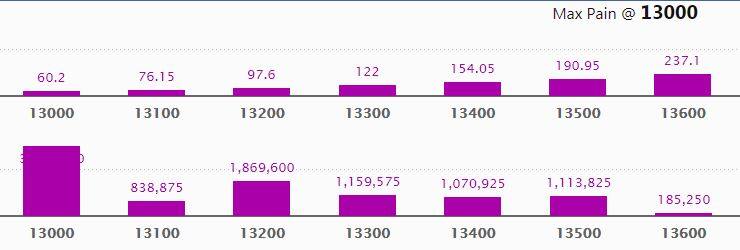

Call option data

Maximum Call open interest of 24.10 lakh contracts was seen at 13,000 strike, which will act as a crucial level in the December series.

This is followed by 13,500 strike, which holds 21.88 lakh contracts, and 14,000 strike, which has accumulated 17.74 lakh contracts.

Call writing was seen at 13,500 strike, which added 3.11 lakh contracts, followed by 14,000 strike which added 2.85 lakh contracts.

Call unwinding was seen at 13,000 strike, which shed 1.06 lakh contracts, followed by 13,300 strike which shed 79,350 contracts.

Put option data

Maximum Put open interest of 37.21 lakh contracts was seen at 13,000 strike, which will act as crucial support in the December series.

This is followed by 13,200 strike, which holds 18.7 lakh contracts, and 13,300 strike, which has accumulated 11.6 lakh contracts.

Put writing was seen at 13,200 strike, which added 7.36 lakh contracts, followed by 13,400 strike, which added 1.65 lakh contracts.

Put unwinding was seen at 13,000 strike which shed 1.25 lakh contracts, followed by 13,600 strike which shed 18,975 contracts and 13,700 which shed 15,450 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

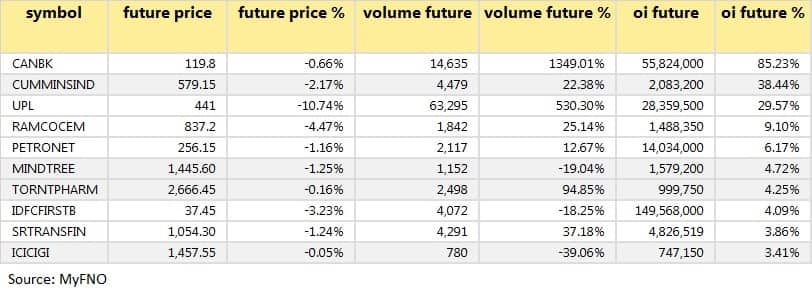

33 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which a long build-up was seen.

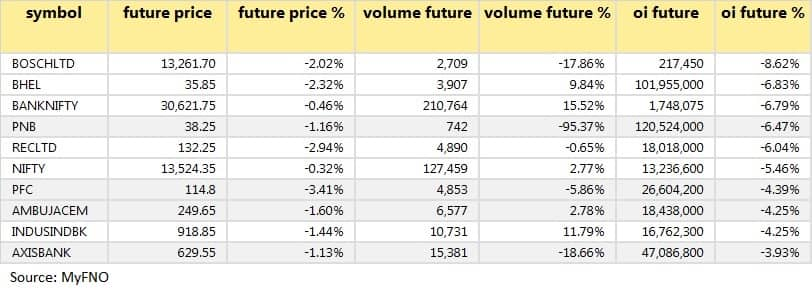

45 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

37 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

24 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

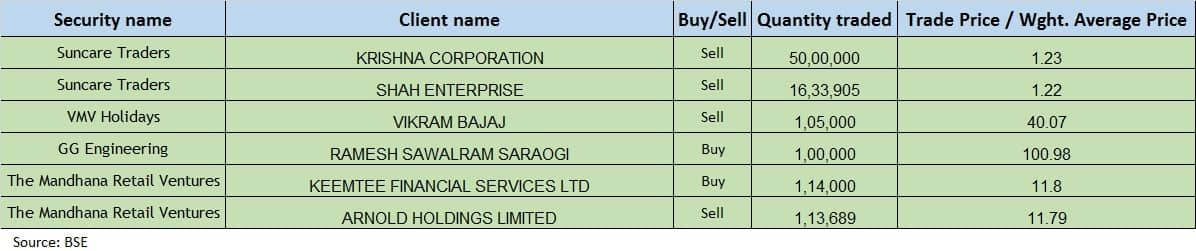

Bulk deals

(For more bulk deals, click here)

Board Meetings

Central Bank of India: The board will meet on December 11 for general purposes.

Hatsun Agro Products: The board will meet on December 11 to consider and approve the bonus issue.

Power Grid: The board will meet on December 12 to consider interim dividend.

Midas Infra Trade: The board will meet on December 12 to consider and approve quarterly results.

Sayaji Hotels: The board will meet on December 12 to consider and approve quarterly results.

Stocks in the news

Kotak Mahindra Bank - The RBI restricts the bank from paying out dividends on PNCPS as well.

Ircon International - The company is awarded work of Rs 900 crore by NHAI.

Bank of Baroda- The bank has revised the Marginal Cost of Funds Based Lending Rate (MCLR) w.e. f. December 12, 2020.

Jash Engineering - The company receives orders worth Rs 20.65 crore in November 2020.

TCS - The company expands its presence in Texas with a new facility in Austin.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,259.98 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,275.22 crore in the Indian equity market on December 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Canara Bank and Punjab National Bank - are under the F&O ban for December 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!