In a perfect example of how investment decisions are influenced by social media frenzy and how investors tend to get on the bandwagon in haste without doing enough research, shares of Bombay Oxygen Investments have jumped 157 percent since February 1, 2021.

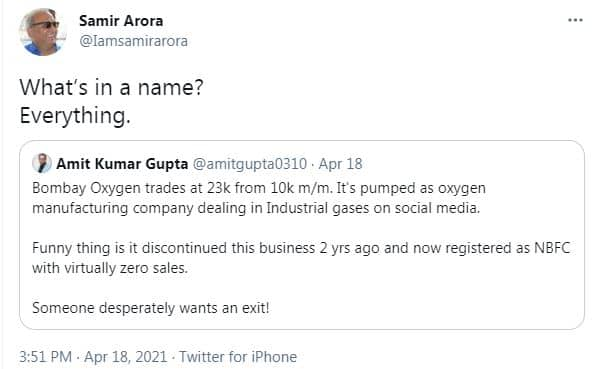

Interestingly, this stock has surged just because of its name and not the fundamentals. As ridiculous as it may sound, its middle name 'Oxygen' suggested to the investors that the company deals in oxygen supply- the gas which is in heightened demand ever since the second wave of COVID-19 hit India.

Investors have lapped up the stock with both hands in the last two months. On April 19, the stock closed at its 52-week high of Rs 24,574.85, up 5 percent, on BSE.

The company's old name was Bombay Oxygen Corporation and its primary business was manufacturing and supplying industrial gases, which was discontinued on August 1, 2019. Now it is a non-banking financial company (NBFC) that doesn't accept public deposits. All this information is available on the company's website.

A few months ago, shares of GameStop saw a rally driven by social media. Of late, we have seen the price of Dogecoin surging just because of Elon Musk's tweets and memes.

Social media channels such as WhatsApp and Telegram have thousands of groups that give investing tips and their power in influencing investors cannot be downplayed.

"Market regulator SEBI needs to frame policies and bring out measures to curb such frenzy at the beginning. Frenzy-driven trades are no less than a scam," a market expert observed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.