Aditya AgarwalaYes Securities

The Nifty extended its rising streak in July to 4.15 percent. It has broken out of a Flag pattern consolidation this week triggering a fresh start to the bull trend. A sustained trade above 11,150 can extend the current upmove to 11,185-11,245 levels. However, a trade below 11,070 can halt the current uptrend dragging it lower to levels of 11,000-10,810.

On a larger timeframe, the relative strength index (RSI) is still in bull territory. On a shorter timeframe, RSI has turned lower from overbought levels, suggesting a minor correction before the uptrend resumes.

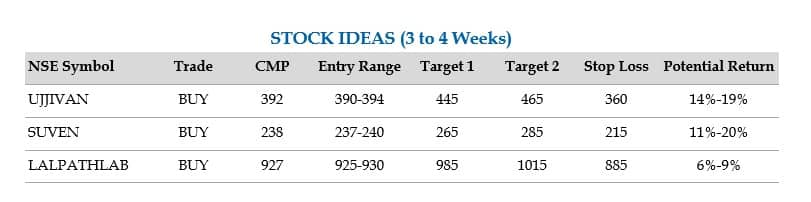

Here is a list of 3 stocks that could return 6-19% in the next 3-4 weeks:

Ujjivan Financial Services: Buy| CMP: Rs 392| Target: Rs 445-465| Stop Loss: Rs 360| Return 14-19%

On the weekly chart, Ujjivan Financial Services Ltd. (UJJIVAN) is on the verge of a breakout from a Cup and Handle pattern neckline placed at Rs 421.

A breakout above Rs 421 with healthy volumes can resume the uptrend taking it to levels of Rs 445-465. On the daily chart, it has broken out from a Triangle pattern affirming bullishness dominant in the stock.

Moreover, RSI turned upwards after taking support at the lower end of the bull zone i.e. 40 level suggesting higher levels in the coming trading sessions. The stock may be bought in the range of Rs 390-394 for the target of Rs 445-465, keeping a stop loss below Rs 360.

Suven Life: Buy| CMP: 238| Target: Rs 265-285| Stop Loss: Rs 215| Return 11-20%

On the weekly chart, Suven Life Sciences Ltd. (SUVEN) is on the verge of a breakout from an Ascending Triangle pattern. A sustained trade above Rs 242 will trigger a breakout which can extend the uptrend.

Further, on the weekly chart, it continues to form higher highs and higher lows affirming strong bullishness dominant in the stock.

RSI has turned upwards after forming a double bottom formation suggesting extended bullishness in the coming trading sessions. The stock may be bought in the range of Rs 237-240 for targets of Rs 265-285, keeping a stop loss below Rs 215.

Dr Lal PathLabs: Buy| CMP: Rs 927| Target: Rs 985-1015| Stop Loss: Rs 885| Return 6-9%

On the daily chart, Dr. Lal Path Labs Ltd. (LALPATHLAB) is on the verge of a breakout from a channel pattern suggesting bullishness building up in the stock.

Further, the stock has taken support at multiple moving averages affirming strength dominant. RSI has turned upwards after forming a positive divergence indicating that the downtrend is losing steam.

The stock may be bought in the range of Rs 925-930 for the target of Rs 985-1,015, keeping a stop loss below Rs 885.

Disclaimer: The author Technical Analyst at YES Securities (I) Ltd. The views and investment tips expressed by investment expert on Moneycontrol are his own and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.