Deepak ShenoyCapitalmind

The Bhushan Steel resolution gave the company to Tata Steel, which renamed it to Tata Steel BSL, which continues to be listed. The latest price, Rs 34 per share.

This is interesting. Because, till now, the shareholding was like this:

-Tata Steel (through Bamnipal Steel): 79 crore shares (72 percent)

-Banks: 11 crore shares (10 percent)

-Others: 19 crore shares (18 percent)

-Total: 109 crore shares.

That’s a market cap of around Rs 3,500 crore so far.

Tata Steel Will Invest Rs 9,000 crore at Rs 30.43 per share

Tata Steel will now buy more shares. This is an indirect route: Bhushan Steel will issue Rs 9,000 crore worth Optionally Convertible Preference Shares. These can be converted to Bhushan Steel (TATASTLBSL) shares at Rs 30.43 per share.

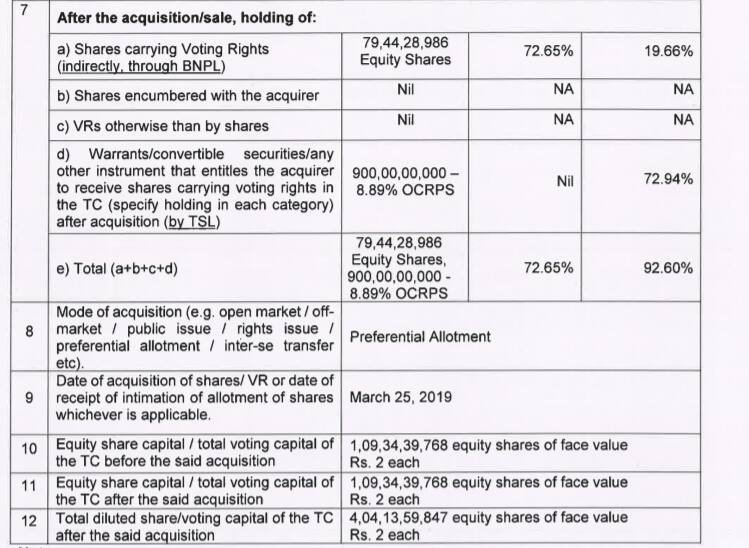

The shareholding will eventually take them to 92.6 percent ownership. From their PR release:

So, if they convert all the shares:

-Tata Steel will own 92.6 percent of Tata Steel BSL (old Bhushan Steel) with about 375.2 crore shares.

-Banks will be diluted down to 2.7 percent

-And others to 4.7 percent

Totally there will be 404 crore equity shares.

Is this Good, Bad or Ugly?

It’s actually much much better than we earlier thought. Our view was that the first tranche of shares (79 crore odd) was issued to Tata Steel at Rs 2 per share. So they would convert the rest at Rs 2 also and therefore, see a massive dilution.

This is still massive, but not quite as much.

Also importantly, the Convertible shares carry an interest of 8.89 percent a year. That means about Rs 800 crore of interest will have to be paid on them till the conversion. We’ll come to this.

The Tata Steel management didn’t do that – possibly because of regulation itself. The SEBI rules will not allow such a deal if it wasn’t part of the bankruptcy resolution itself. In the Bhushan Steel resolution, they didn’t mention specifically how much they would convert the optionally convertible shares at, even later. So they might have had to abide by the regulations that SEBI provided, and Rs 30 was a reasonable deal given the circumstances (the share traded at Rs 40 in January, but slid back to Rs 26 in February).

How do you now value a Bhushan Steel (TATASTLBSL)?

If you look at the interest component on what they have to pay – they will have about 26,000 crore of debt remaining. (Tata Steel put in Rs 35,000 crore and this Rs 9,000 crore is now going to be converted to shares). Tata Steel has issued themselves that debt at about 11 percent, meaning that interest costs will be about 2,900 crore. There is about Rs 1,200 crore of depreciation per year.

EBIDTA per tonne could be pushed up to Rs 10,000 per tonne, which for Bhushan Steel at 50 lakh tonnes means an EBIDTA of Rs 5,000 crore.

Subtract the depreciation and interest, and you have about Rs 900 crore in profit. Assuming you pay 30 percent tax, that’s a net profit of Rs 650 crore.

A P/E multiple of 10 would provide an equity value of Rs 6,500.

Spread across 404 crore shares, this is about a price of Rs. 16 per share.

That would mean the current price of Rs 34 is a little high.

(Note that if there is no conversion, an additional Rs 800 crore is paid as interest, that brings net profit to zero. That’s not fun.)

How about EV-EBIDTA?

Steel companies could be valued another way: EV to EBIDTA. EV = Enterprise Value = Equity Plus Debt.

Debt is about Rs 26,000 crore (after Rs 9,000 crore is converted to equity).

For an EBIDTA of Rs 5,000 crore, let’s also crosscheck what EV-EBIDTA we are paying for Tata Steel itself. The answer is about six times. JSW Steel is seven times.

Let’s give Bhushan a 6.5x and say that the EV is 5000 x 6.5 = Rs 33,000 crore.

At that point, debt is Rs 26,000 crore so the equity is valued at Rs 7,000 crore.

Again, for 404 crore shares this is a price of Rs 17.5 per share.

To justify a price of Rs 32 per share, you need an EV-EBIDTA of 7.5+. This is possible in a good market (however, most steel companies are trading below those valuations today).

The Verdict: Much Better Outcome Than Earlier

This is an interesting outcome, because Tata Steel chose to convert at Rs 30 per share. At some level, this provides a valuation base to the company. Of course, at current relative valuations, the price is still way too high (we estimate that if it were valued as per its peers, the share should be below Rs 20 per share).

But still, there are questions – all these valuation estimates assume conversion. If Tata Steel does convert they could quickly force a delisting of the company, since they will have more than 90 percent. And then, shareholders may not be able to exit in any meaningful way.

We expect that the Tata’s will play nice here – and either merge the company with Tata Steel, at a possible conversion price closer to Rs 30 per share (effectively) after conversion. Eventually, of course, the future will depend on the performance of Tata Steel. That performance hasn’t been all that great, even with a steel upcycle. A return of capex planning in the economy would do it a lot of good, so the real verdict will have to be after the budget later this year.

For Bhushan Steel (Now Tata Steel BSL) shareholders, this conversion must be a sigh of relief, because it provides clarity on exactly what the minority shareholders will own in this business.

The author is Founder and CEO of Capitalmind.

The article first appeared on Capitalmind. It has been reproduced with permission. You can read the original article here.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.