While most brokerages rushed to take a bite out of food delivery and quick commerce players, Ambit Capital has refused to dig in. The broking house initiated coverage on recently listed Swiggy Ltd., issuing a 'sell' rating amid concerns on operational efficiencies and vulnerability to competition.

The brokerage kicked off coverage with a price target of Rs 310 per share, indicating a downside of around 10 percent from the current market price.

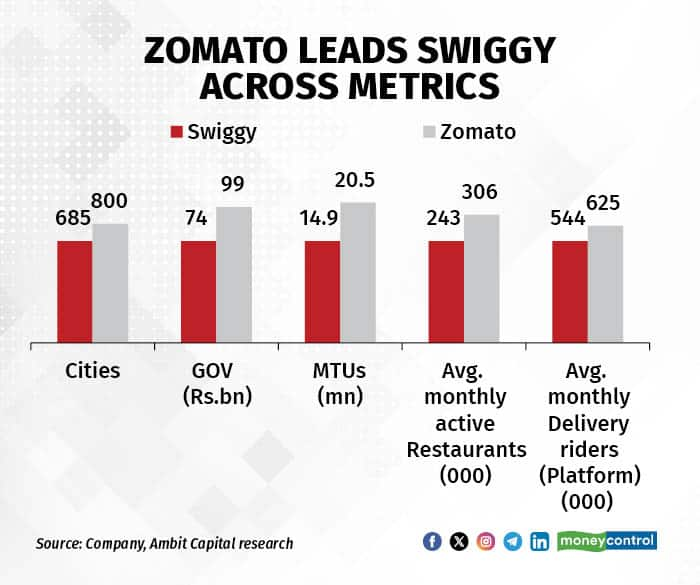

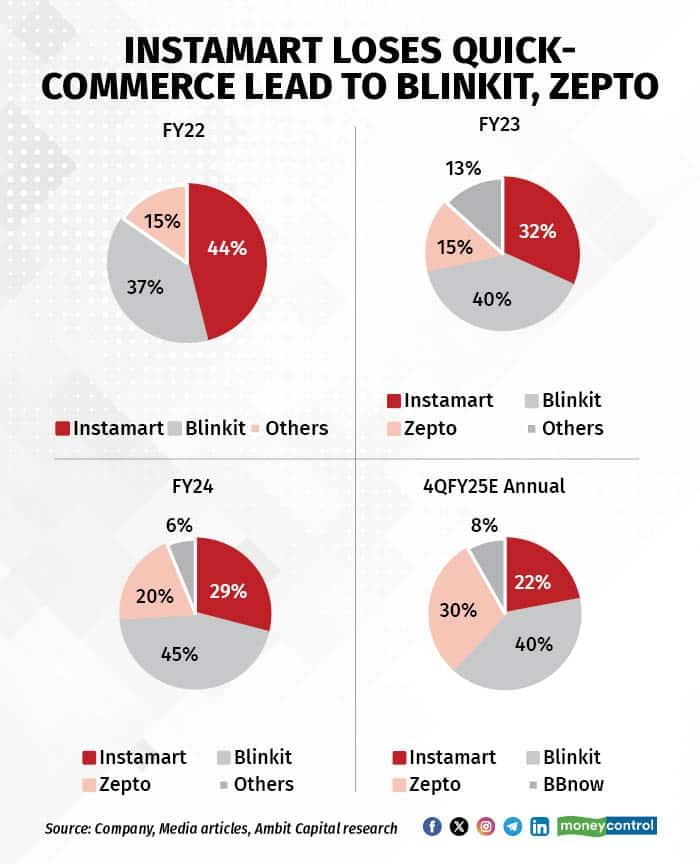

The brokerage noted that while Swiggy was a first mover in the food delivery space, it lost its pole position to competitor Zomato Ltd. Further, sank to the third place in quick commerce (QC). Swiggy’s food delivery market share fell from 52% to 43% over from CY2020 FY2025, however there is stablization seen lately. On the QC-front, Swiggy's share fell from ~44% to ~22% over FY2022 to FY25.

The brokerage shared a few reasons for Swiggy losing its first mover advantage:

"But low urbanization, women’s labour participation, cultural preferences and smaller organized restaurant share are constraints to matching China/US FD penetration," noted the brokerage.

Swiggy is expected to see a tougher climb in quick commerce. Swiggy Instamart is 50% smaller than Zomato's Blinkit on GMV and lags revenue by 57%.

Swiggy has a tough job at hand in terms of reducing scale difference, narrowing assortment gap, reducing take rate differential through internal fulfilment and advertising, improving dark store efficiencies and accelerating customer acquisition. "All of which would need investments and put pressure on profitability," said the report.

"Swiggy is caught between an efficient Zomato and aggressor Zepto, with Flipkart/Amazon joining the fray by year-end. With 2200+ orders per dark store per day needed to break even (versus ~1350 for Blinkit), near-term losses will expand," added the brokerage.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!