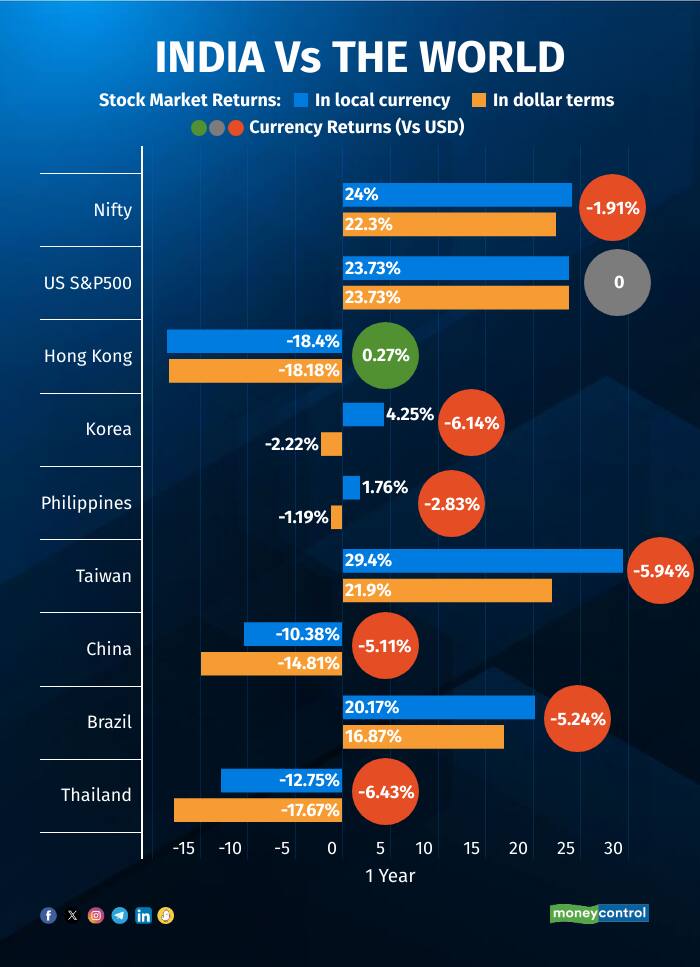

A relatively stronger rupee has ensured that Indian equities top the returns chart, racing ahead of other emerging markets in a year that was defined by large outflow from emerging markets in the wake of high bond yields in the US and fears of rates staying higher for longer.

The rupee depreciated 1.9% in FY24, which was far lower than other emerging markets like Indonesia (-6%), Taiwan (-5.9%), Shanghai (-5.1%), Thailand (-6.4%), and Malaysia (-7.7%).

This helped Indian indices fare better in dollar returns compared to certain other large markets that gave better returns in local currency.

The Taiwanese index, for instance, delivered a local currency return of 29% over the past year, even as its steep 5.9% currency depreciation dragged down dollar returns to 22%.

While Indian markets have been driven by strong macros and robust local growth, the central bank's timely interventions have also helped to keep the rupee under check, experts said.

The past year’s depreciation in the rupee is significantly lower than the average 3% annual depreciation seen over the past 10 years. Barring the risk of oil going completely going berserk due to geo-political issues or otherwise, the rupee should remain in a range, lending confidence to foreign investors, experts said.

What will also help in the coming year is the potential inflow of $30 billion into Indian bonds after India’s inclusion in the JPMorgan bond index.

Rupee vs US dollar

A strong US dollar due to high bond yields and higher crude oil prices has put the Indian rupee under pressure causing it to hit a new record low this year.

Beyond the strong greenback, a decline in China's yuan against the USD has put further pressure on rupee, given that New Delhi runs an almost 40 percent trade deficit with China. A directional move in yuan deeply influences rupee direction, and most Asian currencies, said Emkay Global in a recent report.

Another key factor causing the rupee's decline is the rise in global crude oil prices. Brent crude futures hover near $90 a barrel. Given that India is a net importer of crude oil, a rise in prices, payment for which is primarily in dollars, increases demand for the US currency.

The rupee typically weakens when there is higher dollar demand, especially from local oil refining companies, which is the case currently.

Growing expectations that the US Federal Reserve may cut interest rates later and fewer times than anticipated is also putting the local currency under pressure against the US dollar. However, despite the rupee depreciating against USD in the last year, the benchmark Nifty managed to rise 24 percent during this period, mirroring the rise seen in S&P 500.

Rupee vs Asian peers

Compared to the rupee's 1.91 percent fall against the US dollar in a year, the Chinese Yuan has tumbled over 5 percent as a widening gap in interest rates between China and the US put pressure on the Chinese currency.

More attractive returns offered by treasuries lured money away from the Chinese market. Worsening economic sentiment has led the People's Bank of China (PBOC) toward looser monetary policy, including cuts to key policy loan rates.

With Europe and the US rates still high, conditions are bearish for Yuan. External demand has been China’s main growth engine since Covid started in 2020, but it has been waning. Chinese exports have fallen and the Dragon's shrinking trade surplus has played a role in Yuan depreciation as trading companies sell less foreign currency to buy yuan.

Another Asian peer, the Japanese Yen, fell to its 34-year low recently. The currency has slipped nearly 13 percent in the last one year due to PBOC's moves on daily central parity rates, which serve as a guideline for yuan exchange transactions and influence the dollar exchange rate against a wide range of currencies including the yen.

A persistently strong dollar, backed by protectionist US policies, has also fueled the yen's weakness. Japan's shrinking population and rigid labour force weighed on the nation's growth, leading to its economy officially entering recession earlier this year. This weakness has also contributed to the yen's weakness against the greenback.

In comparison to the South Korean won and Taiwanese dollar, which depreciated up to over 6 percent against the USD, Indian rupee's nearly 2 percent decline suggested strength in the domestic unit.

Why rupee fared well compared to peers?

Rupee managed to outperform Asian peers like Yuan, Yen, Hong Kong dollar and Taiwanese dollar in the last 12 months due to robust domestic fundamentals and the supportive global macro landscape.

“A Fed rate cut is just lurking around the corner and by market estimates, a June 2024 rate cut is most likely. This will provide further impetus to rupee,” said BoB Economist Aditi Gupta in a report.

"RBI has been vigilant when it comes to intervention from either side. When flows remain positive, they try to accumulate reserves without much depreciation while on the other end in case of any sharp rupee depreciation, they use the reserves as ammunition to curtail excessive volatility," Kunal Sodhani of Shinhan Bank told Moneycontrol.

The Indian economy is one of the fastest among major global economies, and this helped draw $20.7 billion in overseas equity flows in 2023 and $1.85 billion as of March this year.

The Reserve Bank of India (RBI) has chosen to absorb most of these flows to avoid volatility in the rupee, adding to its reserves.

Indian markets shrugged off the impact of slight rupee depreciation against the US dollar as the country's favourable macroeconomic conditions, robust corporate earnings, stabilized interest rates, manageable inflation, and consistent policy momentum drew in investors, both domestic and foreign.

Thus, rupee remaining largely stable contributed to Indian markets outpacing the stock indices of China, Japan, Taiwan, South Korea and Hong Kong.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.