The stock market is becoming more vulnerable to foreign investor behavior because the supply of new stocks in the market is accelerating, said Ashish Gupta, chief investment officer of Axis Mutual Fund in its Acumen report.

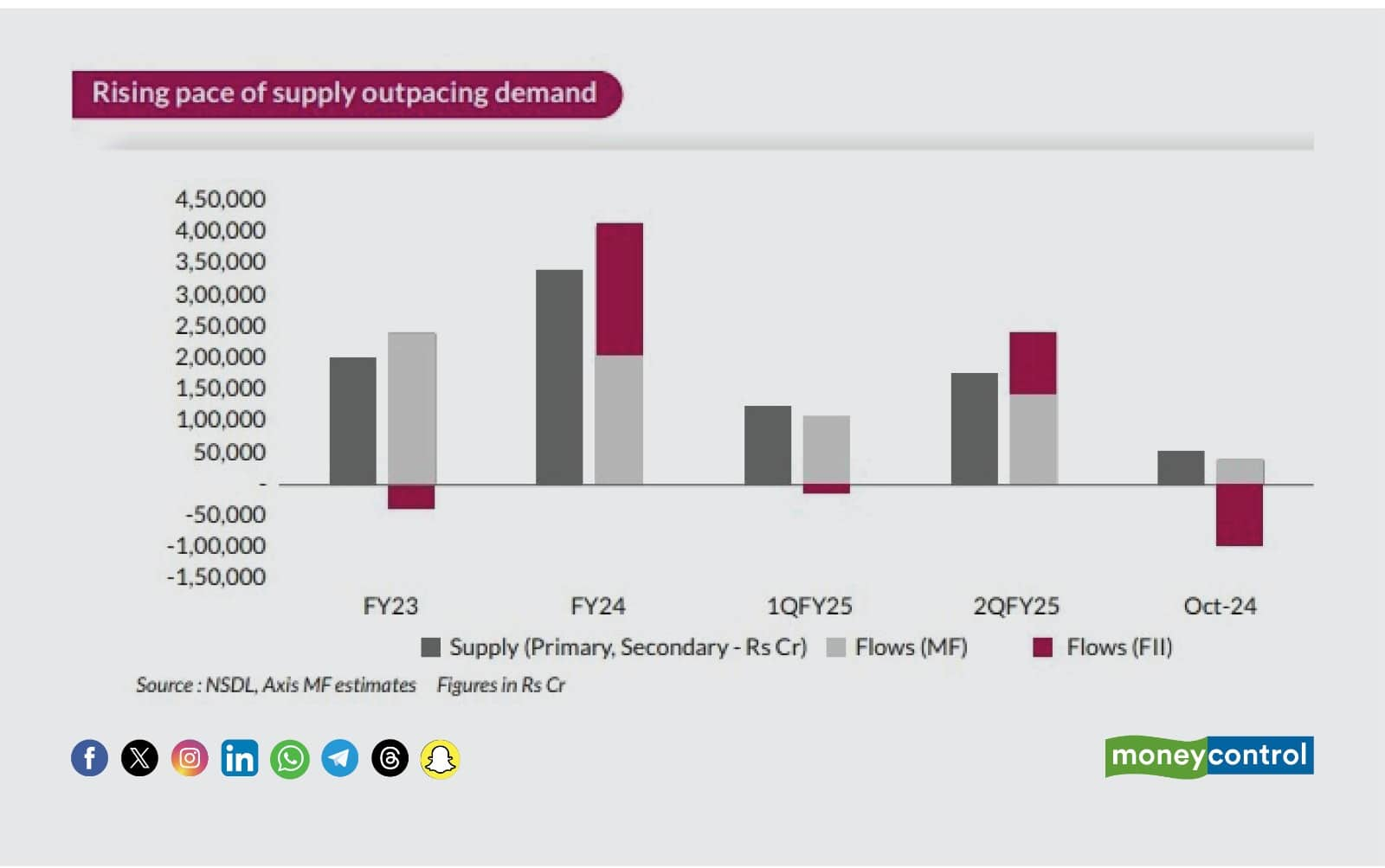

The report says that in Q2FY25, companies issued new shares to the tune of $21 billion, up from $15 billion in the previous quarter. This was more than the $18 billion invested by mutual funds during the quarter. However, since foreign investors added $11.6 billion, the market continued to rise.

Since FY24, the supply of new stocks has been 1.5 times the money flowing into mutual funds. But the market didn't feel the impact because foreign investors added $35 billion from April 2023 to September 2024, helping to absorb the extra supply.

In the second half of the year, the supply of new stocks in the market is expected to be much higher than in the first half, the report said. It is because 91 companies plan to raise $17 billion through Initial Public Offerings (IPOs). Another 70 listed companies have recently received board approval to raise $16 billion through Qualified Institutional Placements (QIPs). Further, secondary sales (when promoters and private equity investors sell existing shares) are expected to add another $22 billion, similar to the first half.

A large amount of money is being raised by companies through selling shares, which could help speed up private investment in the economy, the report said. Unlike previous cycles, this time, companies are relying more on equity (selling shares) rather than borrowing money (debt).

In the last 18 months, companies raised $39 billion through IPOs and QIPs, with $25 billion going directly to the companies for investment. In the second half of FY25, companies are expected to raise another $24 billion, which they can use for things like expanding their businesses, building new facilities (capex), or making acquisitions.

The report said that judicious use of the capital by corporates would be a key determinant for sustaining the earnings growth momentum as easy capital availability can tempt companies into low return capex, unrelated diversifications and expensive acquisitions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!