IT and financial services stocks were among the top drivers of the market while some selling in oil and gas and realty names knocked off some points from the top of the day.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,720.38 | 110.87 | +0.13% |

| Nifty 50 | 26,215.55 | 10.25 | +0.04% |

| Nifty Bank | 59,737.30 | 209.25 | +0.35% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Bajaj Finance | 1,033.80 | 23.10 | +2.29% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Eicher Motors | 6,999.00 | -199.50 | -2.77% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Bank | 59737.30 | 209.20 | +0.35% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Energy | 35756.20 | -208.60 | -0.58% |

The Indian market witnessed a straightforward rally on Tuesday, supported by positive FIIs inflow.Sensex gained 0.42 percent and closed at 65479.05 and Nifty inched up 0.34 percent intraday and ended at 19389 while Bank nifty at 43954.45 with a 0.32 percent gain.

Sectorally PSU Bank, Metal and Metal contributed 1 to 2 percent each. However Nifty Oil and Gas, Auto and Infra ended marginally lower. In Nifty stocks, Bajaj Finance, Bajaj Finserv and Hero MotoCorp were the top gainers while Eicher Motors, Bharti Airtel and Grasim were the prime laggards.

Nifty has formed a long-legged Doji pattern after four runaway gaps indicating bulls are in mood to book some profit after a fantastic rally. The market may consolidate amid a big surge, although stock-specific movement may persist. However with a pause; market would attempt to test 19580-19640 in the coming days.

OI Data indicates, on the call side the highest OI was witnessed at 19500 strike prices while on the put side, the highest OI was at 19300 followed by 19200 strike price.

Investors can add good quality stocks from the Auto, FMCG and IT sectors; while traders are suggested to book some profits as well and with buy on decline strategy.India VIX could shoot up in the coming days while the Nifty PCR settles at 1.48.

Markets consolidated in a range and ended with modest gains, taking a breather after the recent surge. After the initial uptick, Nifty oscillated in a band throughout the session and finally settled at 19389 levels. Meanwhile, a mixed trend on the sectoral front kept the traders busy wherein IT and financials posted decent gains. After the weeks of outperformance, we are seeing some consolidation in midcap and smallcap space too.

The rotational buying across sectors is helping the index to maintain a positive tone despite the overbought condition. And, we feel the scenario would continue, citing the prevailing structure and favorable global cues. Having said that, traders should not get carried away with prevailing buoyancy and stick only with the quality stocks and avoid penny stocks or laggards, in anticipation of a recovery.

Buoyancy in the markets continued as benchmark indices touched new highs in spite of mixed Asian cues and weak European markets in early trades. The cushion provided by Indian markets on the back of its strong fundamentals is offsetting some of the negative catalysts seen in key developed economies, and strong backing by the FIIs in recent weeks is a testimony to it.

Rupee erased the early morning gains and becomes the worst performer among Asian currencies following bargain buying from the oil importers and hedgers. The speculative activities and inflows remained limited due to the closure of US markets.

Spot USDINR has been oscillating around the 200-day simple moving average since June 16, lacking a directional movement. We believe the pair is expected to consolidate between 81.60 to 82.30 in the coming weeks.

Indian Rupee depreciated on a positive US Dollar and recovery in crude oil prices. However, a sharp fall in the rupee was prevented by a surge in domestic markets and FII inflows. In July, US Dollar gained on rising expectations of a hawkish US Federal Reserve monetary policy. US markets will remain closed today.

We expect Rupee to trade with a slight negative bias on the strong Dollar and rebound in crude oil prices as Saudi Arabia and Russia announced output cuts and export cuts respectively. However, a positive tone in domestic markets and steady FII inflows may support Rupee at lower levels. Market participants may remain cautious ahead of US non-farm payrolls report later this week. We expect the USDINR spot to trade between 81.60 to 82.50 in the near term.

Rupee ends at 82.02/$ against Monday’s close of81.96/$

Indices end at fresh closing highs for the fourth session, Nifty settles around 19,400.

The Sensex was up 274.00 points or 0.42 percentat 65,479.05, and the Nifty was up 66.50 points or 0.34percentat 19,389.00. About 1,582 shares advanced, 1,826 shares declined, and 118 shares were unchanged.

The top gainers were Bajaj Finance, Bajaj Finserv and Hero MotoCorp while Eicher Motors was the biggest laggard, followed by Grasim and Bharti Airtel.

Among sectors, IT, pharma and PSU banks rose 0.5-1.9 percent while automobile,energy and infra were the worst hit, down 0.3-0.6 percent.

The mid-cap indexalso underperformedand ended weak, snapping five-day winning streak.

-Can find opportunities in mid & small cap pharma

-Financials look interesting atthis point oftime

-Hospital EBITDA margins have expanded meaningfully along with valuations

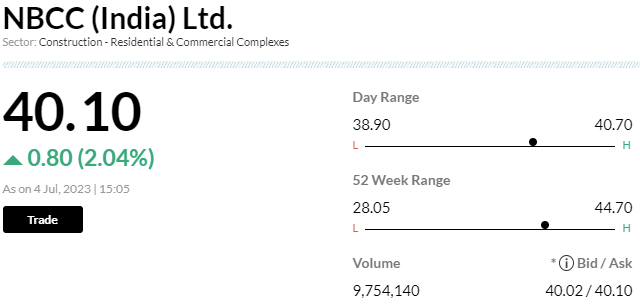

Shares of NBCC (India) Ltd gained 2 percent in afternoon trade on July 4 after the company announced the signing of a memorandum of understanding (MOU) with the Currency Note Press (CNP) under the Security Printing and Minting Corporation of India Limited (SPMCIL).

On June 23, the Chief General Manager (CGM) of CNP, Bolewar Babu, and Pradeep Sharma, CGM (Engineering) of NBCC, inked an MOU for planning, designing, and execution of upcoming works such as a state-of-the-art museum and infrastructure development works like treatment plants at CNP Nasik, said the regulatory filling.

Benchmark indices held on to their gains, with the Nifty around 19,400.

The Sensex was up 290.55 points or 0.45 percentat 65,495.60, and the Nifty was up 60.00 points or 0.31percentat 19,382.50. About 1,443 shares advanced, 1,797 shares declined, and 98 shares were unchanged.