LiveNow

Closing Bell: Nifty below 19,150, Sensex down 523 pts; metals outperform

Prashanth Tapse, Senior VP (Research), Mehta Equities

It was a sea of red at Dalal Street which was primarily clouded by lingering concerns about corporate India’s earnings which as of date was uninspiring and, most importantly, they could come under heavy pressure from inflation, an economic downturn, and soaring interest rates. The negative takeaway was that the bear remained in total control despite WTI Oil prices tumbling to $83 a barrel. Technically, Nifty has support at 18851 mark and strength only above the biggest hurdle at 19557 mark.

Shrikant Chouhan, Head of Research (Retail), Kotak Securities

Markets extended fall for the 5th straight session as banking, IT stocks led the slump in the backdrop of persisting global turbulence. Higher valuations of Indian stocks have been a concern and the current global turmoil is allowing investors to reduce their equity exposure. Technically, due to weak sentiments, the Nifty has breached the important support level of 19200 and has also formed a bearish candle on daily charts, which is largely negative.

For day traders, 19050 would act as a trend decider level, above which we could see a one quick pullback rally till 19200-19250. On the flip side, fresh selloff is possible only after the dismissal of 19050 and below the same, the market could slip till 19000-18930.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas:

The Nifty opened mildly in the green however it was unable to sustain at higher levels and continued to drift lower to close down ~159 points. On the daily charts we can observe that the Nifty has reached the lower end of the falling channel and very close to the psychological level of 19000.

The short-term trend is negative and minor degree pullbacks are being sold into. Considering the sharp fall in the last couple of trading sessions, there can be consolidation, however it is likely to be a temporary pause. On the downside the Nifty is likely to drift towards 19000 from short term perspective. On the way up 19350 – 19370 shall act as an immediate hurdle zone.

Bank Nifty also witnessed to drift lower and closed in the negative. It is likely to continue to drift lower towards 42500 from short term perspective. Intraday minor pullbacks should be sold into. Crucial resistance is placed at 43000 – 43100 while support is placed at 42600 – 42500.

Deven Mehata, Research Analyst at Choice Broking:

The Indian stock market faced significant downward pressure as investors grew increasingly concerned about the geopolitical tensions and increasing bond yields in US. Nifty has broken its important support of 19220 and closed below the mentioned levels indicating breakdown of Head and shoulder pattern on daily chart.

Sensex ended the day 0.81 percent, or 522.82 points, down at 64049.06, while the broader Nifty declined 159.60 points, or 0.83 percent, end at 19122.15. Market breadth favoured declined. About 596 shares advanced, 1504 declined.

INDIA VIX was Positive by 3.67 percent intraday and settled at 11.31.

Index has a support around 19000-18900 zone. Coming to the OI Data, on the call side, the highest OI observed at 19300 followed by 19200 strike prices while on the put side, the highest OI is at 19000 strike price. On the other hand, Bank Nifty has support at 42500-42300 while resistance is placed at 43400-43500 levels.

Deepak Jasani, Head of Retail Research, HDFC Securities:

Nifty declined for the fifth day on October 25 as the uncertainties associated with the Israel-Hamas conflict continue to weigh on markets. At close, Nifty was down 0.83% or 159.6 points at 19122.2. Broad market indices fell largely in line with the Nifty even as the advance decline ratio fell to 0.14:1.

China helped Asian stocks rise from 11-month lows on Wednesday as investors cheered the approval of a trillion-yuan sovereign issue as a harbinger of stimulus. European shares gave up early gains on Wednesday as investors digested a slew of mixed earnings reports from the region, while weakness in energy firms on lower crude prices added to the declines.

Nifty kept falling of October 25, showing small intraday bounce. It could now take support from 19011 which is a gap support, while 19229-19333 could offer resistance on upmove.

Aditya Gaggar Director of Progressive Shares:

Relentless selling remained in the Indian markets and bears were seen tightening their grip by dragging the Index lower to breach its previous swing low of 19,220. Nifty50 ended the day at 19,122.15 declining by 159.60 points. Among the sectors, only Metal and PSU Banking managed to end the day in green; while Media and IT were the major laggards. Pressure was seen in the broader markets as well but Mid and Smallcap have already witnessed a freefall in the previous session which led to a marginal outperformance.

Post the Head and Shoulder breakout, follow-up selling was seen in today's trade and Nifty50 has formed another bearish candle on the daily chart. The trend turned negative but at present, the Index appears to be in an extremely oversold situation and a relief rally cannot be ruled out.

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets extended its decline and lost over half a percent amid mixed signals. After the flat start, Nifty gradually drifted lower and breached crucial support at 19,200 to finally settle at 19,150.35 levels. Most sectors traded in sync wherein realty, financials and IT were the top losers. The broader indices too remained under pressure and lost nearly half a percent each.

Nifty has breached the lower band i.e. 19,200 of the broadening formation and now the next crucial support comes at 200 EMA, which currently lies around 18,830 levels. And, it also coincides with the neckline (breakout) area of the previous consolidation range. Meanwhile, global cues and the scheduled expiry of October month derivatives contracts would add to the choppiness. Traders should align their positions accordingly and prefer index majors over others.

Vinod Nair, Head of Research at Geojit Financial Services:

Investor sentiment is on edge as tensions in West Asia continue to drag the market. Despite a drop in oil prices and an optimistic view of the progressing Q2 results season, investors took a cautious approach due to the expectation that a higher interest rate scenario would continue slowing future growth. However, a positive strategy is evident on large-cap stocks, amid growing geopolitical worries and valuation concerns in mid- and small-cap stocks, as overall earnings growth is being sustained.

Rupee Close:

Indian rupee ended flat at 83.18 per dollar on Wednesday against Monday's close of 83.19.

Market Close: Indian benchmark indices ended lower for the fifth consecutive session on October 25 with Nifty around 19,100.

At close, the Sensex was down 522.82 points or 0.81 percent at 64,049.06, and the Nifty was down 159.60 points or 0.83 percent at 19,122.20. About 1162 shares advanced, 2404 shares declined, and 100 shares unchanged.

Top losers on the Nifty were Infosys, Cipla, NTPC, Apollo Hospitals and Adani Enterprises, while top gainers included Coal India, Tata Steel, Hindalco Industries, Tata Consumer Products and SBI.

Among sectors, metal index up nearly 1 percent while bank, power, realty, capital goods, pharma and IT down 0.5-1 percent each.

BSE Midcap and Smallcap indices declined 0.5 percent each.

Stock Market LIVE Updates | Jefferies View On Torrent Pharma:

-Hold rating, target at Rs 2,040 per share

-India's revenue grew 18% YoY while brazil sales bounced back strongly

-Branded market is key focus area

-Capital allocation will remain disciplined as per company

Sensex Today | Jaykrishna Gandhi, Head - Business Development, Institutional Equities, Emkay Global Financial Services:

Finally, Nifty had the much awaited correction giving up almost 3% for the week. The sell-off was even more brutal within the small and mid-cap space as retail investors finally seem like throwing in the towel on back of lack lustre earnings and no clear positive commentary from managements. The market sell-off was triggered by the US 10yr hitting the 5% mark which pulled down risk levels materially in the region. Nifty will have its expiry this week which can add to further volatility, we see Bank Nifty at the highest risk below the 43K levels with support at 42,200 levels which in turn can drag the market below 19K towards the strong support levels of 18,800.

All eyes will be on the US 10yr, the geopolitical uncertainty along with the FOMC commentary to get direction for the week forward.

Sensex Today | Blue Jet Healthcare issue subscribed 0.23 times so far, retail portion bought 0.34 times

Blue Jet Healthcare’s Rs 840.27 crore IPO, which opened for subscription on October 25, has been subscribed 0.41 times so far, receiving bids for 70.05 lakh shares against the issue size of 1.7 crore shares. Retail investors bought 0.54 times while high networth individuals picked 0.67 times the allotted quota.

The public issue is entirely an offer-for-sale (OFS) of over 2.4 crore equity shares by promoters, and there is no fresh issue component. The price band for the issue, which will conclude on October 27, has been fixed at Rs 329-346 per share. The stock is expected to be listed on the bourses on November 6.

Stock Market LIVE Updates | Goldman Sachs View On Torrent Pharma

-Buy rating, target at Rs 2,325 per share

-Strong growth in core markets drives profitability beat

-Longer term outlook remains intact

-EBITDA margin came in above expectations at 31%

-Forecast a 20%+ EBITDA CAGR over FY23-26 for overall business

Sensex Today | Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas:

Indian Rupee remained flat on Wednesday. A sharp decline in global crude oil prices over the past two days supported Rupee. However, a strong Dollar and weak domestic markets capped initial gains. US Dollar gained on strong economic data from US which shows a resilient economy. US’ ISM manufacturing PMI expanded to 50 in October versus 49.8 in September, after 5 months of contraction. Services PMI also topped forecast and came in at 50.9 versus 50.1 in the previous month.

We expect Rupee to trade with a slight negative bias on strong Dollar and risk aversion in global markets amid geopolitical uncertainty in the Middle East. Deteriorating of macro-economic conditions in Europe raised recession concerns. However, a decline in crude oil prices may prevent sharp fall in the domestic currency. Traders may remain cautious of Fed Chair Jerome Powell’s speech later today and US GDP and inflation data later this week. USDINR spot price is expected to trade in a range of Rs 82.80 to Rs 83.60.

Stock Market LIVE Updates | Morgan Stanley View On PNB Housing Finance

-Overweight call, target at Rs 880 per share

-B/S got stronger by using a large corporate NPL recovery to write off retail GNPLs

-Stock has re-rated sharply in past year

-See more scope as risk perception abates

Stock Market LIVE Updates | GMR Airports to acquire 11% stake of GMR Hyderabad International Airport

GMR Airports along with its Affiliate, subsidiaries of GMR Airports Infrastructure Limited have entered into a share purchase agreement with Malaysia Airports Holding Berhad (MAHB) and its wholly owned subsidiary, MAHB (Mauritius) Private Limited, towards acquisition by GMR Group from the MAHB Group, of their current minority 11% equity stake in GMR Hyderabad International Airport Limited, a step down subsidiary of the- company. The said acquisition would be for a negotiated aggregate consideration of USD 100 million.

Sensex Today | Nifty Bank index shed 0.5 percent and turned negative for the year. The major gainers included ICICI Bank, IndusInd Bank, Bandhan Bank, Federal Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ICICI Bank | 916.25 | -1.47 | 10.65m |

| IndusInd Bank | 1,416.10 | -1.32 | 3.46m |

| Bandhan Bank | 218.65 | -1.2 | 9.80m |

| Federal Bank | 142.20 | -0.84 | 11.91m |

| Kotak Mahindra | 1,729.65 | -0.64 | 2.97m |

| Axis Bank | 958.35 | -0.62 | 6.08m |

| HDFC Bank | 1,500.40 | -0.38 | 12.27m |

Sensex Today | Market at 3 Pm

The Sensex was down 442.88 points or 0.69 percent at 64,129.00, and the Nifty was down 139.00 points or 0.72 percent at 19,142.80. About 979 shares advanced, 2201 shares declined, and 90 shares unchanged.

| Company | Price at 14:00 | Price at 14:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Spenta Intl | 139.95 | 127.10 | -12.85 52 |

| SHRYDUS IND | 33.75 | 30.83 | -2.92 0 |

| Prism Medico | 31.98 | 29.59 | -2.39 7.76k |

| Tirupati Tyres | 34.44 | 32.00 | -2.44 1.62k |

| Rama Vision | 56.00 | 52.04 | -3.96 539 |

| Lotus Chocolate | 298.00 | 278.35 | -19.65 207 |

| MPDL | 27.89 | 26.07 | -1.82 0 |

| SBL Infratech | 57.85 | 54.11 | -3.74 3.60k |

| Quest Softech | 68.29 | 63.99 | -4.30 255 |

| Prithvi Exc | 77.74 | 72.90 | -4.84 66 |

| Company | Price at 14:00 | Price at 14:54 | Chg(%) Hourly Vol |

|---|---|---|---|

| Welspun India | 123.95 | 143.50 | 19.55 144.94k |

| Martin Burn Ltd | 40.00 | 44.92 | 4.92 377 |

| Apoorva Leasing | 19.75 | 21.73 | 1.98 27 |

| Sainik Finance | 28.88 | 31.64 | 2.76 1.02k |

| Shanthi Gears | 408.00 | 442.60 | 34.60 1.20k |

| Citadel Realty | 25.31 | 27.38 | 2.07 0 |

| KJMC Fin Ser | 47.05 | 50.86 | 3.81 0 |

| Gowra Leasing | 24.81 | 26.73 | 1.92 60 |

| Agarwal Fortune | 19.25 | 20.74 | 1.49 213 |

| Kokuyo Camlin | 132.00 | 141.65 | 9.65 1.17k |

Stock Market LIVE Updates | BSE Bank index down 0.6 percent dragged by ICICI Bank, Canara Bank, Axis Bank

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| ICICI Bank | 914.35 | -1.66 | 211.44k |

| Canara Bank | 350.25 | -1.3 | 95.52k |

| Axis Bank | 956.15 | -0.76 | 61.59k |

| Federal Bank | 142.30 | -0.7 | 1.05m |

| Kotak Mahindra | 1,730.15 | -0.56 | 20.10k |

| IndusInd Bank | 1,430.65 | -0.53 | 23.30k |

| HDFC Bank | 1,500.00 | -0.39 | 200.34k |

Sensex Today | Aditya Gaggar Director of Progressive Shares

The markets are reacting to the uncertainty that persists through the geopolitical heat up led by Middle East (Israel-Hamas conflict). Along with these, the other factors the rising bond yield and dollar index as well as crude oil price fluctuations supported by the technical confirmations of the Head and shoulder breakdown in Nifty and double top breakdown in Bank Nifty. Cumulatively, this has led to a cautious investor fraternity; which is the right approach, till some clarity emerges on the global front.

Stock Market LIVE Updates | Macquarie View On JSW Steel

-Neutral rating, target at Rs 841 per share

-Healthy Q2 & outlook is positive

-6.5 mt capacity expected to be commissioned in the next couple of quarters

-It is on track to expand capacity to 37 mt by FY25 versus 28.2 mt currently

-Management believes global steel prices have bottomed

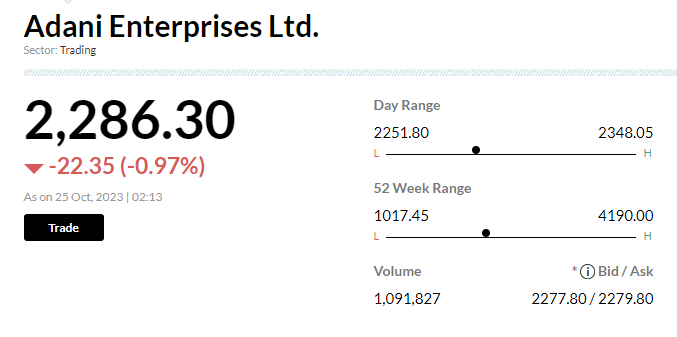

Stock Market LIVE Updates | Adani Enterprises reacts to India's imported coal blending move

Adani Enterprises reduces losses as India calls for increased blending of imported coal with domestic sources to meet power demand. The stock initially dropped 2.5% but later traded 0.9% lower at 2.40pm. However, it's on track for an eighth consecutive day of decline, its longest such streak since March 2020.

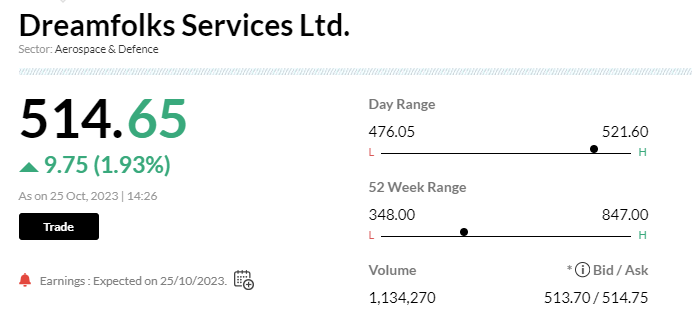

Stock Market LIVE Updates | DreamFolks Reports Strong Q2 Earnings with 20.3% Profit Growth

DreamFolks Services Q2 earnings show a 20.3% increase in net profit to Rs17.8 crore compared to Rs15 crore YoY. Revenue surged by 65% to Rs282.4 crore from Rs171.2 crore YoY. EBITDA also rose by 21.6% to Rs24.2 crore, up from Rs19.9 crore YoY, with a margin of 8.6%, down from 11.6% YoY.

Stock Market LIVE Updates | Aditya Birla Fashion sees huge block deal

Aditya Birla Fashion and Retail stock saw a huge block deal. Around 9.73 million shares of the company changed hands in a single block deal, Bloomberg reported. However, details of the buyers and sellers were not known.

Stock Market LIVE Updates | Tech Mahindra Q2 revenue, profit, margin may fall on-year; deal wins seen muted

Tech Mahindra is likely to report dull fiscal second-quarter earnings on October 25. The IT firm’s Q2 FY24 net profit is expected to decline on a year-on-year (YoY) basis while its revenue is likely to remain flat due to lacklustre performance in the communications vertical, delayed telecom revenue and weak discretionary spends, according to analysts.

Tech Mahindra’s EBIT margin is likely to be the major concern as brokerages expect a big contraction in Q2 FY24 on an on-year basis. The company’s deal wins are also expected to remain muted in the quarter under review, on account of weak macro and slow decision-making.

The IT major's net profit may decline around 37 percent YoY to Rs 822 crore, per the average of six brokerages’ estimates. However, sequentially, there might be an 18 percent rise. The quarter may witness certain one-time costs, said analysts. Read More

Stock Market LIVE Updates | JK Financial View on Poonawalla Fincorp

Broking house believes that Poonawalla Fincorp's strong business model and solid operational execution aided by benign credit environment can deliver PAT of 50% CAGR over FY23-25 and achieve ROA/RoEs of ~4.7%/ 12% in FY25.

Its quality focus, continued digital developments to optimize operations, strong balance sheet and long growth trajectory should see the stock re-rate further.

Maintain BUY rating on the stock with a target price of Rs 480 (values PFL at 24x FY25 P/E and 3.5x FY25E P/B).

Stock Market LIVE Updates | Axis Bank Q2 profit likely to rise 7%, Citi integration to be keenly watched

Axis Bank is likely to clock a modest 7 percent on-year net profit growth at Rs 5,698 crore in the September quarter, led by net interest income (NII) growth and firm asset quality when it reports its second-quarter result on October 25.

Higher costs of funds will continue to exert pressure on the margins of the private bank, just like for other lenders, analysts said.

Axis Bank’s net interest income (NII), the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors, is expected to increase 15 percent on-year to Rs 11,908 crore, driven by a steady pick-up in loan growth, according to the average of five brokerages’ estimates.

Net profit is likely to fall 2 percent on-quarter, weighed down by elevated cost ratios due to Citi integration. NII is estimated to remain flat from Rs 11,959 crore in the previous quarter. Read More

Sensex Today | Market at 2 PM

The Sensex was down 421.36 points or 0.65 percent at 64,150.52, and the Nifty was down 127.30 points or 0.66 percent at 19,154.50. About 834 shares advanced, 2319 shares declined, and 98 shares unchanged.

| Company | CMP Chg(%) | Volume | Value(Rs cr) |

|---|---|---|---|

| Bharti Airtel | 922.90 -1.79 | 460.65k | 42.57 |

| Zomato | 107.65 -1.15 | 3.97m | 42.67 |

| Reliance | 2,258.15 -0.2 | 169.15k | 38.24 |

| Tata Motors | 638.40 -1.38 | 555.80k | 35.84 |

| Infosys | 1,375.70 -2.36 | 248.20k | 34.31 |

| HDFC Bank | 1,501.50 -0.29 | 205.28k | 30.92 |

| SBI | 557.10 0.73 | 517.03k | 28.83 |

| Adani Power | 316.55 0.02 | 891.55k | 28.61 |

| Tata Power | 236.80 -0.63 | 1.11m | 26.33 |

| Adani Enterpris | 2,280.05 -1.26 | 110.98k | 25.46 |

Stock Market LIVE Updates | Bharat Wire Ropes Q2 Results:

Net profit up 2.5% at Rs 24.4 crore versus Rs 24 crore and revenue up 0.4% at Rs 159.1 crore versus Rs 158.4 crore, YoY.

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Cyber Media Res | 119.70 | 108.30 | -11.40 1.80k |

| Zodiac Energy | 172.05 | 163.00 | -9.05 46.27k |

| Hindustan Media | 78.85 | 75.00 | -3.85 75.47k |

| Barak Vally Cem | 38.25 | 36.50 | -1.75 792 |

| Weizmann | 106.95 | 102.15 | -4.80 4.70k |

| Cineline India | 109.60 | 104.70 | -4.90 15.43k |

| Maan Aluminium | 108.30 | 103.50 | -4.80 18.10k |

| Pansari Develop | 79.50 | 76.00 | -3.50 9 |

| TARACHAND | 137.00 | 131.00 | -6.00 0 |

| Krishival Foods | 279.90 | 268.00 | -11.90 462 |

| Company | Price at 13:00 | Price at 13:57 | Chg(%) Hourly Vol |

|---|---|---|---|

| Auro Impex | 62.10 | 70.00 | 7.90 0 |

| KHFM HOSPITALIT | 47.05 | 51.35 | 4.30 716 |

| Univastu India | 104.50 | 112.60 | 8.10 5.45k |

| Skipper | 204.15 | 218.00 | 13.85 48.95k |

| BEW Engineering | 1,508.05 | 1,594.00 | 85.95 429 |

| Dreamfolks Serv | 481.25 | 506.05 | 24.80 36.38k |

| JTEKT India | 127.00 | 133.40 | 6.40 15.70k |

| Golden Tobacco | 47.65 | 49.90 | 2.25 312 |

| Tilaknagar Ind | 179.50 | 187.90 | 8.40 177.57k |

| Aurionpro Solut | 1,386.65 | 1,450.00 | 63.35 1.83k |

Stock Market LIVE Updates | Welspun India Q2 Results:

Net profit at Rs 196.7 crore versus Rs 8.7 crore and revenue up 18.7% at Rs 2,509.1 crore versus Rs 2,113.5 crore, YoY.

Stock Market LIVE Updates | Dreamfolks Services Q2 Earnings:

Net profit up 20.3% at Rs 17.8 crore versus Rs 15 crore and revenue up 65% at Rs 282.4 crore versus Rs 171.2 crore, YoY.

Sensex Today | BSE realty index down 1 percent dragged by Sobha, Godrej Properties, Indiabulls Real Estate

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Sobha | 703.45 | -2.28 | 25.86k |

| Godrej Prop | 1,591.60 | -2.25 | 13.58k |

| Indiabulls Real | 71.51 | -1.8 | 757.42k |

| Phoenix Mills | 1,768.05 | -1.7 | 4.55k |

| Macrotech Dev | 766.55 | -1.47 | 16.08k |

| Oberoi Realty | 1,069.65 | -1.28 | 3.98k |

| Prestige Estate | 733.45 | -1.2 | 72.72k |

| DLF | 529.50 | -0.61 | 68.35k |

| Brigade Ent | 597.45 | -0.55 | 1.97k |

| Company | CMP | High Low | Fall from Day's High |

|---|---|---|---|

| Nilkamal | 2,308.50 | 2,310.00 2,256.20 | -0.06% |

4,501.20

7,424.95

3,344.70

773.05

220.00

474.95

3,876.10

885.25

2,421.35

Stock Market LIVE Updates | Morgan Stanley View On RBL Bank

-Underweight call, target raised to Rs 245 per share

-Core PPoP grew 54% YoY & was 12% above estimate

-Expect retail loan growth to remain strong & drive better PPoP in FY24

-Stay underweight as profitability recovery set to be gradual

| Company | Quantity | Price | Value(Cr) |

|---|---|---|---|

| NCL Research | 225734 | 0.48 | 0.01 |

| Vodafone Idea | 472119 | 10.68 | 0.5 |

| Rattanindia Ent | 200000 | 49.68 | 0.99 |

| LIQUIDBEES | 23397 | 999.99 | 2.34 |

| LIQUIDBEES | 24297 | 1000 | 2.43 |

| Rajnish Wellnes | 500000 | 11.48 | 0.57 |

| Jaiprakash Pow | 221461 | 8.57 | 0.19 |

| Rajnish Wellnes | 490000 | 11.5 | 0.56 |

| Vodafone Idea | 289996 | 10.83 | 0.31 |

| Bank of Baroda | 101031 | 196.25 | 1.98 |

Sensex Today | Blue Jet Healthcare IPO subscribed 0.23 times so far, retail portion bought 0.34 times on Day 1

Blue Jet Healthcare’s Rs 840.27 crore IPO, which opened for subscription on October 25, has been subscribed 0.23 times so far, receiving bids for 39.25 lakh shares against the issue size of 1.69 crore shares. Retail investors bought 0.34 times while high networth individuals picked 0.29 times the allotted quota.

The public issue is entirely an offer-for-sale (OFS) of over 2.4 crore equity shares by promoters, and there is no fresh issue component. The price band for the issue, which will conclude on October 27, has been fixed at Rs 329-346 per share. The stock is expected to be listed on the bourses on November 6. Read More

| Company | 52-Week Low | Day’s Low | CMP |

|---|---|---|---|

| Hindustan Aeron | 1872.65 | 1872.65 | 1,786.50 |

| Adani Total Gas | 579.55 | 579.55 | 555.80 |

| V-Mart Retail | 1897.15 | 1897.15 | 1,820.00 |

| Campus Active | 282.80 | 282.80 | 272.65 |

| Rajesh Exports | 438.70 | 438.70 | 421.70 |

| Navin Fluorine | 3541.65 | 3541.65 | 3,460.75 |

| Atul | 6447.70 | 6447.70 | 6,278.30 |

| Adani Wilmar | 332.25 | 332.25 | 319.80 |

| Gujarat Gas | 408.85 | 408.85 | 402.05 |

| TCI Express | 1331.50 | 1331.50 | 1,306.00 |

Stock Market LIVE Updates | HSBC View On Torrent Pharma

-Buy call, target at Rs 2,200 per share

-Q2 largely in-line, core India segment sustained above-market growth

-Positive on its structurally strong business profile