Tech Mahindra is likely to report dull fiscal second-quarter earnings on October 25. The IT firm’s Q2 FY24 net profit is expected to decline on a year-on-year (YoY) basis while its revenue is likely to remain flat due to lacklustre performance in the communications vertical, delayed telecom revenue and weak discretionary spends, according to analysts.

Tech Mahindra’s EBIT margin is likely to be the major concern as brokerages expect a big contraction in Q2 FY24 on an on-year basis. The company’s deal wins are also expected to remain muted in the quarter under review, on account of weak macro and slow decision-making.

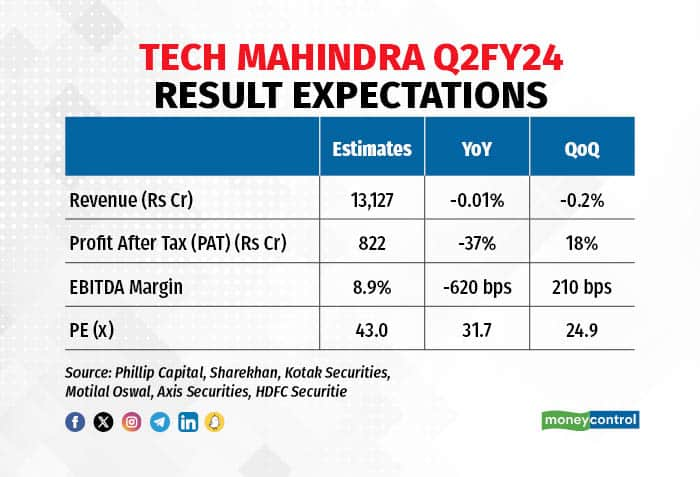

The IT major's net profit may decline around 37 percent YoY to Rs 822 crore, per the average of six brokerages’ estimates. However, sequentially, there might be an 18 percent rise. The quarter may witness certain one-time costs, said analysts.

Weak communications segment to hit revenue growthFor the quarter ended September 2023, Tech Mahindra's revenue may fall marginally on a year-on-year (YoY) basis to Rs 13,127 crore, according to the average of six brokerage firms’ estimates. Analysts expect its revenues in constant currency (CC) terms to also see a slight fall with weak performance across communications and enterprise segments.

Also Read | Tech Mahindra board to consider interim dividend on October 25

Pressure likely on margin due to wages, bad debtTech Mahindra’s EBIT margin is likely to contract by around 620 basis points (bps) on-year to 8.9 percent because of wage hikes, the absence of bad debt provision, and various business restructuring actions, according to the median estimate.

The pressure on margins will partially be offset by reduced subcontract cost, the expense incurred when a company outsources specific projects to subcontractors. Sequentially, margins may recover 210 bps, following the sharp decline in the previous quarter.

Tech Mahindra Q2 FY24 Result ExpectationsDeal wins remain weak in Q2

Tech Mahindra Q2 FY24 Result ExpectationsDeal wins remain weak in Q2Analysts expect deal wins to be weak on a YoY basis due to weak macro and slow decision-making. "We forecast net new TCV (total contract value) of $400-500 million. We expect quarterly financials to have limited sway in the near term with a focus on turnaround under Mohit Joshi," said Kotak Securities, adding that the recently announced organisation structure can lead to a few exits at the leadership levels.

Also Read | Mphasis Q2 results: Revenue declines 6.5% to Rs 3,276.5 crore, net profit down 6%

Key monitorablesEmployee addition and visibility on telecom and 5G will be among the key monitorables going ahead. The focus will remain on the turnaround strategy and implications of the recently announced organisation structure that will be effective January 2024. The timing of divestments of low-margin businesses that will aid margins but adversely impact revenue growth will also be keenly watched.

Moreover, investors will watch for the outlook for margins in FY24, margin normalisation timelines and aspirational growth and margin levels. Outlook for vulnerable segments such as XDS, ERD and network services, which have higher exposure to discretionary spending, will also be eyed. Investors will also monitor management commentary on the health of the deal pipeline and positioning in cost take-out deals.

Other key monitorables include any revenue leakage in existing accounts and positioning in vendor consolidation events, the outlook for revenue growth in top telecom clients and requests for furloughs in retail vertical and BPO services.

Also Read | Cyient Q2 Results: Net profit rises 66% YoY to Rs 184 crore

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.