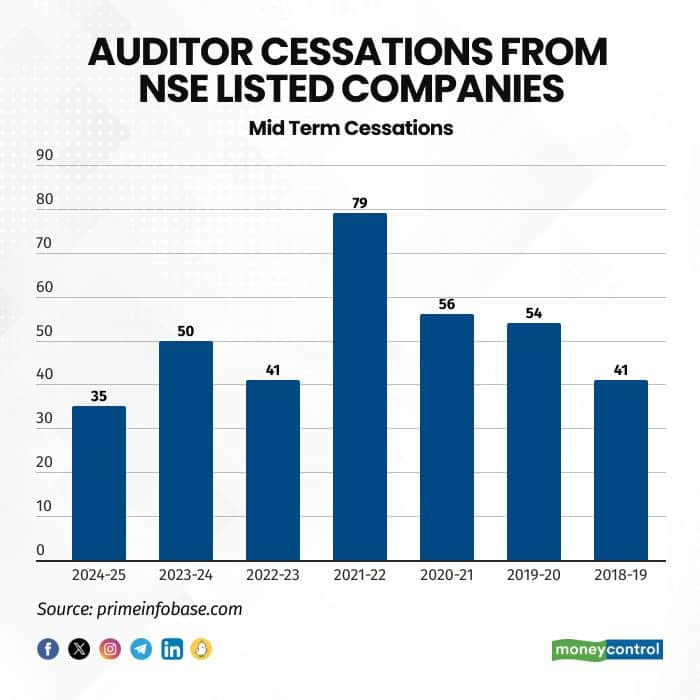

Auditors of 18 companies resigned abruptly in August, with the total number of such sudden exits pegged at 35 since April.

Data from primeinfobase.com shows that instances of such exits in the first five months of the current financial year are already inching close to the 41 exits seen in in FY23.

Further, the previous financial year (FY24) saw 50 instances of auditors unexpectedly exiting a company without finishing their agreed terms. If the trend of the first five months is anything to go by, then it appears that FY25 could see a higher number of such instances.

More importantly, while experts believe this is a major governance issue and the reasons for such sudden departure need to be examined, the auditors have mostly been very ambiguous in giving the reasons for resigning.

In most cases, the reasons cited for such exits have been merely mentioned as “pre-occupation” or “commercial” though in some cases auditors mentioned that they were resigning due to “alignment” issues with “group/subsidiary auditors”.

Companies in which auditors have resigned in the middle of their term include Easy Trip Planners, Gulshan Polyols, Platinum Industries, SVP Global Textiles, Uflex Ltd, Wanbury Ltd, Polo Queen Industrial & Fintech, Ind-Swift Laboratories and SJ Logistics (India) among others.

Data from primeinfobase.com shows that instances of such exits in the first five months of the current financial year (35) is already inching close to the full year number for FY23 when it was 41.

Data from primeinfobase.com shows that instances of such exits in the first five months of the current financial year (35) is already inching close to the full year number for FY23 when it was 41.Meanwhile, there have been 22 separate instances this fiscal wherein auditors resigned before the completion of their agreed tenure. Well-known companies like Abans Holdings, Adani Wilmar, Cantabil Retail India, and Nandan Denim among others saw their auditors resign in the middle of their term.

“This is obviously a governance issue as many a time auditors ask for detailed information from the management and if the responses are not satisfactory or in accordance with the law, then it becomes difficult to continue,” says Shriram Subramanian, Founder and Managing Director, InGovern Research Services, a proxy advisory firm.

“The more important issue is to know the exact reasons for such abrupt resignations. Because if they just mention reasons as personal or preoccupation, then the impact is lost,” he added.

This assumes significance as auditors have a ringside view of the company’s financial health and balance sheet strength and hence would be aware of any financial violations or malpractices done by the company.

Interestingly, on September 11, Religare Enterprises, which is in the midst of probes by various agencies including the Ministry of Corporate Affairs, reported that Nangia & Co LLP, which was supposed to be appointed as the auditor, had withdrawn its consent for being considered as statutory auditors.

“This shows that even statutory auditors, a key stakeholder who had initially consented to audit the company… are suspicious of the happenings at the company,” stated a recent report by InGovern.

“At a time when stock market valuations are on the rise and stocks of most small- and mid-cap companies are going through the roof and racing ahead of fundamentals, auditors have a difficult job of asking tough questions. Many-a-time, there is no convincing reply especially while dealing with the management of lesser-known companies. The only recourse left for the auditor is to move out,” said a lawyer specialising in securities market regulations.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.